PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

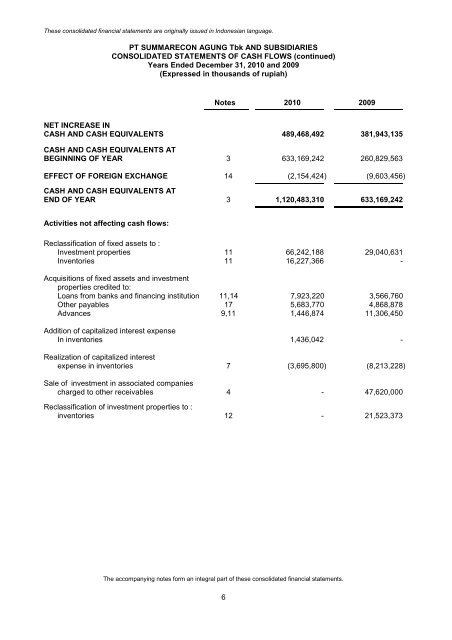

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah)<br />

Notes <strong>2010</strong> 2009<br />

NET INCREASE IN<br />

CASH AND CASH EQUIVALENTS 489,468,492 381,943,135<br />

CASH AND CASH EQUIVALENTS AT<br />

BEGINNING OF YEAR 3 633,169,242 260,829,563<br />

EFFECT OF FOREIGN EXCHANGE 14 (2,154,424) (9,603,456)<br />

CASH AND CASH EQUIVALENTS AT<br />

END OF YEAR 3 1,120,483,310 633,169,242<br />

Activities not affecting cash flows:<br />

Reclassification of fixed assets to :<br />

Investment properties 11 66,242,188 29,040,631<br />

Inventories 11 16,227,366 -<br />

Acquisitions of fixed assets and investment<br />

properties credited to:<br />

Loans from banks and financing institution 11,14 7,923,220 3,566,760<br />

Other payables 17 5,683,770 4,868,878<br />

Advances 9,11 1,446,874 11,306,450<br />

Addition of capitalized interest expense<br />

In inventories 1,436,042 -<br />

Realization of capitalized interest<br />

expense in inventories 7 (3,695,800) (8,213,228)<br />

Sale of investment in associated companies<br />

charged to other receivables 4 - 47,620,000<br />

Reclassification of investment properties to :<br />

inventories 12 - 21,523,373<br />

The accompanying notes form an integral part of these consolidated financial statements.<br />

6