PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

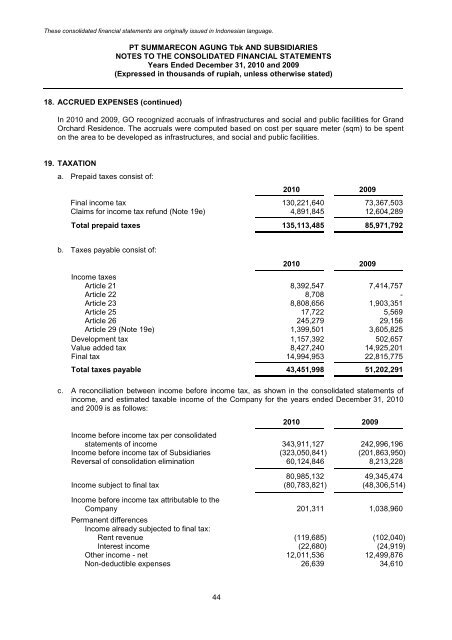

18. ACCRUED EXPENSES (continued)<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

In <strong>2010</strong> and 2009, GO recognized accruals of infrastructures and social and public facilities for Grand<br />

Orchard Residence. The accruals were computed based on cost per square meter (sqm) to be spent<br />

on the area to be developed as infrastructures, and social and public facilities.<br />

19. TAXATION<br />

a. Prepaid taxes consist of:<br />

44<br />

<strong>2010</strong> 2009<br />

Final income tax 130,221,640 73,367,503<br />

Claims for income tax refund (Note 19e) 4,891,845 12,604,289<br />

Total prepaid taxes 135,113,485 85,971,792<br />

b. Taxes payable consist of:<br />

<strong>2010</strong> 2009<br />

Income taxes<br />

Article 21 8,392,547 7,414,757<br />

Article 22 8,708 -<br />

Article 23 8,808,656 1,903,351<br />

Article 25 17,722 5,569<br />

Article 26 245,279 29,156<br />

Article 29 (Note 19e) 1,399,501 3,605,825<br />

Development tax 1,157,392 502,657<br />

Value added tax 8,427,240 14,925,201<br />

Final tax 14,994,953 22,815,775<br />

Total taxes payable 43,451,998 51,202,291<br />

c. A reconciliation between income before income tax, as shown in the consolidated statements of<br />

income, and estimated taxable income of the Company for the years ended December 31, <strong>2010</strong><br />

and 2009 is as follows:<br />

<strong>2010</strong> 2009<br />

Income before income tax per consolidated<br />

statements of income 343,911,127 242,996,196<br />

Income before income tax of Subsidiaries (323,050,841) (201,863,950)<br />

Reversal of consolidation elimination 60,124,846 8,213,228<br />

80,985,132 49,345,474<br />

Income subject to final tax (80,783,821) (48,306,514)<br />

Income before income tax attributable to the<br />

Company 201,311 1,038,960<br />

Permanent differences<br />

Income already subjected to final tax:<br />

Rent revenue (119,685) (102,040)<br />

Interest income (22,680) (24,919)<br />

Other income - net 12,011,536 12,499,876<br />

Non-deductible expenses 26,639 34,610