PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

These consolidated financial statements are originally issued in Indonesian language.<br />

1. GENERAL (continued)<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

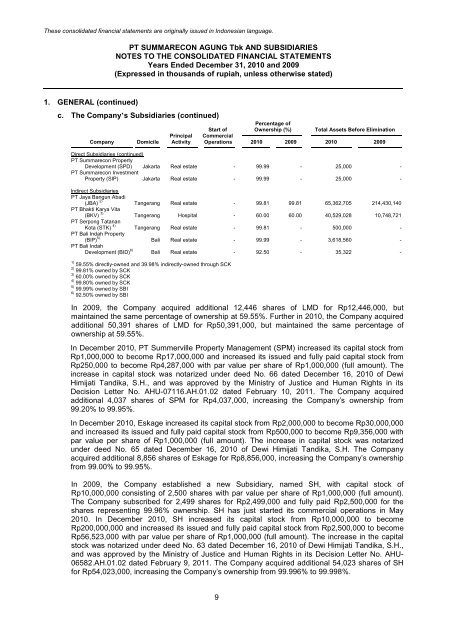

c. The Company’s Subsidiaries (continued)<br />

Percentage of<br />

Start of Ownership (%) Total Assets Before Elimination<br />

Principal Commercial<br />

Company Domicile Activity Operations <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Direct Subsidiaries (continued)<br />

<strong>PT</strong> <strong>Summarecon</strong> Property<br />

Development (SPD) Jakarta Real estate - 99.99 - 25,000 -<br />

<strong>PT</strong> <strong>Summarecon</strong> Investment<br />

Property (SIP) Jakarta Real estate - 99.99 - 25,000 -<br />

Indirect Subsidiaries<br />

<strong>PT</strong> Jaya Bangun Abadi<br />

(JBA) 2) Tangerang Real estate - 99.81 99.81 65,362,705 214,430,140<br />

<strong>PT</strong> Bhakti Karya Vita<br />

(BKV) 3) Tangerang Hospital - 60.00 60.00 40,529,028 10,748,721<br />

<strong>PT</strong> Serpong Tatanan<br />

Kota (STK) 4) Tangerang Real estate - 99.81 - 500,000 -<br />

<strong>PT</strong> Bali Indah Property<br />

(BIP) 5) Bali Real estate - 99.99 - 3,618,560 -<br />

<strong>PT</strong> Bali Indah<br />

Development (BID) 6) Bali Real estate - 92.50 - 35,322 -<br />

1) 59.55% directly-owned and 39.98% indirectly-owned through SCK<br />

2) 99.81% owned by SCK<br />

3) 60.00% owned by SCK<br />

4) 99.80% owned by SCK<br />

5) 99.99% owned by SBI<br />

6) 92.50% owned by SBI<br />

In 2009, the Company acquired additional 12,446 shares of LMD for Rp12,446,000, but<br />

maintained the same percentage of ownership at 59.55%. Further in <strong>2010</strong>, the Company acquired<br />

additional 50,391 shares of LMD for Rp50,391,000, but maintained the same percentage of<br />

ownership at 59.55%.<br />

In December <strong>2010</strong>, <strong>PT</strong> Summerville Property Management (SPM) increased its capital stock from<br />

Rp1,000,000 to become Rp17,000,000 and increased its issued and fully paid capital stock from<br />

Rp250,000 to become Rp4,287,000 with par value per share of Rp1,000,000 (full amount). The<br />

increase in capital stock was notarized under deed No. 66 dated December 16, <strong>2010</strong> of Dewi<br />

Himijati Tandika, S.H., and was approved by the Ministry of Justice and Human Rights in its<br />

Decision Letter No. AHU-07116.AH.01.02 dated February 10, 2011. The Company acquired<br />

additional 4,037 shares of SPM for Rp4,037,000, increasing the Company’s ownership from<br />

99.20% to 99.95%.<br />

In December <strong>2010</strong>, Eskage increased its capital stock from Rp2,000,000 to become Rp30,000,000<br />

and increased its issued and fully paid capital stock from Rp500,000 to become Rp9,356,000 with<br />

par value per share of Rp1,000,000 (full amount). The increase in capital stock was notarized<br />

under deed No. 65 dated December 16, <strong>2010</strong> of Dewi Himijati Tandika, S.H. The Company<br />

acquired additional 8,856 shares of Eskage for Rp8,856,000, increasing the Company’s ownership<br />

from 99.00% to 99.95%.<br />

In 2009, the Company established a new Subsidiary, named SH, with capital stock of<br />

Rp10,000,000 consisting of 2,500 shares with par value per share of Rp1,000,000 (full amount).<br />

The Company subscribed for 2,499 shares for Rp2,499,000 and fully paid Rp2,500,000 for the<br />

shares representing 99.96% ownership. SH has just started its commercial operations in May<br />

<strong>2010</strong>. In December <strong>2010</strong>, SH increased its capital stock from Rp10,000,000 to become<br />

Rp200,000,000 and increased its issued and fully paid capital stock from Rp2,500,000 to become<br />

Rp56,523,000 with par value per share of Rp1,000,000 (full amount). The increase in the capital<br />

stock was notarized under deed No. 63 dated December 16, <strong>2010</strong> of Dewi Himijati Tandika, S.H.,<br />

and was approved by the Ministry of Justice and Human Rights in its Decision Letter No. AHU-<br />

06582.AH.01.02 dated February 9, 2011. The Company acquired additional 54,023 shares of SH<br />

for Rp54,023,000, increasing the Company’s ownership from 99.996% to 99.998%.<br />

9