PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

06<br />

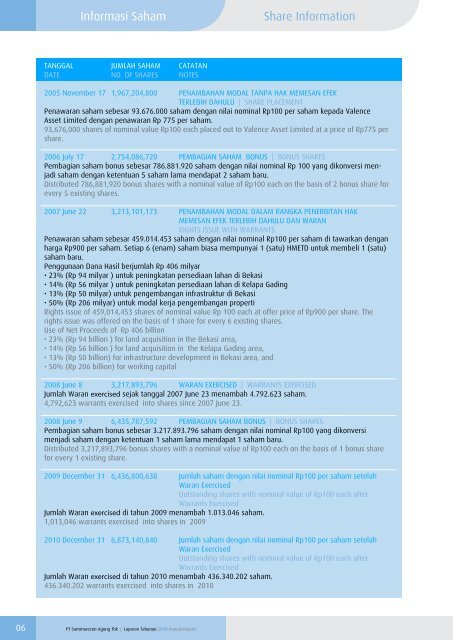

Informasi Saham Share Information<br />

TANGGAL JUMLAH SAHAM CATATAN<br />

DATE NO. OF SHARES NOTES<br />

2005 November 17 1,967,204,800 PENAMBAHAN MODAL TANPA HAK MEMESAN EFEK<br />

TERLEBIH DAHULU | SHARE PLACEMENT<br />

Penawaran saham sebesar 93.676.000 saham dengan nilai nominal Rp100 per saham kepada Valence<br />

Asset Limited dengan penawaran Rp 775 per saham.<br />

93,676,000 shares of nominal value Rp100 each placed out to Valence Asset Limited at a price of Rp775 per<br />

share.<br />

2006 July 17 2,754,086,720 PEMBAGIAN SAHAM BONUS | BONUS SHARES<br />

Pembagian saham bonus sebesar 786.881.920 saham dengan nilai nominal Rp 100 yang dikonversi menjadi<br />

saham dengan ketentuan 5 saham lama mendapat 2 saham baru.<br />

Distributed 786,881,920 bonus shares with a nominal value of Rp100 each on the basis of 2 bonus share for<br />

every 5 existing shares.<br />

2007 June 22 3,213,101,173 PENAMBAHAN MODAL DALAM RANGKA PENERBITAN HAK<br />

MEMESAN EFEK TERLEBIH DAHULU DAN WARAN<br />

RIGHTS ISSUE WITH WARRANTS<br />

Penawaran saham sebesar 459.014.453 saham dengan nilai nominal Rp100 per saham di tawarkan dengan<br />

harga Rp900 per saham. Setiap 6 (enam) saham biasa mempunyai 1 (satu) HMETD untuk membeli 1 (satu)<br />

saham baru.<br />

Penggunaan Dana Hasil berjumlah Rp 406 milyar<br />

• 23% (Rp 94 milyar ) untuk peningkatan persediaan lahan di Bekasi<br />

• 14% (Rp 56 milyar ) untuk peningkatan persediaan lahan di Kelapa Gading<br />

• 13% (Rp 50 milyar) untuk pengembangan infrastruktur di Bekasi<br />

• 50% (Rp 206 milyar) untuk modal kerja pengembangan properti<br />

Rights issue of 459,014,453 shares of nominal value Rp 100 each at offer price of Rp900 per share. The<br />

rights issue was offered on the basis of 1 share for every 6 existing shares.<br />

Use of Net Proceeds of Rp 406 billion<br />

• 23% (Rp 94 billion ) for land acquisition in the Bekasi area,<br />

• 14% (Rp 56 billion ) for land acquisition in the Kelapa Gading area,<br />

• 13% (Rp 50 billion) for infrastructure development in Bekasi area, and<br />

• 50% (Rp 206 billion) for working capital<br />

2008 June 8 3,217,893,796 WARAN EXERCISED | WARRANTS EXERCISED<br />

Jumlah Waran exercised sejak tanggal 2007 June 23 menambah 4.792.623 saham.<br />

4,792,623 warrants exercised into shares since 2007 June 23.<br />

2008 June 9 6,435,787,592 PEMBAGIAN SAHAM BONUS | BONUS SHARES<br />

Pembagian saham bonus sebesar 3.217.893.796 saham dengan nilai nominal Rp100 yang dikonversi<br />

menjadi saham dengan ketentuan 1 saham lama mendapat 1 saham baru.<br />

Distributed 3,217,893,796 bonus shares with a nominal value of Rp100 each on the basis of 1 bonus share<br />

for every 1 existing share.<br />

2009 December 31 6,436,800,638 Jumlah saham dengan nilai nominal Rp100 per saham setelah<br />

Waran Exercised<br />

Outstanding shares with nominal value of Rp100 each after<br />

Warrants Exercised<br />

Jumlah Waran exercised di tahun 2009 menambah 1.013.046 saham.<br />

1,013,046 warrants exercised into shares in 2009<br />

<strong>2010</strong> December 31 6,873,140,840 Jumlah saham dengan nilai nominal Rp100 per saham setelah<br />

Waran Exercised<br />

Outstanding shares with nominal value of Rp100 each after<br />

Warrants Exercised<br />

Jumlah Waran exercised di tahun <strong>2010</strong> menambah 436.340.202 saham.<br />

436.340.202 warrants exercised into shares in <strong>2010</strong><br />

<strong>PT</strong> <strong>Summarecon</strong> <strong>Agung</strong> <strong>Tbk</strong> | <strong>Laporan</strong> <strong>Tahunan</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong>