IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

198 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

IAS 36.134<br />

IAS 36.134<br />

IAS 36.134<br />

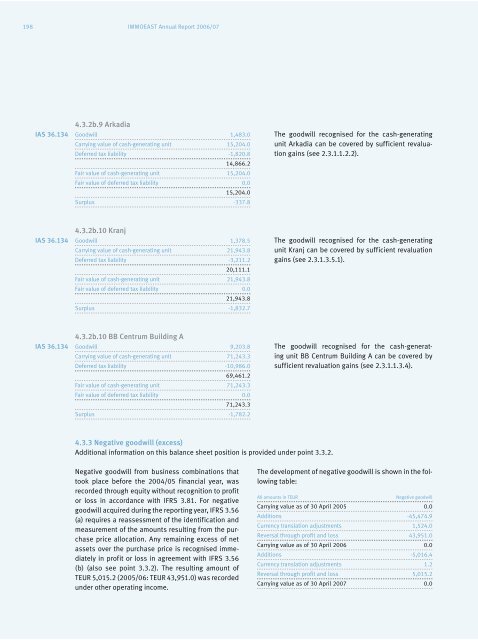

4.3.2b.9 Arkadia<br />

Goodwill 1,483.0<br />

Carrying value of cash-generating unit 15,204.0<br />

Deferred tax liability -1,820.8<br />

14,866.2<br />

Fair value of cash-generating unit 15,204.0<br />

Fair value of deferred tax liability 0.0<br />

15,204.0<br />

Surplus -337.8<br />

4.3.2b.10 Kranj<br />

Goodwill 1,378.5<br />

Carrying value of cash-generating unit 21,943.8<br />

Deferred tax liability -3,211.2<br />

20,111.1<br />

Fair value of cash-generating unit 21,943.8<br />

Fair value of deferred tax liability 0.0<br />

21,943.8<br />

Surplus -1,832.7<br />

4.3.2b.10 BB Centrum Building A<br />

Goodwill 9,203.8<br />

Carrying value of cash-generating unit 71,243.3<br />

Deferred tax liability -10,986.0<br />

69,461.2<br />

Fair value of cash-generating unit 71,243.3<br />

Fair value of deferred tax liability 0.0<br />

71,243.3<br />

Surplus -1,782.2<br />

4.3.3 Negative goodwill (excess)<br />

Additional information on this balance sheet position is provided under point 3.3.2.<br />

Negative goodwill from business combinations that<br />

took place before the 2004/05 financial year, was<br />

recorded through equity without recognition to profit<br />

or loss in accordance with IFRS 3.81. For negative<br />

goodwill acquired during the reporting year, IFRS 3.56<br />

(a) requires a reassessment of the identification and<br />

measurement of the amounts resulting from the purchase<br />

price allocation. Any remaining excess of net<br />

assets over the purchase price is recognised immediately<br />

in profit or loss in agreement with IFRS 3.56<br />

(b) (also see point 3.3.2). The resulting amount of<br />

TEUR 5,015.2 (2005/06: TEUR 43,951.0) was recorded<br />

under other operating income.<br />

The goodwill recognised for the cash-generating<br />

unit Arkadia can be covered by sufficient revaluation<br />

gains (see 2.3.1.1.2.2).<br />

The goodwill recognised for the cash-generating<br />

unit Kranj can be covered by sufficient revaluation<br />

gains (see 2.3.1.3.5.1).<br />

The goodwill recognised for the cash-generating<br />

unit BB Centrum Building A can be covered by<br />

sufficient revaluation gains (see 2.3.1.1.3.4).<br />

The development of negative goodwill is shown in the following<br />

table:<br />

All amounts in TEUR Negative goodwill<br />

Carrying value as of 30 April 2005 0.0<br />

Additions -45,474.9<br />

Currency translation adjustments 1,524.0<br />

Reversal through profit and loss 43,951.0<br />

Carrying value as of 30 April <strong>2006</strong> 0.0<br />

Additions -5,016.4<br />

Currency translation adjustments 1.2<br />

Reversal through profit and loss 5,015.2<br />

Carrying value as of 30 April 20<strong>07</strong> 0.0