IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The market value represents the amount that the relevant company would receive or be required to pay if the transaction<br />

were terminated as of the balance sheet date. The market values do not reflect the proportionate consolidation<br />

of the company in the consolidated financial statements.<br />

8.1.2.2.2 Interest rate risk<br />

As an international company, <strong>IMMOEAST</strong> is exposed to the risk of interest rate fluctuations on various property submarkets.<br />

Changes in interest rates can influence the earnings recorded by the Group through higher interest costs for<br />

existing variable rate financing, and can also have a reflex effect on the valuation of properties.<br />

Changes in interest rates have a direct influence on the financial results recorded by the Group in that they increase<br />

the cost of variable rate financing. <strong>IMMOEAST</strong> manages the risk associated with rising interest rates, which would<br />

lead to an increase in interest expense and a decline in financial results, through the use of derivative financial<br />

instruments. The derivative financial instruments used by <strong>IMMOEAST</strong> to hedge interest rate risk are recorded as<br />

independent transactions and not as hedge transactions. Hedge accounting as defined in IAS 39.85 – IAS 39.102 is<br />

not applied because the requirements stated in these regulations are not met.<br />

Derivative financial instruments are stated at market value. Derivatives with a positive market value are included<br />

under the balance sheet position “other financial instruments”, while derivatives with a negative market value are<br />

shown under “other liabilities“.<br />

Any changes in this market value are recognised as income or expenses under financial results. In addition, the Group<br />

has concluded financing contracts that carry fixed interest rates.<br />

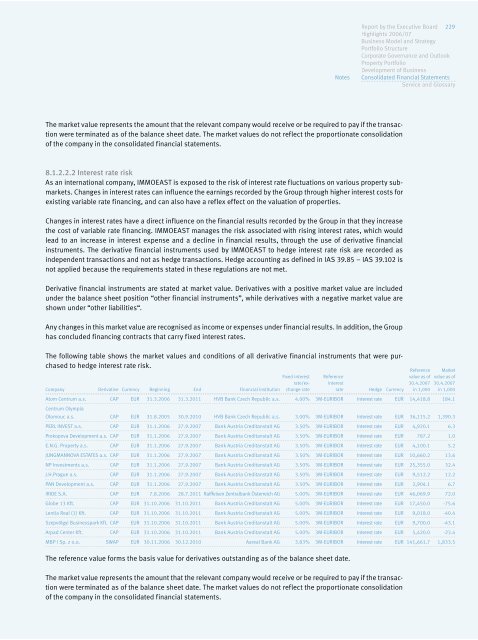

The following table shows the market values and conditions of all derivative financial instruments that were purchased<br />

to hedge interest rate risk.<br />

The reference value forms the basis value for derivatives outstanding as of the balance sheet date.<br />

The market value represents the amount that the relevant company would receive or be required to pay if the transaction<br />

were terminated as of the balance sheet date. The market values do not reflect the proportionate consolidation<br />

of the company in the consolidated financial statements.<br />

<strong>Report</strong> by the Executive Board 229<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

Reference Market<br />

Fixed interest Reference value as of value as of<br />

rate/ex- interest 30.4.20<strong>07</strong> 30.4.20<strong>07</strong><br />

Company Derivative Currency Beginning End Financial institution change rate rate Hedge Currency in 1,000 in 1,000<br />

Atom Centrum a.s.<br />

Centrum Olympia<br />

CAP EUR 31.3.<strong>2006</strong> 31.3.2011 HVB Bank Czech Republic a.s. 4.00% 3M-EURIBOR Interest rate EUR 14,418.8 184.1<br />

Olomouc a.s. CAP EUR 31.8.2005 30.9.2010 HVB Bank Czech Republic a.s. 3.00% 3M-EURIBOR Interest rate EUR 36,115.2 1,390.3<br />

PERL INVEST a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 4,920.1 6.3<br />

Prokopova Development a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 787.2 1.0<br />

E.N.G. Property a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 4,100.1 5.2<br />

JUNGMANNOVA ESTATES a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 10,660.2 13.6<br />

NP Investments a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 25,355.0 32.4<br />

J.H.Prague a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 9,512.2 12.2<br />

PAN Development a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 2,904.1 6.7<br />

IRIDE S.A. CAP EUR 7.8.<strong>2006</strong> 28.7.2011 Raiffeisen Zentralbank Österreich AG 5.00% 3M-EURIBOR Interest rate EUR 46,069.9 72.0<br />

Globe 13 Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 17,450.0 -75.6<br />

Lentia Real (1) Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 9,018.0 -40.4<br />

Szepvölgyi Businesspark Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 9,700.0 -43.1<br />

Arpad Center Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 5,420.0 -23.4<br />

MBP I Sp. z o.o. SWAP EUR 30.11.<strong>2006</strong> 30.12.2010 Aareal Bank AG 3.83% 3M-EURIBOR Interest rate EUR 141,661.7 1,833.5<br />

Notes