PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

PT Summarecon Agung Tbk | Laporan Tahunan 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

These consolidated financial statements are originally issued in Indonesian language.<br />

<strong>PT</strong> SUMMARECON AGUNG <strong>Tbk</strong> AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years Ended December 31, <strong>2010</strong> and 2009<br />

(Expressed in thousands of rupiah, unless otherwise stated)<br />

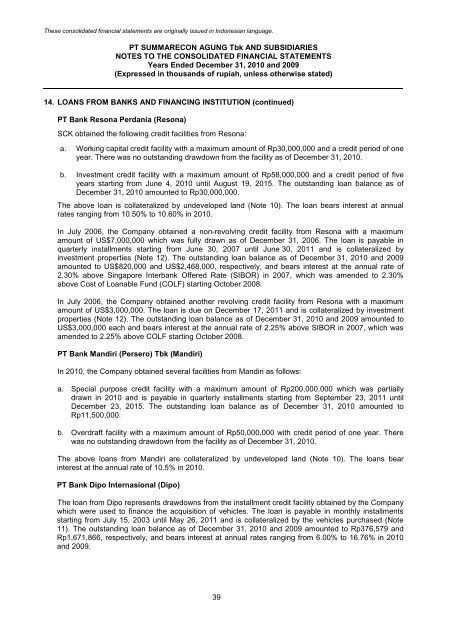

14. LOANS FROM BANKS AND FINANCING INSTITUTION (continued)<br />

<strong>PT</strong> Bank Resona Perdania (Resona)<br />

SCK obtained the following credit facilities from Resona:<br />

a. Working capital credit facility with a maximum amount of Rp30,000,000 and a credit period of one<br />

year. There was no outstanding drawdown from the facility as of December 31, <strong>2010</strong>.<br />

b. Investment credit facility with a maximum amount of Rp58,000,000 and a credit period of five<br />

years starting from June 4, <strong>2010</strong> until August 19, 2015. The outstanding loan balance as of<br />

December 31, <strong>2010</strong> amounted to Rp30,000,000.<br />

The above loan is collateralized by undeveloped land (Note 10). The loan bears interest at annual<br />

rates ranging from 10.50% to 10.60% in <strong>2010</strong>.<br />

In July 2006, the Company obtained a non-revolving credit facility from Resona with a maximum<br />

amount of US$7,000,000 which was fully drawn as of December 31, 2006. The loan is payable in<br />

quarterly installments starting from June 30, 2007 until June 30, 2011 and is collateralized by<br />

investment properties (Note 12). The outstanding loan balance as of December 31, <strong>2010</strong> and 2009<br />

amounted to US$820,000 and US$2,468,000, respectively, and bears interest at the annual rate of<br />

2.30% above Singapore Interbank Offered Rate (SIBOR) in 2007, which was amended to 2.30%<br />

above Cost of Loanable Fund (COLF) starting October 2008.<br />

In July 2006, the Company obtained another revolving credit facility from Resona with a maximum<br />

amount of US$3,000,000. The loan is due on December 17, 2011 and is collateralized by investment<br />

properties (Note 12). The outstanding loan balance as of December 31, <strong>2010</strong> and 2009 amounted to<br />

US$3,000,000 each and bears interest at the annual rate of 2.25% above SIBOR in 2007, which was<br />

amended to 2.25% above COLF starting October 2008.<br />

<strong>PT</strong> Bank Mandiri (Persero) <strong>Tbk</strong> (Mandiri)<br />

In <strong>2010</strong>, the Company obtained several facilities from Mandiri as follows:<br />

a. Special purpose credit facility with a maximum amount of Rp200,000,000 which was partially<br />

drawn in <strong>2010</strong> and is payable in quarterly installments starting from September 23, 2011 until<br />

December 23, 2015. The outstanding loan balance as of December 31, <strong>2010</strong> amounted to<br />

Rp11,500,000.<br />

b. Overdraft facility with a maximum amount of Rp50,000,000 with credit period of one year. There<br />

was no outstanding drawdown from the facility as of December 31, <strong>2010</strong>.<br />

The above loans from Mandiri are collateralized by undeveloped land (Note 10). The loans bear<br />

interest at the annual rate of 10.5% in <strong>2010</strong>.<br />

<strong>PT</strong> Bank Dipo Internasional (Dipo)<br />

The loan from Dipo represents drawdowns from the installment credit facility obtained by the Company<br />

which were used to finance the acquisition of vehicles. The loan is payable in monthly installments<br />

starting from July 15, 2003 until May 26, 2011 and is collateralized by the vehicles purchased (Note<br />

11). The outstanding loan balance as of December 31, <strong>2010</strong> and 2009 amounted to Rp376,579 and<br />

Rp1,671,866, respectively, and bears interest at annual rates ranging from 6.00% to 16.76% in <strong>2010</strong><br />

and 2009.<br />

39