PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Analisa dan Diskusi Manajemen<br />

2. Pendapatan bunga meningkat Rp30 milyar dari Rp14<br />

milyar menjadi Rp44 milyar di tahun <strong>2010</strong> yang<br />

disebabkan marketing sales properti yang sangat baik.<br />

3. Penurunan bagian atas laba bersih perusahaan asosiasi<br />

sebesar Rp26 milyar karena kepemilikan saham pada <strong>PT</strong><br />

Jakartabaru Graha Permai yang dijual pada tahun 2009.<br />

4. Beban pajak meningkat Rp35 milyar oleh karena<br />

peningkatan volume bisnis.<br />

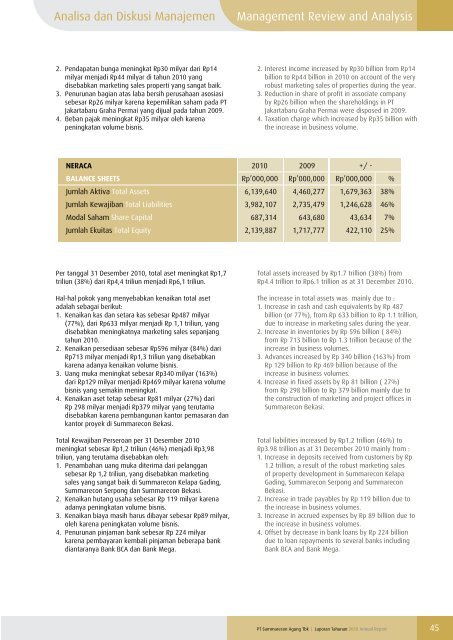

NERACA <strong>2010</strong> 2009 +/ -<br />

BALANCE SHEETS Rp’000,000 Rp’000,000 Rp’000,000 %<br />

Jumlah Aktiva Total Assets 6,139,640 4,460,277 1,679,363 38%<br />

Jumlah Kewajiban Total Liabilities 3,982,107 2,735,479 1,246,628 46%<br />

Modal Saham Share Capital 687,314 643,680 43,634 7%<br />

Jumlah Ekuitas Total Equity 2,139,887 1,717,777 422,110 25%<br />

Per tanggal 31 Desember <strong>2010</strong>, total aset meningkat Rp1,7<br />

triliun (38%) dari Rp4,4 triliun menjadi Rp6,1 triliun.<br />

Hal-hal pokok yang menyebabkan kenaikan total aset<br />

adalah sebagai berikut:<br />

1. Kenaikan kas dan setara kas sebesar Rp487 milyar<br />

(77%), dari Rp633 milyar menjadi Rp 1,1 triliun, yang<br />

disebabkan meningkatnya marketing sales sepanjang<br />

tahun <strong>2010</strong>.<br />

2. Kenaikan persediaan sebesar Rp596 milyar (84%) dari<br />

Rp713 milyar menjadi Rp1,3 triliun yang disebabkan<br />

karena adanya kenaikan volume bisnis.<br />

3. Uang muka meningkat sebesar Rp340 milyar (163%)<br />

dari Rp129 milyar menjadi Rp469 milyar karena volume<br />

bisnis yang semakin meningkat.<br />

4. Kenaikan aset tetap sebesar Rp81 milyar (27%) dari<br />

Rp 298 milyar menjadi Rp379 milyar yang terutama<br />

disebabkan karena pembangunan kantor pemasaran dan<br />

kantor proyek di <strong>Summarecon</strong> Bekasi.<br />

Total Kewajiban Perseroan per 31 Desember <strong>2010</strong><br />

meningkat sebesar Rp1,2 triliun (46%) menjadi Rp3,98<br />

triliun, yang terutama disebabkan oleh:<br />

1. Penambahan uang muka diterima dari pelanggan<br />

sebesar Rp 1,2 triliun, yang disebabkan marketing<br />

sales yang sangat baik di <strong>Summarecon</strong> Kelapa Gading,<br />

<strong>Summarecon</strong> Serpong dan <strong>Summarecon</strong> Bekasi.<br />

2. Kenaikan hutang usaha sebesar Rp 119 milyar karena<br />

adanya peningkatan volume bisnis.<br />

3. Kenaikan biaya masih harus dibayar sebesar Rp89 milyar,<br />

oleh karena peningkatan volume bisnis.<br />

4. Penurunan pinjaman bank sebesar Rp 224 milyar<br />

karena pembayaran kembali pinjaman beberapa bank<br />

diantaranya Bank BCA dan Bank Mega.<br />

Management Review and Analysis<br />

2. Interest income increased by Rp30 billion from Rp14<br />

billion to Rp44 billion in <strong>2010</strong> on account of the very<br />

robust marketing sales of properties during the year.<br />

3. Reduction in share of profit in associate company<br />

by Rp26 billion when the shareholdings in <strong>PT</strong><br />

Jakartabaru Graha Permai were disposed in 2009.<br />

4. Taxation charge which increased by Rp35 billion with<br />

the increase in business volume.<br />

Total assets increased by Rp1.7 trillion (38%) from<br />

Rp4.4 trillion to Rp6.1 trillion as at 31 December <strong>2010</strong>.<br />

The increase in total assets was mainly due to :<br />

1. Increase in cash and cash equivalents by Rp 487<br />

billion (or 77%), from Rp 633 billion to Rp 1.1 trillion,<br />

due to increase in marketing sales during the year.<br />

2. Increase in inventories by Rp 596 billion ( 84%)<br />

from Rp 713 billion to Rp 1.3 trillion because of the<br />

increase in business volumes.<br />

3. Advances increased by Rp 340 billion (163%) from<br />

Rp 129 billion to Rp 469 billion because of the<br />

increase in business volumes.<br />

4. Increase in fixed assets by Rp 81 billion ( 27%)<br />

from Rp 298 billion to Rp 379 billion mainly due to<br />

the construction of marketing and project offices in<br />

<strong>Summarecon</strong> Bekasi.<br />

Total liabilities increased by Rp1.2 trillion (46%) to<br />

Rp3.98 trillion as at 31 December <strong>2010</strong> mainly from :<br />

1. Increase in deposits received from customers by Rp<br />

1.2 trillion, a result of the robust marketing sales<br />

of property development in <strong>Summarecon</strong> Kelapa<br />

Gading, <strong>Summarecon</strong> Serpong and <strong>Summarecon</strong><br />

Bekasi.<br />

2. Increase in trade payables by Rp 119 billion due to<br />

the increase in business volumes.<br />

3. Increase in accrued expenses by Rp 89 billion due to<br />

the increase in business volumes.<br />

4. Offset by decrease in bank loans by Rp 224 billion<br />

due to loan repayments to several banks including<br />

Bank BCA and Bank Mega.<br />

<strong>PT</strong> <strong>Summarecon</strong> <strong>Agung</strong> <strong>Tbk</strong> | <strong>Laporan</strong> <strong>Tahunan</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong><br />

45