PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

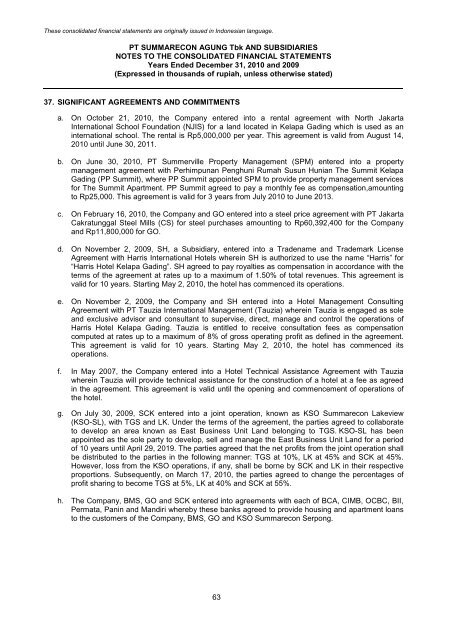

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

37. SIGNIFICANT AGREEMENTS AND COMMITMENTS<br />

a. On October 21, <strong>2010</strong>, the Company entered into a rental agreement with North Jakarta<br />

International School Foundation (NJIS) for a land located in Kelapa Gading which is used as an<br />

international school. The rental is Rp5,000,000 per year. This agreement is valid from August 14,<br />

<strong>2010</strong> until June 30, 2011.<br />

b. On June 30, <strong>2010</strong>, <strong>PT</strong> Summerville Property Management (SPM) entered into a property<br />

management agreement with Perhimpunan Penghuni Rumah Susun Hunian The Summit Kelapa<br />

Gading (PP Summit), where PP Summit appointed SPM to provide property management services<br />

for The Summit Apartment. PP Summit agreed to pay a monthly fee as compensation,amounting<br />

to Rp25,000. This agreement is valid for 3 years from July <strong>2010</strong> to June 2013.<br />

c. On February 16, <strong>2010</strong>, the Company and GO entered into a steel price agreement with <strong>PT</strong> Jakarta<br />

Cakratunggal Steel Mills (CS) for steel purchases amounting to Rp60,392,400 for the Company<br />

and Rp11,800,000 for GO.<br />

d. On November 2, 2009, SH, a Subsidiary, entered into a Tradename and Trademark License<br />

Agreement with Harris International Hotels wherein SH is authorized to use the name “Harris” for<br />

“Harris Hotel Kelapa Gading”. SH agreed to pay royalties as compensation in accordance with the<br />

terms of the agreement at rates up to a maximum of 1.50% of total revenues. This agreement is<br />

valid for 10 years. Starting May 2, <strong>2010</strong>, the hotel has commenced its operations.<br />

e. On November 2, 2009, the Company and SH entered into a Hotel Management Consulting<br />

Agreement with <strong>PT</strong> Tauzia International Management (Tauzia) wherein Tauzia is engaged as sole<br />

and exclusive advisor and consultant to supervise, direct, manage and control the operations of<br />

Harris Hotel Kelapa Gading. Tauzia is entitled to receive consultation fees as compensation<br />

computed at rates up to a maximum of 8% of gross operating profit as defined in the agreement.<br />

This agreement is valid for 10 years. Starting May 2, <strong>2010</strong>, the hotel has commenced its<br />

operations.<br />

f. In May 2007, the Company entered into a Hotel Technical Assistance Agreement with Tauzia<br />

wherein Tauzia will provide technical assistance for the construction of a hotel at a fee as agreed<br />

in the agreement. This agreement is valid until the opening and commencement of operations of<br />

the hotel.<br />

g. On July 30, 2009, SCK entered into a joint operation, known as KSO <strong>Summarecon</strong> Lakeview<br />

(KSO-SL), with TGS and LK. Under the terms of the agreement, the parties agreed to collaborate<br />

to develop an area known as East Business Unit Land belonging to TGS. KSO-SL has been<br />

appointed as the sole party to develop, sell and manage the East Business Unit Land for a period<br />

of 10 years until April 29, 2019. The parties agreed that the net profits from the joint operation shall<br />

be distributed to the parties in the following manner: TGS at 10%, LK at 45% and SCK at 45%.<br />

However, loss from the KSO operations, if any, shall be borne by SCK and LK in their respective<br />

proportions. Subsequently, on March 17, <strong>2010</strong>, the parties agreed to change the percentages of<br />

profit sharing to become TGS at 5%, LK at 40% and SCK at 55%.<br />

h. The Company, BMS, GO and SCK entered into agreements with each of BCA, CIMB, OCBC, BII,<br />

Permata, Panin and Mandiri whereby these banks agreed to provide housing and apartment loans<br />

to the customers of the Company, BMS, GO and KSO <strong>Summarecon</strong> Serpong.<br />

63