PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

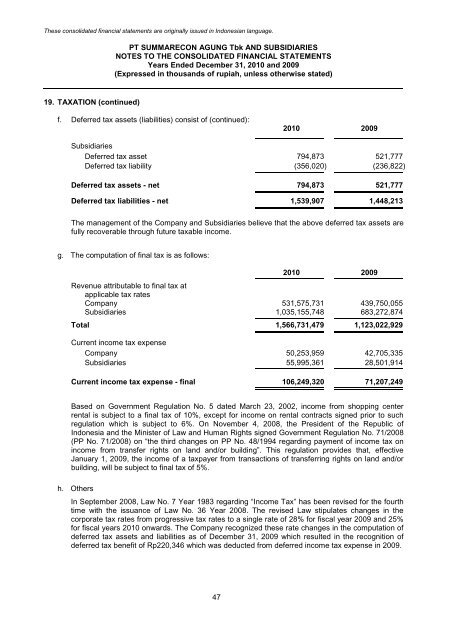

19. TAXATION (continued)<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

f. Deferred tax assets (liabilities) consist of (continued):<br />

47<br />

<strong>2010</strong> 2009<br />

Subsidiaries<br />

Deferred tax asset 794,873 521,777<br />

Deferred tax liability (356,020) (236,822)<br />

Deferred tax assets - net 794,873 521,777<br />

Deferred tax liabilities - net 1,539,907 1,448,213<br />

The management of the Company and Subsidiaries believe that the above deferred tax assets are<br />

fully recoverable through future taxable income.<br />

g. The computation of final tax is as follows:<br />

<strong>2010</strong> 2009<br />

Revenue attributable to final tax at<br />

applicable tax rates<br />

Company 531,575,731 439,750,055<br />

Subsidiaries 1,035,155,748 683,272,874<br />

Total 1,566,731,479 1,123,022,929<br />

Current income tax expense<br />

Company 50,253,959 42,705,335<br />

Subsidiaries 55,995,361 28,501,914<br />

Current income tax expense - final 106,249,320 71,207,249<br />

Based on Government Regulation No. 5 dated March 23, 2002, income from shopping center<br />

rental is subject to a final tax of 10%, except for income on rental contracts signed prior to such<br />

regulation which is subject to 6%. On November 4, 2008, the President of the Republic of<br />

Indonesia and the Minister of Law and Human Rights signed Government Regulation No. 71/2008<br />

(PP No. 71/2008) on “the third changes on PP No. 48/1994 regarding payment of income tax on<br />

income from transfer rights on land and/or building”. This regulation provides that, effective<br />

January 1, 2009, the income of a taxpayer from transactions of transferring rights on land and/or<br />

building, will be subject to final tax of 5%.<br />

h. Others<br />

In September 2008, Law No. 7 Year 1983 regarding “Income Tax” has been revised for the fourth<br />

time with the issuance of Law No. 36 Year 2008. The revised Law stipulates changes in the<br />

corporate tax rates from progressive tax rates to a single rate of 28% for fiscal year 2009 and 25%<br />

for fiscal years <strong>2010</strong> onwards. The Company recognized these rate changes in the computation of<br />

deferred tax assets and liabilities as of December 31, 2009 which resulted in the recognition of<br />

deferred tax benefit of Rp220,346 which was deducted from deferred income tax expense in 2009.