PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

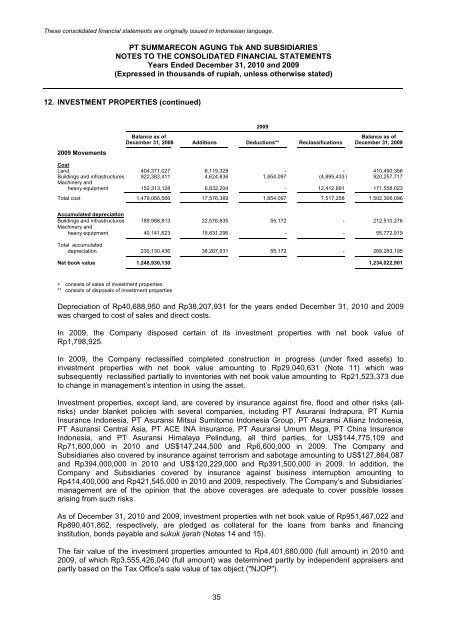

12. INVESTMENT PROPERTIES (continued)<br />

2009 Movements<br />

35<br />

2009<br />

Balance as of Balance as of<br />

December 31, 2008 Additions Deductions** Reclassifications December 31, 2009<br />

Cost<br />

Land 404,371,027 6,119,329 - - 410,490,356<br />

Buildings and infrastructures 922,382,411 4,624,836 1,854,097 (4,895,433 ) 920,257,717<br />

Machinery and<br />

heavy equipment 152,313,128 6,832,204 - 12,412,691 171,558,023<br />

Total cost 1,479,066,566 17,576,369 1,854,097 7,517,258 1,502,306,096<br />

Accumulated depreciation<br />

Buildings and infrastructures 189,988,813 22,576,635 55,172 - 212,510,276<br />

Machinery and<br />

heavy equipment 40,141,623 15,631,296 - - 55,772,919<br />

Total accumulated<br />

depreciation 230,130,436 38,207,931 55,172 - 268,283,195<br />

Net book value 1,248,936,130 1,234,022,901<br />

∗ consists of sales of investment properties<br />

** consists of disposals of investment properties<br />

Depreciation of Rp40,688,950 and Rp38,207,931 for the years ended December 31, <strong>2010</strong> and 2009<br />

was charged to cost of sales and direct costs.<br />

In 2009, the Company disposed certain of its investment properties with net book value of<br />

Rp1,798,925.<br />

In 2009, the Company reclassified completed construction in progress (under fixed assets) to<br />

investment properties with net book value amounting to Rp29,040,631 (Note 11) which was<br />

subsequently reclassified partially to inventories with net book value amounting to Rp21,523,373 due<br />

to change in management’s intention in using the asset.<br />

Investment properties, except land, are covered by insurance against fire, flood and other risks (allrisks)<br />

under blanket policies with several companies, including <strong>PT</strong> Asuransi Indrapura, <strong>PT</strong> Kurnia<br />

Insurance Indonesia, <strong>PT</strong> Asuransi Mitsui Sumitomo Indonesia Group, <strong>PT</strong> Asuransi Allianz Indonesia,<br />

<strong>PT</strong> Asuransi Central Asia, <strong>PT</strong> ACE INA Insurance, <strong>PT</strong> Asuransi Umum Mega, <strong>PT</strong> China Insurance<br />

Indonesia, and <strong>PT</strong> Asuransi Himalaya Pelindung, all third parties, for US$144,775,109 and<br />

Rp71,600,000 in <strong>2010</strong> and US$147,244,500 and Rp6,600,000 in 2009. The Company and<br />

Subsidiaries also covered by insurance against terrorism and sabotage amounting to US$127,864,087<br />

and Rp394,000,000 in <strong>2010</strong> and US$120,229,000 and Rp391,500,000 in 2009. In addition, the<br />

Company and Subsidiaries covered by insurance against business interruption amounting to<br />

Rp414,400,000 and Rp421,545,000 in <strong>2010</strong> and 2009, respectively. The Company’s and Subsidiaries’<br />

management are of the opinion that the above coverages are adequate to cover possible losses<br />

arising from such risks.<br />

As of December 31, <strong>2010</strong> and 2009, investment properties with net book value of Rp951,467,022 and<br />

Rp890,401,862, respectively, are pledged as collateral for the loans from banks and financing<br />

institution, bonds payable and sukuk ijarah (Notes 14 and 15).<br />

The fair value of the investment properties amounted to Rp4,401,680,000 (full amount) in <strong>2010</strong> and<br />

2009, of which Rp3,555,426,040 (full amount) was determined partly by independent appraisers and<br />

partly based on the Tax Office's sale value of tax object ("NJOP").