PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

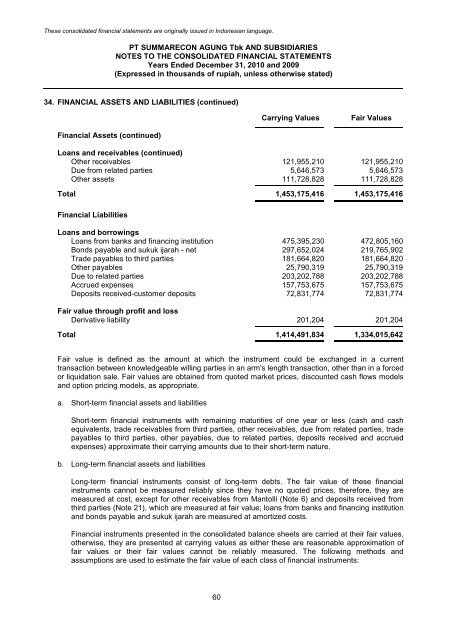

34. FINANCIAL ASSETS AND LIABILITIES (continued)<br />

Financial Assets (continued)<br />

60<br />

Carrying Values Fair Values<br />

Loans and receivables (continued)<br />

Other receivables 121,955,210 121,955,210<br />

Due from related parties 5,646,573 5,646,573<br />

Other assets 111,728,828 111,728,828<br />

Total 1,453,175,416 1,453,175,416<br />

Financial Liabilities<br />

Loans and borrowings<br />

Loans from banks and financing institution 475,395,230 472,805,160<br />

Bonds payable and sukuk ijarah - net 297,652,024 219,765,902<br />

Trade payables to third parties 181,664,820 181,664,820<br />

Other payables 25,790,319 25,790,319<br />

Due to related parties 203,202,788 203,202,788<br />

Accrued expenses 157,753,675 157,753,675<br />

Deposits received-customer deposits 72,831,774 72,831,774<br />

Fair value through profit and loss<br />

Derivative liability 201,204 201,204<br />

Total 1,414,491,834 1,334,015,642<br />

Fair value is defined as the amount at which the instrument could be exchanged in a current<br />

transaction between knowledgeable willing parties in an arm's length transaction, other than in a forced<br />

or liquidation sale. Fair values are obtained from quoted market prices, discounted cash flows models<br />

and option pricing models, as appropriate.<br />

a. Short-term financial assets and liabilities<br />

Short-term financial instruments with remaining maturities of one year or less (cash and cash<br />

equivalents, trade receivables from third parties, other receivables, due from related parties, trade<br />

payables to third parties, other payables, due to related parties, deposits received and accrued<br />

expenses) approximate their carrying amounts due to their short-term nature.<br />

b. Long-term financial assets and liabilities<br />

Long-term financial instruments consist of long-term debts. The fair value of these financial<br />

instruments cannot be measured reliably since they have no quoted prices, therefore, they are<br />

measured at cost, except for other receivables from Mantolli (Note 6) and deposits received from<br />

third parties (Note 21), which are measured at fair value; loans from banks and financing institution<br />

and bonds payable and sukuk ijarah are measured at amortized costs.<br />

Financial instruments presented in the consolidated balance sheets are carried at their fair values,<br />

otherwise, they are presented at carrying values as either these are reasonable approximation of<br />

fair values or their fair values cannot be reliably measured. The following methods and<br />

assumptions are used to estimate the fair value of each class of financial instruments: