IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

50 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

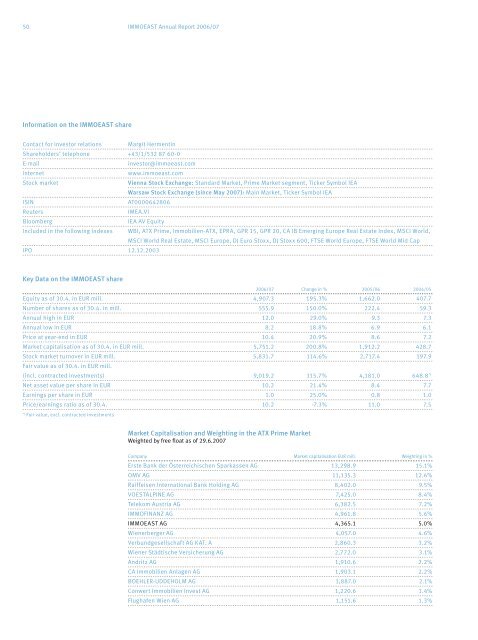

Information on the <strong>IMMOEAST</strong> share<br />

Contact for investor relations Margit Hermentin<br />

Shareholders’ telephone +43/1/532 87 60-0<br />

E-mail investor@immoeast.com<br />

Internet www.immoeast.com<br />

Stock market Vienna Stock Exchange: Standard Market, Prime Market segment, Ticker Symbol IEA<br />

Warsaw Stock Exchange (since May 20<strong>07</strong>): Main Market, Ticker Symbol IEA<br />

ISIN AT0000642806<br />

Reuters IMEA.VI<br />

Bloomberg IEA AV Equity<br />

Included in the following indexes WBI, ATX Prime, Immobilien-ATX, EPRA, GPR 15, GPR 20, CA IB Emerging Europe Real Estate Index, MSCI World,<br />

MSCI World Real Estate, MSCI Europe, DJ Euro Stoxx, DJ Stoxx 600, FTSE World Europe, FTSE World Mid Cap<br />

IPO 12.12.2003<br />

Key Data on the <strong>IMMOEAST</strong> share<br />

<strong>2006</strong>/<strong>07</strong> Change in % 2005/06 2004/05<br />

Equity as of 30.4. in EUR mill. 4,9<strong>07</strong>.3 195.3% 1,662.0 4<strong>07</strong>.7<br />

Number of shares as of 30.4. in mill. 555.9 150.0% 222.4 59.3<br />

<strong>Annual</strong> high in EUR 12.0 29.0% 9.3 7.3<br />

<strong>Annual</strong> low in EUR 8.2 18.8% 6.9 6.1<br />

Price at year-end in EUR 10.4 20.9% 8.6 7.2<br />

Market capitalisation as of 30.4. in EUR mill. 5,751.2 200.8% 1,912.2 428.7<br />

Stock market turnover in EUR mill.<br />

Fair value as of 30.4. in EUR mill.<br />

5,831.7 114.6% 2,717.4 197.9<br />

(incl. contracted investments) 9,019.2 115.7% 4,181.0 648.8 *)<br />

Net asset value per share in EUR 10.2 21.4% 8.4 7.7<br />

Earnings per share in EUR 1.0 25.0% 0.8 1.0<br />

Price/earnings ratio as of 30.4.<br />

*) Fair value, excl. contracted investments<br />

10.2 -7.3% 11.0 7.5<br />

Market Capitalisation and Weighting in the ATX Prime Market<br />

Weighted by free float as of 29.6.20<strong>07</strong><br />

Company Market capitalisation EUR mill. Weighting in %<br />

Erste Bank der Österreichischen Sparkassen AG 13,298.9 15.1%<br />

OMV AG 11,135.3 12.6%<br />

Raiffeisen International Bank Holding AG 8,402.0 9.5%<br />

VOESTALPINE AG 7,425.0 8.4%<br />

Telekom Austria AG 6,382.5 7.2%<br />

IMMOFINANZ AG 4,961.8 5.6%<br />

<strong>IMMOEAST</strong> AG 4,365.1 5.0%<br />

Wienerberger AG 4,057.0 4.6%<br />

Verbundgesellschaft AG KAT. A 2,860.3 3.2%<br />

Wiener Städtische Versicherung AG 2,772.0 3.1%<br />

Andritz AG 1,910.6 2.2%<br />

CA Immobilien Anlagen AG 1,903.1 2.2%<br />

BOEHLER-UDDEHOLM AG 1,887.0 2.1%<br />

Conwert Immobilien Invest AG 1,220.6 1.4%<br />

Flughafen Wien AG 1,151.6 1.3%