PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

These consolidated financial statements are originally issued in Indonesian language.<br />

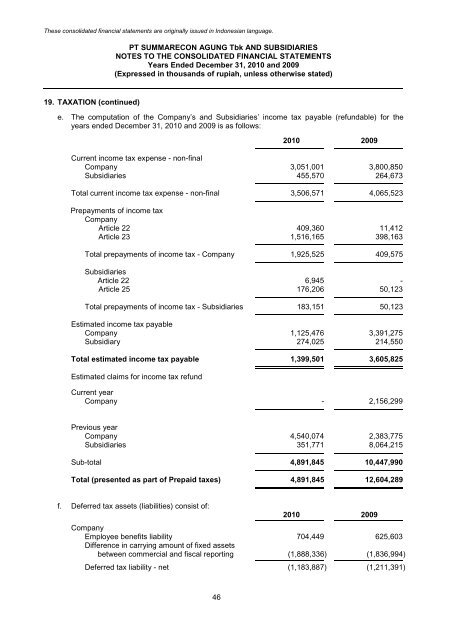

19. TAXATION (continued)<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

e. The computation of the Company’s and Subsidiaries’ income tax payable (refundable) for the<br />

years ended December 31, <strong>2010</strong> and 2009 is as follows:<br />

46<br />

<strong>2010</strong> 2009<br />

Current income tax expense - non-final<br />

Company 3,051,001 3,800,850<br />

Subsidiaries 455,570 264,673<br />

Total current income tax expense - non-final 3,506,571 4,065,523<br />

Prepayments of income tax<br />

Company<br />

Article 22 409,360 11,412<br />

Article 23 1,516,165 398,163<br />

Total prepayments of income tax - Company 1,925,525 409,575<br />

Subsidiaries<br />

Article 22 6,945 -<br />

Article 25 176,206 50,123<br />

Total prepayments of income tax - Subsidiaries 183,151 50,123<br />

Estimated income tax payable<br />

Company 1,125,476 3,391,275<br />

Subsidiary 274,025 214,550<br />

Total estimated income tax payable 1,399,501 3,605,825<br />

Estimated claims for income tax refund<br />

Current year<br />

Company - 2,156,299<br />

Previous year<br />

Company 4,540,074 2,383,775<br />

Subsidiaries 351,771 8,064,215<br />

Sub-total 4,891,845 10,447,990<br />

Total (presented as part of Prepaid taxes) 4,891,845 12,604,289<br />

f. Deferred tax assets (liabilities) consist of:<br />

<strong>2010</strong> 2009<br />

Company<br />

Employee benefits liability 704,449 625,603<br />

Difference in carrying amount of fixed assets<br />

between commercial and fiscal reporting (1,888,336) (1,836,994)<br />

Deferred tax liability - net (1,183,887) (1,211,391)