PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

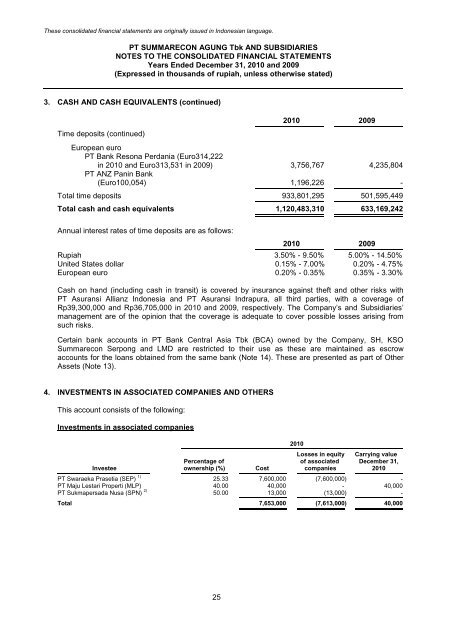

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

3. CASH AND CASH EQUIVALENTS (continued)<br />

Time deposits (continued)<br />

25<br />

<strong>2010</strong> 2009<br />

European euro<br />

<strong>PT</strong> Bank Resona Perdania (Euro314,222<br />

in <strong>2010</strong> and Euro313,531 in 2009) 3,756,767 4,235,804<br />

<strong>PT</strong> ANZ Panin Bank<br />

(Euro100,054) 1,196,226 -<br />

Total time deposits 933,801,295 501,595,449<br />

Total cash and cash equivalents 1,120,483,310 633,169,242<br />

<strong>Annual</strong> interest rates of time deposits are as follows:<br />

<strong>2010</strong> 2009<br />

Rupiah 3.50% - 9.50% 5.00% - 14.50%<br />

United States dollar 0.15% - 7.00% 0.20% - 4.75%<br />

European euro 0.20% - 0.35% 0.35% - 3.30%<br />

Cash on hand (including cash in transit) is covered by insurance against theft and other risks with<br />

<strong>PT</strong> Asuransi Allianz Indonesia and <strong>PT</strong> Asuransi Indrapura, all third parties, with a coverage of<br />

Rp39,300,000 and Rp36,705,000 in <strong>2010</strong> and 2009, respectively. The Company’s and Subsidiaries’<br />

management are of the opinion that the coverage is adequate to cover possible losses arising from<br />

such risks.<br />

Certain bank accounts in <strong>PT</strong> Bank Central Asia <strong>Tbk</strong> (BCA) owned by the Company, SH, KSO<br />

<strong>Summarecon</strong> Serpong and LMD are restricted to their use as these are maintained as escrow<br />

accounts for the loans obtained from the same bank (Note 14). These are presented as part of Other<br />

Assets (Note 13).<br />

4. INVESTMENTS IN ASSOCIATED COMPANIES AND OTHERS<br />

This account consists of the following:<br />

Investments in associated companies<br />

Losses in equity Carrying value<br />

Percentage of of associated December 31,<br />

Investee ownership (%) Cost companies <strong>2010</strong><br />

<strong>PT</strong> Swaraeka Prasetia (SEP) 1) 25.33 7,600,000 (7,600,000) -<br />

<strong>PT</strong> Maju Lestari Properti (MLP) 40.00 40,000 - 40,000<br />

<strong>PT</strong> Sukmapersada Nusa (SPN) 2) 50.00 13,000 (13,000) -<br />

Total 7,653,000 (7,613,000) 40,000<br />

<strong>2010</strong>