IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Non-current liabilities<br />

Non-current liabilities rose by 81% or TEUR 666,285.2 to TEUR 1,486,306.1, primarily as a result of<br />

liabilities taken over in connection with the acquisition of companies. Deferred tax liabilities also<br />

increased by a substantial 153% to TEUR 473,099.1, above all due to the revaluation of assets as<br />

part of the initial consolidation of acquisitions or the revaluation of properties at year-end.<br />

Current liabilities<br />

Current liabilities rose by TEUR 113,323.1 to TEUR 318,801.8.<br />

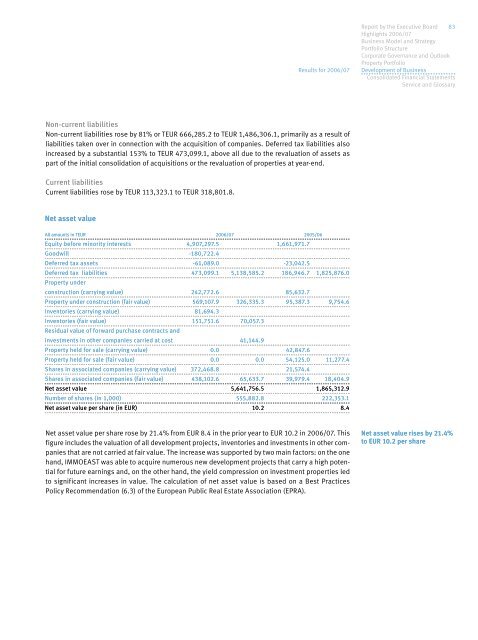

Net asset value<br />

Results for <strong>2006</strong>/<strong>07</strong><br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong> 2005/06<br />

Equity before minority interests 4,9<strong>07</strong>,297.5 1,661,971.7<br />

Goodwill -180,722.4<br />

Deferred tax assets -61,089.0 -23,042.5<br />

Deferred tax liabilities<br />

Property under<br />

473,099.1 5,138,585.2 186,946.7 1,825,876.0<br />

construction (carrying value) 242,772.6 85,632.7<br />

Property under construction (fair value) 569,1<strong>07</strong>.9 326,335.3 95,387.3 9,754.6<br />

Inventories (carrying value) 81,694.3<br />

Inventories (fair value)<br />

Residual value of forward purchase contracts and<br />

151,751.6 70,057.3<br />

investments in other companies carried at cost 41,144.9<br />

Property held for sale (carrying value) 0.0 42,847.6<br />

Property held for sale (fair value) 0.0 0.0 54,125.0 11,277.4<br />

Shares in associated companies (carrying value) 372,468.8 21,574.4<br />

Shares in associated companies (fair value) 438,102.6 65,633.7 39,979.4 18,404.9<br />

Net asset value 5,641,756.5 1,865,312.9<br />

Number of shares (in 1,000) 555,882.8 222,353.1<br />

Net asset value per share (in EUR) 10.2 8.4<br />

Net asset value per share rose by 21.4% from EUR 8.4 in the prior year to EUR 10.2 in <strong>2006</strong>/<strong>07</strong>. This<br />

figure includes the valuation of all development projects, inventories and investments in other companies<br />

that are not carried at fair value. The increase was supported by two main factors: on the one<br />

hand, <strong>IMMOEAST</strong> was able to acquire numerous new development projects that carry a high potential<br />

for future earnings and, on the other hand, the yield compression on investment properties led<br />

to significant increases in value. The calculation of net asset value is based on a Best Practices<br />

Policy Recommendation (6.3) of the European Public Real Estate Association (EPRA).<br />

<strong>Report</strong> by the Executive Board 83<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

Net asset value rises by 21.4%<br />

to EUR 10.2 per share