PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

11. FIXED ASSETS (continued)<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

On October 1, 2009, SCK, a Subsidiary, handed over Discovery Dormitory to Yayasan Media<br />

Nusantara located in Pondok Hijau Golf Street, Gading Serpong, for a total consideration amounting to<br />

Rp20,713,228 (including value added tax and dormitory facilities for 192 bedrooms). In <strong>2010</strong>, the<br />

related assets with net book value totaling Rp11,178,932 were reclassified to inventories, and then<br />

sold to Yayasan Media Nusantara.<br />

The percentages of completion of the construction in progress as of December 31, <strong>2010</strong> and 2009 are<br />

based on the actual expenditures incurred compared to the total budgeted project cost.<br />

Fixed assets, except land, are covered by insurance against fire, flood and other risks (all-risks) under<br />

blanket policies with several companies, including <strong>PT</strong> Asuransi Mitsui Sumitomo Indonesia Group,<br />

<strong>PT</strong> Asuransi Allianz Indonesia, <strong>PT</strong> Asuransi Central Asia, <strong>PT</strong> Asuransi Indrapura, <strong>PT</strong> Kurnia Insurance<br />

Indonesia, <strong>PT</strong> Asuransi Umum Mega, <strong>PT</strong> Asuransi Sinar Mas, and <strong>PT</strong> Asuransi Himalaya Pelindung,<br />

all third parties, for US$38,824,125 and Rp57,707,528 in <strong>2010</strong>, and US$22,543,550 and Rp48,536,909<br />

in 2009. SH, a Subsidiary, also covered by insurance against terrorism and sabotage amounting to<br />

US$14,000,000 and US$5,000,000 in <strong>2010</strong> and 2009, respectively. In addition, the Company and<br />

Subsidiaries obtained insurance against business interruption amounting to Rp114,544,485 and<br />

Rp36,199,485 in <strong>2010</strong> and 2009, respectively. The Company’s and Subsidiaries’ management are of<br />

the opinion that the above coverages are adequate to cover possible losses arising from such risks.<br />

As of December 31, <strong>2010</strong> and 2009, fixed assets with net book value of Rp29,182,935 and<br />

Rp31,273,979, respectively, are pledged as collateral for the loans from banks and financing institution<br />

(Note 14).<br />

Based on the Company’s and Subsidiaries’ assessment, there were no events or changes in<br />

circumstances which indicated an impairment in the value of fixed assets as of December 31, <strong>2010</strong><br />

and 2009.<br />

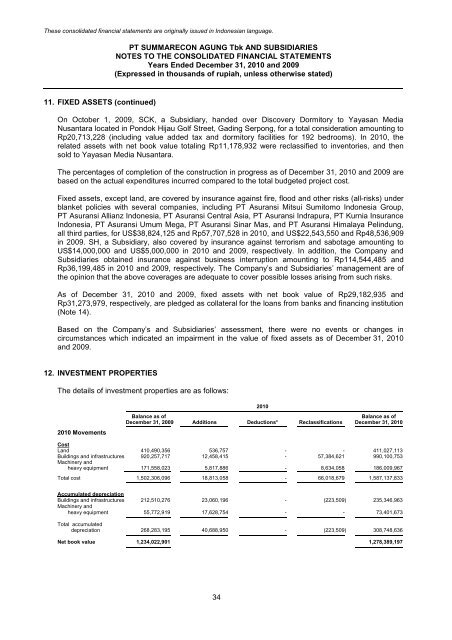

12. INVESTMENT PROPERTIES<br />

The details of investment properties are as follows:<br />

<strong>2010</strong> Movements<br />

34<br />

<strong>2010</strong><br />

Balance as of Balance as of<br />

December 31, 2009 Additions Deductions* Reclassifications December 31, <strong>2010</strong><br />

Cost<br />

Land 410,490,356 536,757 - - 411,027,113<br />

Buildings and infrastructures 920,257,717 12,458,415 - 57,384,621 990,100,753<br />

Machinery and<br />

heavy equipment 171,558,023 5,817,886 - 8,634,058 186,009,967<br />

Total cost 1,502,306,096 18,813,058 - 66,018,679 1,587,137,833<br />

Accumulated depreciation<br />

Buildings and infrastructures 212,510,276 23,060,196 - (223,509) 235,346,963<br />

Machinery and<br />

heavy equipment 55,772,919 17,628,754 - - 73,401,673<br />

Total accumulated<br />

depreciation 268,283,195 40,688,950 - (223,509) 308,748,636<br />

Net book value 1,234,022,901 1,278,389,197