PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

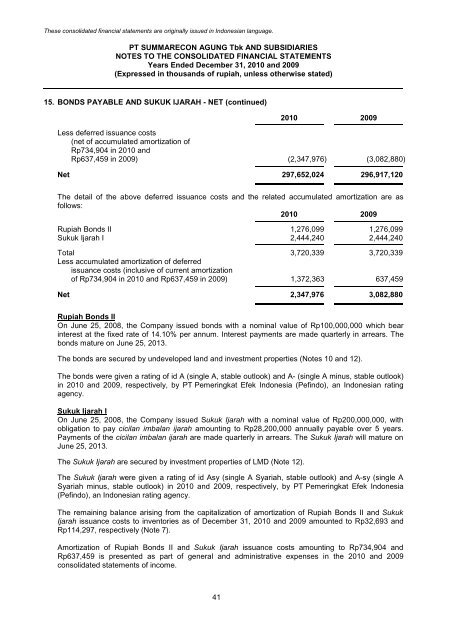

15. BONDS PAYABLE AND SUKUK IJARAH - NET (continued)<br />

41<br />

<strong>2010</strong> 2009<br />

Less deferred issuance costs<br />

(net of accumulated amortization of<br />

Rp734,904 in <strong>2010</strong> and<br />

Rp637,459 in 2009) (2,347,976) (3,082,880)<br />

Net 297,652,024 296,917,120<br />

The detail of the above deferred issuance costs and the related accumulated amortization are as<br />

follows:<br />

<strong>2010</strong> 2009<br />

Rupiah Bonds II 1,276,099 1,276,099<br />

Sukuk Ijarah I 2,444,240 2,444,240<br />

Total 3,720,339 3,720,339<br />

Less accumulated amortization of deferred<br />

issuance costs (inclusive of current amortization<br />

of Rp734,904 in <strong>2010</strong> and Rp637,459 in 2009) 1,372,363 637,459<br />

Net 2,347,976 3,082,880<br />

Rupiah Bonds II<br />

On June 25, 2008, the Company issued bonds with a nominal value of Rp100,000,000 which bear<br />

interest at the fixed rate of 14.10% per annum. Interest payments are made quarterly in arrears. The<br />

bonds mature on June 25, 2013.<br />

The bonds are secured by undeveloped land and investment properties (Notes 10 and 12).<br />

The bonds were given a rating of id A (single A, stable outlook) and A- (single A minus, stable outlook)<br />

in <strong>2010</strong> and 2009, respectively, by <strong>PT</strong> Pemeringkat Efek Indonesia (Pefindo), an Indonesian rating<br />

agency.<br />

Sukuk Ijarah I<br />

On June 25, 2008, the Company issued Sukuk Ijarah with a nominal value of Rp200,000,000, with<br />

obligation to pay cicilan imbalan ijarah amounting to Rp28,200,000 annually payable over 5 years.<br />

Payments of the cicilan imbalan ijarah are made quarterly in arrears. The Sukuk Ijarah will mature on<br />

June 25, 2013.<br />

The Sukuk Ijarah are secured by investment properties of LMD (Note 12).<br />

The Sukuk Ijarah were given a rating of id Asy (single A Syariah, stable outlook) and A-sy (single A<br />

Syariah minus, stable outlook) in <strong>2010</strong> and 2009, respectively, by <strong>PT</strong> Pemeringkat Efek Indonesia<br />

(Pefindo), an Indonesian rating agency.<br />

The remaining balance arising from the capitalization of amortization of Rupiah Bonds II and Sukuk<br />

Ijarah issuance costs to inventories as of December 31, <strong>2010</strong> and 2009 amounted to Rp32,693 and<br />

Rp114,297, respectively (Note 7).<br />

Amortization of Rupiah Bonds II and Sukuk Ijarah issuance costs amounting to Rp734,904 and<br />

Rp637,459 is presented as part of general and administrative expenses in the <strong>2010</strong> and 2009<br />

consolidated statements of income.