PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

15. BONDS PAYABLE AND SUKUK IJARAH - NET (continued)<br />

Based on the bondsholders and Sukuk Ijarah holders’ general meeting held on August 5, 2008, the<br />

bondholders and Sukuk Ijarah holders agreed that about 70% of the funds generated from the<br />

issuance of the bonds and Sukuk Ijarah will be used to acquire land through the acquisition of GO and<br />

about 30% will be used for working capital.<br />

Based on Perjanjian Perwaliamanatan Obligasi between the Company and Mandiri as a wali amanat<br />

(trustee), the Company is required to comply with the following covenants, among others:<br />

a. Maintain certain financial ratios as follows:<br />

(1) Interest-bearing debt to equity ratio of not more than 3:1<br />

(2) EBITDA to interest expense ratio of not less than 2.5:1<br />

(3) Collateral value which should be appraised every year by an appraiser registered with<br />

BAPEPAM and LK, to the bonds payable of not less than 1:1.<br />

The Company has met all the above financial ratio requirements.<br />

b. The Company is not allowed to:<br />

(1) Enter into merger or acquisition transactions<br />

(2) Reduce the Company’s authorized, issued and fully paid capital stock<br />

(3) Pledge the Company’s assets and its revenues<br />

(4) Transfer the Company’s assets representing more than 15% of the total assets<br />

(5) Provide to or accept loans from other parties<br />

(6) Grant corporate guarantee to another party<br />

(7) Change the Company’s major activities<br />

(8) Enter into business activities which contradict with the Syariah principles (especially for Sukuk<br />

Ijarah).<br />

As of December 31, <strong>2010</strong> and 2009, the Company is not in default of the covenants stated in the<br />

agreements on the bonds and Sukuk Ijarah.<br />

Based on the minutes of the bondholders’ meeting held on June 10, <strong>2010</strong>, which are covered by<br />

notarial deeds No. 22 and No. 19 of Fathiah Helmi, S.H., the bondholders approved the replacement of<br />

Mandiri as a wali amanat (trustee) for the bonds by <strong>PT</strong> Bank Rakyat Indonesia (Persero) <strong>Tbk</strong> (BRI)<br />

due to new credit facilities amounting to Rp250,000,000 obtained by the Company from Bank Mandiri<br />

in <strong>2010</strong>.<br />

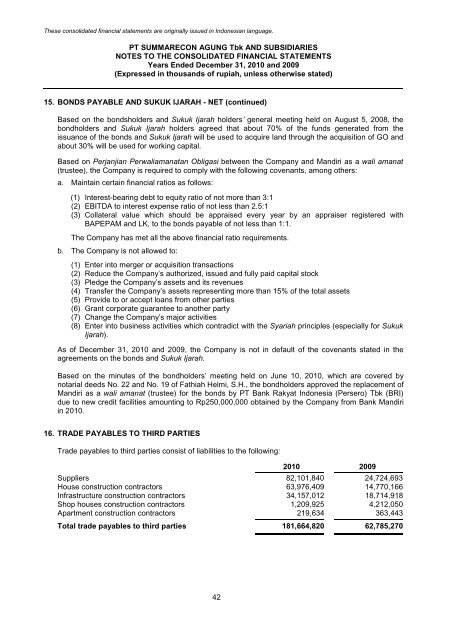

16. TRADE PAYABLES TO THIRD PARTIES<br />

Trade payables to third parties consist of liabilities to the following:<br />

42<br />

<strong>2010</strong> 2009<br />

Suppliers 82,101,840 24,724,693<br />

House construction contractors 63,976,409 14,770,166<br />

Infrastructure construction contractors 34,157,012 18,714,918<br />

Shop houses construction contractors 1,209,925 4,212,050<br />

Apartment construction contractors 219,634 363,443<br />

Total trade payables to third parties 181,664,820 62,785,270