PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

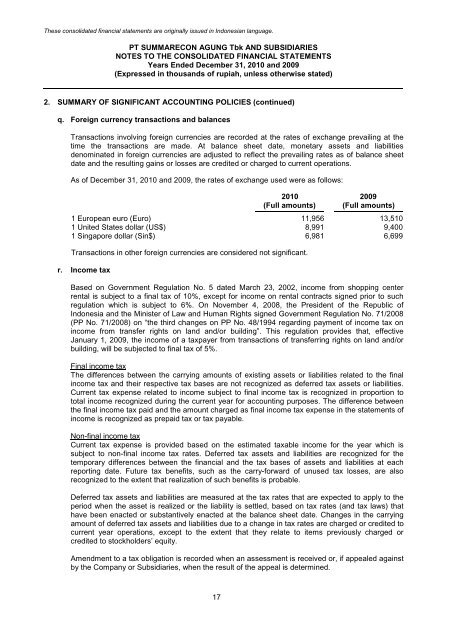

q. Foreign currency transactions and balances<br />

Transactions involving foreign currencies are recorded at the rates of exchange prevailing at the<br />

time the transactions are made. At balance sheet date, monetary assets and liabilities<br />

denominated in foreign currencies are adjusted to reflect the prevailing rates as of balance sheet<br />

date and the resulting gains or losses are credited or charged to current operations.<br />

As of December 31, <strong>2010</strong> and 2009, the rates of exchange used were as follows:<br />

17<br />

<strong>2010</strong> 2009<br />

(Full amounts) (Full amounts)<br />

1 European euro (Euro) 11,956 13,510<br />

1 United States dollar (US$) 8,991 9,400<br />

1 Singapore dollar (Sin$) 6,981 6,699<br />

Transactions in other foreign currencies are considered not significant.<br />

r. Income tax<br />

Based on Government Regulation No. 5 dated March 23, 2002, income from shopping center<br />

rental is subject to a final tax of 10%, except for income on rental contracts signed prior to such<br />

regulation which is subject to 6%. On November 4, 2008, the President of the Republic of<br />

Indonesia and the Minister of Law and Human Rights signed Government Regulation No. 71/2008<br />

(PP No. 71/2008) on “the third changes on PP No. 48/1994 regarding payment of income tax on<br />

income from transfer rights on land and/or building”. This regulation provides that, effective<br />

January 1, 2009, the income of a taxpayer from transactions of transferring rights on land and/or<br />

building, will be subjected to final tax of 5%.<br />

Final income tax<br />

The differences between the carrying amounts of existing assets or liabilities related to the final<br />

income tax and their respective tax bases are not recognized as deferred tax assets or liabilities.<br />

Current tax expense related to income subject to final income tax is recognized in proportion to<br />

total income recognized during the current year for accounting purposes. The difference between<br />

the final income tax paid and the amount charged as final income tax expense in the statements of<br />

income is recognized as prepaid tax or tax payable.<br />

Non-final income tax<br />

Current tax expense is provided based on the estimated taxable income for the year which is<br />

subject to non-final income tax rates. Deferred tax assets and liabilities are recognized for the<br />

temporary differences between the financial and the tax bases of assets and liabilities at each<br />

reporting date. Future tax benefits, such as the carry-forward of unused tax losses, are also<br />

recognized to the extent that realization of such benefits is probable.<br />

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the<br />

period when the asset is realized or the liability is settled, based on tax rates (and tax laws) that<br />

have been enacted or substantively enacted at the balance sheet date. Changes in the carrying<br />

amount of deferred tax assets and liabilities due to a change in tax rates are charged or credited to<br />

current year operations, except to the extent that they relate to items previously charged or<br />

credited to stockholders’ equity.<br />

Amendment to a tax obligation is recorded when an assessment is received or, if appealed against<br />

by the Company or Subsidiaries, when the result of the appeal is determined.