IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6.1.2. Development of business in CEE<br />

Key data on the CEE Segment<br />

<strong>2006</strong>/<strong>07</strong> 2005/06 Change in %<br />

Revenues in TEUR 142,201.0 65,891.1 115.8%<br />

EBIT in TEUR 298,432.5 87,674.8 240.4%<br />

Cash EBIT in TEUR 72,299.0 24,184.0 199.0%<br />

Segment assets in TEUR 2,960,800.9 1,642,033.4 80.3%<br />

Segment liabilities in TEUR 1,810,058.0 1,102,442.9 64.2%<br />

Letable space as a % of the total portfolio 52.2% 84.1% -38.0%<br />

Fair value in EUR million 4,311.7 1,662.6 159.3%<br />

Fair value as a % of the total portfolio 47.8% 86.1% -44.5%<br />

The CEE segment generated an increase of nearly 116% in revenues to TEUR 142,201.0 in <strong>2006</strong>/<strong>07</strong>,<br />

which represents 74% of the total revenues recorded by <strong>IMMOEAST</strong>. Investments in this segment<br />

focus primarily on office properties as well as logistics and commercial objects. EBIT rose by more<br />

than 240% to TEUR 298,432.5 during the reporting year, supported by a further increase in revaluation<br />

results. This development was based primarily on Poland and the Czech Republic. The CEE<br />

segment is responsible for 55% of EBIT in the <strong>IMMOEAST</strong> Group. An increase of nearly 200% in cash<br />

EBIT led to an improvement in the cash EBIT margin from 33.1% to 50.8% during <strong>2006</strong>/<strong>07</strong>.<br />

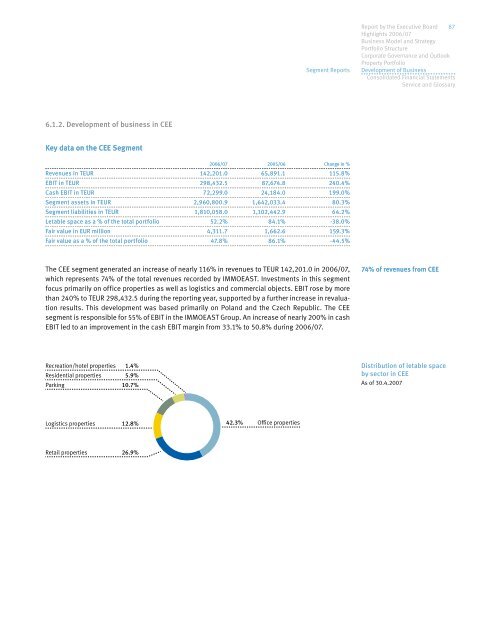

Recreation/hotel properties 1.4%<br />

Residential properties 5.9%<br />

Parking 10.7%<br />

Logistics properties 12.8%<br />

Retail properties 26.9%<br />

42.3% Office properties<br />

Segment <strong>Report</strong>s<br />

<strong>Report</strong> by the Executive Board 87<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

74% of revenues from CEE<br />

Distribution of letable space<br />

by sector in CEE<br />

As of 30.4.20<strong>07</strong>