IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

upward potential for the valuation of the property; if the value in the expert opinion is lower, this effect increases<br />

the write-down.<br />

A decline in foreign exchange rates compared to the Euro lead to lower Euro amounts in the fair values than the<br />

amounts shown in prior years when the fair values of properties are translated. When the latest value is compared<br />

with the unchanged amount from a prior year expert opinion in Euro, the translation of the prior year Euro amount<br />

back into the functional currency (local currency) leads to a higher value – because of the lower exchange rate – and<br />

therefore to a write-up. If the value in the expert opinion rises, this foreign exchange effect increases the upward for<br />

the valuation of the property; if the value in the expert opinion is lower, this effect reduces the write-down.<br />

As of 30 April 20<strong>07</strong>, the net revaluation income recognised by <strong>IMMOEAST</strong> totalled TEUR 493,095.1. This figure comprises<br />

revaluation income of TEUR 567,003.6 and impairment charges of TEUR 73,908.5. Part of the impairment<br />

charges resulted exclusively from an increase in the value of the local currency compared with the Euro. This effect<br />

involved properties in Hungary, Poland, Slovakia and Romania.<br />

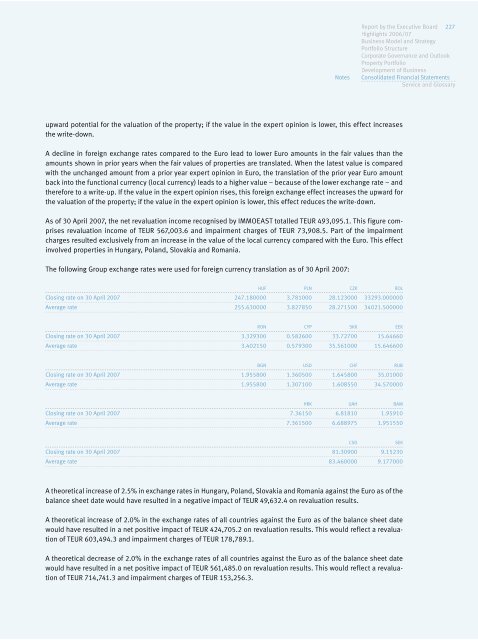

The following Group exchange rates were used for foreign currency translation as of 30 April 20<strong>07</strong>:<br />

HUF PLN CZK ROL<br />

Closing rate on 30 April 20<strong>07</strong> 247.180000 3.781000 28.123000 33293.000000<br />

Average rate 255.630000 3.827850 28.271500 34021.500000<br />

RON CYP SKK EEK<br />

Closing rate on 30 April 20<strong>07</strong> 3.329300 0.582600 33.72700 15.64660<br />

Average rate 3.402150 0.579300 35.561000 15.646600<br />

BGN USD CHF RUB<br />

Closing rate on 30 April 20<strong>07</strong> 1.955800 1.360500 1.645800 35.01000<br />

Average rate 1.955800 1.3<strong>07</strong>100 1.608550 34.570000<br />

HRK UAH BAM<br />

Closing rate on 30 April 20<strong>07</strong> 7.36150 6.81810 1.95910<br />

Average rate 7.361500 6.688975 1.951550<br />

<strong>Report</strong> by the Executive Board 227<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

CSD SEK<br />

Closing rate on 30 April 20<strong>07</strong> 81.30900 9.15230<br />

Average rate 83.460000 9.177000<br />

A theoretical increase of 2.5% in exchange rates in Hungary, Poland, Slovakia and Romania against the Euro as of the<br />

balance sheet date would have resulted in a negative impact of TEUR 49,632.4 on revaluation results.<br />

A theoretical increase of 2.0% in the exchange rates of all countries against the Euro as of the balance sheet date<br />

would have resulted in a net positive impact of TEUR 424,705.2 on revaluation results. This would reflect a revaluation<br />

of TEUR 603,494.3 and impairment charges of TEUR 178,789.1.<br />

A theoretical decrease of 2.0% in the exchange rates of all countries against the Euro as of the balance sheet date<br />

would have resulted in a net positive impact of TEUR 561,485.0 on revaluation results. This would reflect a revaluation<br />

of TEUR 714,741.3 and impairment charges of TEUR 153,256.3.<br />

Notes