PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

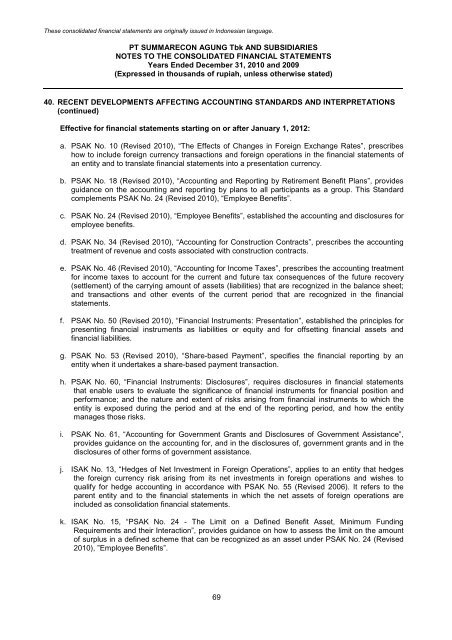

40. RECENT DEVELOPMENTS AFFECTING ACCOUNTING STANDARDS AND INTERPRETATIONS<br />

(continued)<br />

Effective for financial statements starting on or after January 1, 2012:<br />

a. PSAK No. 10 (Revised <strong>2010</strong>), “The Effects of Changes in Foreign Exchange Rates”, prescribes<br />

how to include foreign currency transactions and foreign operations in the financial statements of<br />

an entity and to translate financial statements into a presentation currency.<br />

b. PSAK No. 18 (Revised <strong>2010</strong>), “Accounting and <strong>Report</strong>ing by Retirement Benefit Plans”, provides<br />

guidance on the accounting and reporting by plans to all participants as a group. This Standard<br />

complements PSAK No. 24 (Revised <strong>2010</strong>), “Employee Benefits”.<br />

c. PSAK No. 24 (Revised <strong>2010</strong>), “Employee Benefits”, established the accounting and disclosures for<br />

employee benefits.<br />

d. PSAK No. 34 (Revised <strong>2010</strong>), “Accounting for Construction Contracts”, prescribes the accounting<br />

treatment of revenue and costs associated with construction contracts.<br />

e. PSAK No. 46 (Revised <strong>2010</strong>), “Accounting for Income Taxes”, prescribes the accounting treatment<br />

for income taxes to account for the current and future tax consequences of the future recovery<br />

(settlement) of the carrying amount of assets (liabilities) that are recognized in the balance sheet;<br />

and transactions and other events of the current period that are recognized in the financial<br />

statements.<br />

f. PSAK No. 50 (Revised <strong>2010</strong>), “Financial Instruments: Presentation”, established the principles for<br />

presenting financial instruments as liabilities or equity and for offsetting financial assets and<br />

financial liabilities.<br />

g. PSAK No. 53 (Revised <strong>2010</strong>), “Share-based Payment”, specifies the financial reporting by an<br />

entity when it undertakes a share-based payment transaction.<br />

h. PSAK No. 60, “Financial Instruments: Disclosures”, requires disclosures in financial statements<br />

that enable users to evaluate the significance of financial instruments for financial position and<br />

performance; and the nature and extent of risks arising from financial instruments to which the<br />

entity is exposed during the period and at the end of the reporting period, and how the entity<br />

manages those risks.<br />

i. PSAK No. 61, “Accounting for Government Grants and Disclosures of Government Assistance”,<br />

provides guidance on the accounting for, and in the disclosures of, government grants and in the<br />

disclosures of other forms of government assistance.<br />

j. ISAK No. 13, “Hedges of Net Investment in Foreign Operations”, applies to an entity that hedges<br />

the foreign currency risk arising from its net investments in foreign operations and wishes to<br />

qualify for hedge accounting in accordance with PSAK No. 55 (Revised 2006). It refers to the<br />

parent entity and to the financial statements in which the net assets of foreign operations are<br />

included as consolidation financial statements.<br />

k. ISAK No. 15, “PSAK No. 24 - The Limit on a Defined Benefit Asset, Minimum Funding<br />

Requirements and their Interaction”, provides guidance on how to assess the limit on the amount<br />

of surplus in a defined scheme that can be recognized as an asset under PSAK No. 24 (Revised<br />

<strong>2010</strong>), ”Employee Benefits”.<br />

69