PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44<br />

Analisa dan Diskusi Manajemen Management Review and Analysis<br />

Unit bisnis Pengembangan Properti<br />

Unit bisnis Pengembangan Properti memberikan<br />

kontribusi sebesar 49% dari total laba usaha Perseroan<br />

di tahun <strong>2010</strong>. Laba usaha dari unit bisnis ini meningkat<br />

Rp 35 milyar (atau 23%) menjadi Rp 185 milyar, yang<br />

terutama disebabkan peningkatan pendapatan.<br />

Unit bisnis Investasi dan Manajemen Properti<br />

Unit bisnis ini menyumbangkan 52% dari total laba<br />

usaha <strong>Summarecon</strong> sepanjang tahun <strong>2010</strong>. Laba usaha<br />

meningkat sebesar Rp 24 milyar atau tumbuh 14%<br />

menjadi Rp195 milyar.<br />

Unit Business Rekreasi Dan Hospitality<br />

Unit bisnis ini masih mengalami rugi usaha mengingat<br />

bisnis hotel yang baru dibuka pada bulan Mei <strong>2010</strong>.<br />

Property Development business unit<br />

Property development business contributed 49% to the<br />

Company’s total operating income in <strong>2010</strong>. Operating<br />

income from this business unit increased by Rp 35 billion<br />

(or 23%) to Rp 155 billion, due to increase in revenues.<br />

Investment and Property Management<br />

The business unit contributed 52% to <strong>Summarecon</strong>’s<br />

total operating income in <strong>2010</strong>. Operating income from<br />

this business increased by Rp24 billion (or 14%) to Rp<br />

195 billion.<br />

Leisure and Hospitality<br />

The businesses are still in a loss position as the hotel<br />

opened only May <strong>2010</strong>.<br />

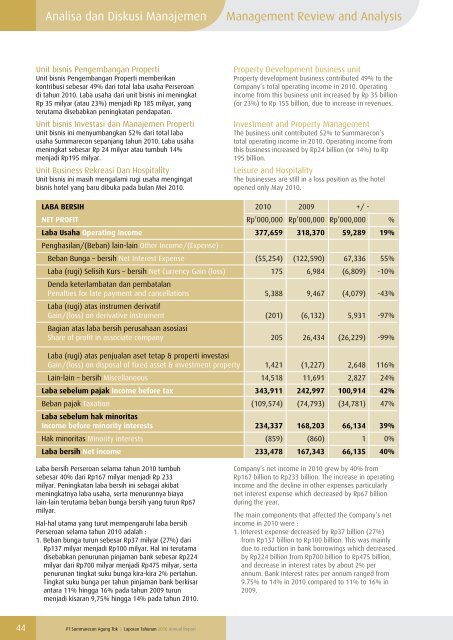

LABA BERSIH <strong>2010</strong> 2009 +/ -<br />

NET PROFIT Rp’000,000 Rp’000,000 Rp’000,000 %<br />

Laba Usaha Operating Income 377,659 318,370 59,289 19%<br />

Penghasilan/(Beban) lain-lain Other Income/(Expense) :<br />

Beban Bunga – bersih Net Interest Expense (55,254) (122,590) 67,336 55%<br />

Laba (rugi) Selisih Kurs – bersih Net Currency Gain (loss) 175 6,984 (6,809) -10%<br />

Denda keterlambatan dan pembatalan<br />

Penalties for late payment and cancellations 5,388 9,467 (4,079) -43%<br />

Laba (rugi) atas instrumen derivatif<br />

Gain/(loss) on derivative instrument (201) (6,132) 5,931 -97%<br />

Bagian atas laba bersih perusahaan asosiasi<br />

Share of profit in associate company 205 26,434 (26,229) -99%<br />

Laba (rugi) atas penjualan aset tetap & properti investasi<br />

Gain/(loss) on disposal of fixed asset & investment property 1,421 (1,227) 2,648 116%<br />

Lain-lain – bersih Miscellaneous 14,518 11,691 2,827 24%<br />

Laba sebelum pajak Income before tax 343,911 242,997 100,914 42%<br />

Beban pajak Taxation (109,574) (74,793) (34,781) 47%<br />

Laba sebelum hak minoritas<br />

Income before minority interests 234,337 168,203 66,134 39%<br />

Hak minoritas Minority interests (859) (860) 1 0%<br />

Laba bersih Net income 233,478 167,343 66,135 40%<br />

Laba bersih Perseroan selama tahun <strong>2010</strong> tumbuh<br />

sebesar 40% dari Rp167 milyar menjadi Rp 233<br />

milyar. Peningkatan laba bersih ini sebagai akibat<br />

meningkatnya laba usaha, serta menurunnya biaya<br />

lain-lain terutama beban bunga bersih yang turun Rp67<br />

milyar.<br />

Hal-hal utama yang turut mempengaruhi laba bersih<br />

Perseroan selama tahun <strong>2010</strong> adalah :<br />

1. Beban bunga turun sebesar Rp37 milyar (27%) dari<br />

Rp137 milyar menjadi Rp100 milyar. Hal ini terutama<br />

disebabkan penurunan pinjaman bank sebesar Rp224<br />

milyar dari Rp700 milyar menjadi Rp475 milyar, serta<br />

penurunan tingkat suku bunga kira-kira 2% pertahun.<br />

Tingkat suku bunga per tahun pinjaman bank berkisar<br />

antara 11% hingga 16% pada tahun 2009 turun<br />

menjadi kisaran 9,75% hingga 14% pada tahun <strong>2010</strong>.<br />

<strong>PT</strong> <strong>Summarecon</strong> <strong>Agung</strong> <strong>Tbk</strong> | <strong>Laporan</strong> <strong>Tahunan</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong><br />

Company’s net income in <strong>2010</strong> grew by 40% from<br />

Rp167 billion to Rp233 billion. The increase in operating<br />

income and the decline in other expenses particularly<br />

net interest expense which decreased by Rp67 billion<br />

during the year.<br />

The main components that affected the Company’s net<br />

income in <strong>2010</strong> were :<br />

1. Interest expense decreased by Rp37 billion (27%)<br />

from Rp137 billion to Rp100 billion. This was mainly<br />

due to reduction in bank borrowings which decreased<br />

by Rp224 billion from Rp700 billion to Rp475 billion,<br />

and decrease in interest rates by about 2% per<br />

annum. Bank interest rates per annum ranged from<br />

9.75% to 14% in <strong>2010</strong> compared to 11% to 16% in<br />

2009.