IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

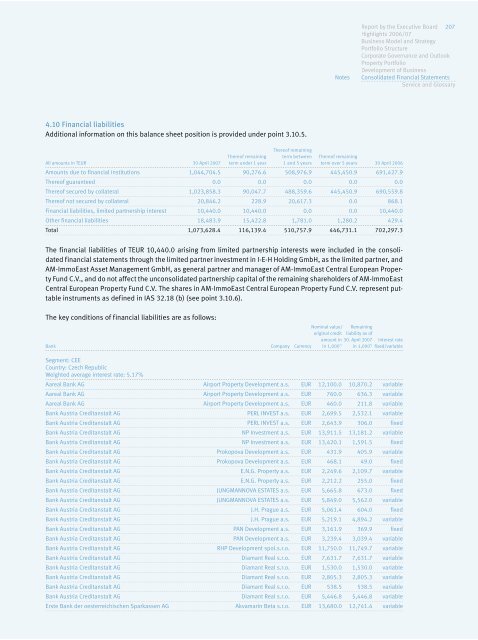

4.10 Financial liabilities<br />

Additional information on this balance sheet position is provided under point 3.10.5.<br />

Thereof remaining<br />

Thereof remaining term between Thereof remaining<br />

All amounts in TEUR 30 April 20<strong>07</strong> term under 1 year 1 and 5 years term over 5 years 30 April <strong>2006</strong><br />

Amounts due to financial institutions 1,044,704.5 90,276.6 508,976.9 445,450.9 691,427.9<br />

Thereof guaranteed 0.0 0.0 0.0 0.0 0.0<br />

Thereof secured by collateral 1,023,858.3 90,047.7 488,359.6 445,450.9 690,559.8<br />

Thereof not secured by collateral 20,846.2 228.9 20,617.3 0.0 868.1<br />

Financial liabilities, limited partnership interest 10,440.0 10,440.0 0.0 0.0 10,440.0<br />

Other financial liabilities 18,483.9 15,422.8 1,781.0 1,280.2 429.4<br />

Total 1,<strong>07</strong>3,628.4 116,139.4 510,757.9 446,731.1 702,297.3<br />

The financial liabilities of TEUR 10,440.0 arising from limited partnership interests were included in the consolidated<br />

financial statements through the limited partner investment in I-E-H Holding GmbH, as the limited partner, and<br />

AM-ImmoEast Asset Management GmbH, as general partner and manager of AM-ImmoEast Central European Property<br />

Fund C.V., and do not affect the unconsolidated partnership capital of the remaining shareholders of AM-ImmoEast<br />

Central European Property Fund C.V. The shares in AM-ImmoEast Central European Property Fund C.V. represent puttable<br />

instruments as defined in IAS 32.18 (b) (see point 3.10.6).<br />

The key conditions of financial liabilities are as follows:<br />

Nominal value/ Remaining<br />

original credit liability as of<br />

amount in 30. April 20<strong>07</strong> Interest rate<br />

Bank Company Currency in 1,000 *) in 1,000 *) fixed/variable<br />

Segment: CEE<br />

Country: Czech Republic<br />

Weighted average interest rate: 5.17%<br />

Aareal Bank AG Airport Property Development a.s. EUR 12,100.0 10,870.2 variable<br />

Aareal Bank AG Airport Property Development a.s. EUR 760.0 636.3 variable<br />

Aareal Bank AG Airport Property Development a.s. EUR 460.0 211.8 variable<br />

Bank Austria Creditanstalt AG PERL INVEST a.s. EUR 2,699.5 2,532.1 variable<br />

Bank Austria Creditanstalt AG PERL INVEST a.s. EUR 2,643.9 306.0 fixed<br />

Bank Austria Creditanstalt AG NP Investment a.s. EUR 13,911.5 13,181.2 variable<br />

Bank Austria Creditanstalt AG NP Investment a.s. EUR 13,420.1 1,591.5 fixed<br />

Bank Austria Creditanstalt AG Prokopova Development a.s. EUR 431.9 405.9 variable<br />

Bank Austria Creditanstalt AG Prokopova Development a.s. EUR 468.1 49.0 fixed<br />

Bank Austria Creditanstalt AG E.N.G. Property a.s. EUR 2,249.6 2,109.7 variable<br />

Bank Austria Creditanstalt AG E.N.G. Property a.s. EUR 2,212.2 255.0 fixed<br />

Bank Austria Creditanstalt AG JUNGMANNOVA ESTATES a.s. EUR 5,665.8 673.0 fixed<br />

Bank Austria Creditanstalt AG JUNGMANNOVA ESTATES a.s. EUR 5,849.0 5,562.0 variable<br />

Bank Austria Creditanstalt AG J.H. Prague a.s. EUR 5,061.4 604.0 fixed<br />

Bank Austria Creditanstalt AG J.H. Prague a.s. EUR 5,219.1 4,894.2 variable<br />

Bank Austria Creditanstalt AG PAN Development a.s. EUR 3,161.9 369.9 fixed<br />

Bank Austria Creditanstalt AG PAN Development a.s. EUR 3,239.4 3,039.4 variable<br />

Bank Austria Creditanstalt AG RHP Development spol.s.r.o. EUR 11,750.0 11,749.7 variable<br />

Bank Austria Creditanstalt AG Diamant Real s.r.o. EUR 7,631.7 7,631.7 variable<br />

Bank Austria Creditanstalt AG Diamant Real s.r.o. EUR 1,530.0 1,530.0 variable<br />

Bank Austria Creditanstalt AG Diamant Real s.r.o. EUR 2,805.3 2,805.3 variable<br />

Bank Austria Creditanstalt AG Diamant Real s.r.o. EUR 538.5 538.5 variable<br />

Bank Austria Creditanstalt AG Diamant Real s.r.o. EUR 5,446.8 5,446.8 variable<br />

Erste Bank der oesterreichischen Sparkassen AG Akvamarin Beta s.r.o. EUR 13,680.0 12,741.4 variable<br />

Notes<br />

<strong>Report</strong> by the Executive Board 2<strong>07</strong><br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary