IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

150 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

2.3.3.3.7 FMZ TM s.r.l.<br />

As of 22 December <strong>2006</strong> a 50% stake was acquired<br />

in the Romanian FMZ TM s.r.l, a 100% subsidiary<br />

of the Cypriote company S+B CEE. This transaction<br />

resulted in the acquisition of the Targu Mures<br />

specialty shopping centre project. This property is<br />

located in the emerging economic region of Transylvania,<br />

which has a population of 160,000. This<br />

specialty shopping centre is scheduled to open in<br />

2009.<br />

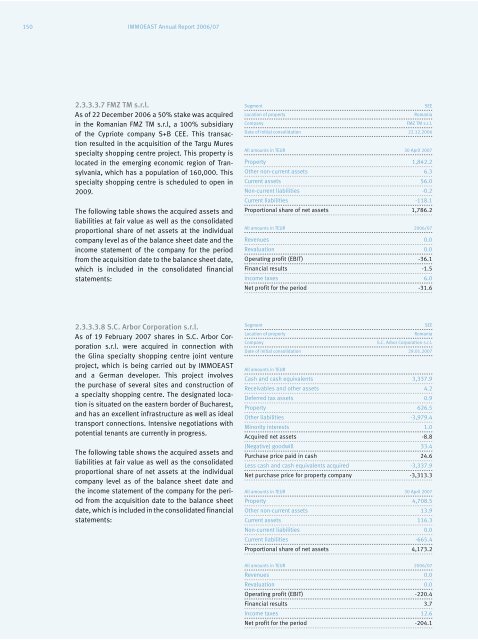

The following table shows the acquired assets and<br />

liabilities at fair value as well as the consolidated<br />

proportional share of net assets at the individual<br />

company level as of the balance sheet date and the<br />

income statement of the company for the period<br />

from the acquisition date to the balance sheet date,<br />

which is included in the consolidated financial<br />

statements:<br />

2.3.3.3.8 S.C. Arbor Corporation s.r.l.<br />

As of 19 February 20<strong>07</strong> shares in S.C. Arbor Corporation<br />

s.r.l. were acquired in connection with<br />

the Glina specialty shopping centre joint venture<br />

project, which is being carried out by <strong>IMMOEAST</strong><br />

and a German developer. This project involves<br />

the purchase of several sites and construction of<br />

a specialty shopping centre. The designated location<br />

is situated on the eastern border of Bucharest,<br />

and has an excellent infrastructure as well as ideal<br />

transport connections. Intensive negotiations with<br />

potential tenants are currently in progress.<br />

The following table shows the acquired assets and<br />

liabilities at fair value as well as the consolidated<br />

proportional share of net assets at the individual<br />

company level as of the balance sheet date and<br />

the income statement of the company for the period<br />

from the acquisition date to the balance sheet<br />

date, which is included in the consolidated financial<br />

statements:<br />

Segment SEE<br />

Location of property Romania<br />

Company FMZ TM s.r.l.<br />

Date of initial consolidation 22.12.<strong>2006</strong><br />

All amounts in TEUR 30 April 20<strong>07</strong><br />

Property 1,842.2<br />

Other non-current assets 6.3<br />

Current assets 56.0<br />

Non-current liabilities -0.2<br />

Current liabilities -118.1<br />

Proportional share of net assets 1,786.2<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong><br />

Revenues 0.0<br />

Revaluation 0.0<br />

Operating profit (EBIT) -36.1<br />

Financial results -1.5<br />

Income taxes 6.0<br />

Net profit for the period -31.6<br />

Segment SEE<br />

Location of property Romania<br />

Company S.C. Arbor Corporation s.r.l.<br />

Date of initial consolidation 29.01.20<strong>07</strong><br />

All amounts in TEUR<br />

Cash and cash equivalents 3,337.9<br />

Receivables and other assets 4.2<br />

Deferred tax assets 0.9<br />

Property 626.5<br />

Other liabilities -3,979.4<br />

Minority interests 1.0<br />

Acquired net assets -8.8<br />

(Negative) goodwill 33.4<br />

Purchase price paid in cash 24.6<br />

Less cash and cash equivalents acquired -3,337.9<br />

Net purchase price for property company -3,313.3<br />

All amounts in TEUR 30 April 20<strong>07</strong><br />

Property 4,708.5<br />

Other non-current assets 13.9<br />

Current assets 116.3<br />

Non-current liabilities 0.0<br />

Current liabilities -665.4<br />

Proportional share of net assets 4,173.2<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong><br />

Revenues 0.0<br />

Revaluation 0.0<br />

Operating profit (EBIT) -220.4<br />

Financial results 3.7<br />

Income taxes 12.6<br />

Net profit for the period -204.1