PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

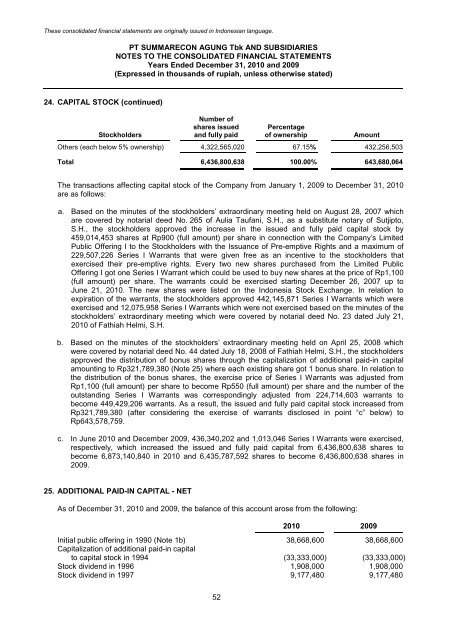

24. CAPITAL STOCK (continued)<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

Number of<br />

shares issued Percentage<br />

Stockholders and fully paid of ownership Amount<br />

Others (each below 5% ownership) 4,322,565,020 67.15% 432,256,503<br />

Total 6,436,800,638 100.00% 643,680,064<br />

The transactions affecting capital stock of the Company from January 1, 2009 to December 31, <strong>2010</strong><br />

are as follows:<br />

a. Based on the minutes of the stockholders’ extraordinary meeting held on August 28, 2007 which<br />

are covered by notarial deed No. 265 of Aulia Taufani, S.H., as a substitute notary of Sutjipto,<br />

S.H., the stockholders approved the increase in the issued and fully paid capital stock by<br />

459,014,453 shares at Rp900 (full amount) per share in connection with the Company’s Limited<br />

Public Offering I to the Stockholders with the Issuance of Pre-emptive Rights and a maximum of<br />

229,507,226 Series I Warrants that were given free as an incentive to the stockholders that<br />

exercised their pre-emptive rights. Every two new shares purchased from the Limited Public<br />

Offering I got one Series I Warrant which could be used to buy new shares at the price of Rp1,100<br />

(full amount) per share. The warrants could be exercised starting December 26, 2007 up to<br />

June 21, <strong>2010</strong>. The new shares were listed on the Indonesia Stock Exchange. In relation to<br />

expiration of the warrants, the stockholders approved 442,145,871 Series I Warrants which were<br />

exercised and 12,075,958 Series I Warrants which were not exercised based on the minutes of the<br />

stockholders’ extraordinary meeting which were covered by notarial deed No. 23 dated July 21,<br />

<strong>2010</strong> of Fathiah Helmi, S.H.<br />

b. Based on the minutes of the stockholders’ extraordinary meeting held on April 25, 2008 which<br />

were covered by notarial deed No. 44 dated July 18, 2008 of Fathiah Helmi, S.H., the stockholders<br />

approved the distribution of bonus shares through the capitalization of additional paid-in capital<br />

amounting to Rp321,789,380 (Note 25) where each existing share got 1 bonus share. In relation to<br />

the distribution of the bonus shares, the exercise price of Series I Warrants was adjusted from<br />

Rp1,100 (full amount) per share to become Rp550 (full amount) per share and the number of the<br />

outstanding Series I Warrants was correspondingly adjusted from 224,714,603 warrants to<br />

become 449,429,206 warrants. As a result, the issued and fully paid capital stock increased from<br />

Rp321,789,380 (after considering the exercise of warrants disclosed in point “c” below) to<br />

Rp643,578,759.<br />

c. In June <strong>2010</strong> and December 2009, 436,340,202 and 1,013,046 Series I Warrants were exercised,<br />

respectively, which increased the issued and fully paid capital from 6,436,800,638 shares to<br />

become 6,873,140,840 in <strong>2010</strong> and 6,435,787,592 shares to become 6,436,800,638 shares in<br />

2009.<br />

25. ADDITIONAL PAID-IN CAPITAL - NET<br />

As of December 31, <strong>2010</strong> and 2009, the balance of this account arose from the following:<br />

52<br />

<strong>2010</strong> 2009<br />

Initial public offering in 1990 (Note 1b) 38,668,600 38,668,600<br />

Capitalization of additional paid-in capital<br />

to capital stock in 1994 (33,333,000) (33,333,000)<br />

Stock dividend in 1996 1,908,000 1,908,000<br />

Stock dividend in 1997 9,177,480 9,177,480