- Page 2 and 3:

TABLE OF CONTENTS Local Economy Ass

- Page 4 and 5:

CHARTS TABLES

- Page 6 and 7:

Report This report includes the

- Page 8 and 9:

Tbilisi in region The capital of Ge

- Page 10 and 11:

City of Tbilisi. By January 1, 2006

- Page 12 and 13:

1876 1897 1922 1926 1959 1979 1989

- Page 14 and 15:

The demographic changes observed du

- Page 16 and 17:

Analyzing the first indicator measu

- Page 18 and 19:

The number of women increased sligh

- Page 20 and 21:

Unemployment changes can be analyze

- Page 22 and 23:

This indicator measures the average

- Page 24 and 25:

The basic measure of the quality of

- Page 26 and 27:

There have been two different perio

- Page 28 and 29:

The demographic changes are primari

- Page 30 and 31:

In thds of students Public universi

- Page 32 and 33:

2005 Tbilisi Saburtalo- Vake Isani-

- Page 34 and 35:

More careful observation of the tre

- Page 36 and 37:

2000 2001 2002 2003 2004 2005 Entit

- Page 38 and 39:

Years Of which by: Total investment

- Page 40 and 41:

Georgian exports are partially conc

- Page 42 and 43:

Railroad Motovehicles Marine Air To

- Page 44 and 45:

Key conclusions on the economic per

- Page 46 and 47:

Population: 142,893,540 Age structu

- Page 48 and 49:

Population: 46,710,816 (July 2006 e

- Page 50 and 51:

state for pipelines and trade. The

- Page 52 and 53:

Population: 5,213,898 (July 2006 es

- Page 54 and 55:

Population: 7,320,815 (July 2006 es

- Page 56 and 57:

140 130 120 110 100 90 80 1995 1996

- Page 58 and 59:

190 180 170 160 150 140 130 120 110

- Page 60 and 61:

Turnover in mnl GEL 8 000 7 000 6 0

- Page 62 and 63:

Year Quarter Georgia - total City o

- Page 64 and 65:

100% Employment in enterprises sphe

- Page 66 and 67:

Ascending rank Minimum Maximum Mean

- Page 68 and 69:

in mln GEL 1998 1999 2000 2001 2002

- Page 70 and 71:

In addition to being the leading gl

- Page 72 and 73:

STRENGTHS • State and economy ref

- Page 74 and 75:

Good outcomes reflecting the satisf

- Page 76 and 77:

albumonous substances, modified dri

- Page 78 and 79:

. (In thousand of tons, unless oth

- Page 80 and 81:

of which: Year of which: of which:

- Page 82 and 83:

LOCAL ECONOMIC DEVELOPMENT PLAN FOR

- Page 84 and 85:

CHARTS Chart 1-1 Population in Geor

- Page 86 and 87:

Report City of Tbilisi Competitiven

- Page 88 and 89:

1.2. Tbilisi in Georgian economy On

- Page 90 and 91:

Economic active population Table 1-

- Page 92 and 93:

Chart 1-3 Employment in Georgia and

- Page 94 and 95:

Turnover In business sector Table 1

- Page 96 and 97:

Chart 1-7 Earnings in business sect

- Page 98 and 99:

Chart 1-10 Comparative analysis of

- Page 100 and 101:

Different factors influence the cit

- Page 102 and 103:

The assessment results are presente

- Page 104 and 105:

City of Batumi Chart 2-3 City of Ba

- Page 106 and 107:

While assessing Tbilisi competitive

- Page 108 and 109:

Chart 2-5 City of Tbilisi in the re

- Page 110 and 111:

3. Identification of competitive ad

- Page 112 and 113:

On the basis of this assessment the

- Page 114 and 115:

application of new technologies. Th

- Page 116 and 117:

Transportation cluster. Table 3-5 T

- Page 118 and 119:

Creative cluster Table 3-7 Creative

- Page 120 and 121:

`

- Page 122 and 123:

CHARTS

- Page 124 and 125:

In order to strengthen the foundati

- Page 126 and 127:

the rest of the country. In each of

- Page 128 and 129:

Earnings in Tbilisi in business sec

- Page 130 and 131:

Construction turnover in Georgia in

- Page 132 and 133:

1 000 800 600 400 Comparative analy

- Page 134 and 135:

Trade turnover in Georgia in mln GE

- Page 136 and 137:

6000,0 5000,0 4000,0 3000,0 2000,0

- Page 138 and 139:

Industry turnover in Georgia in mln

- Page 140 and 141:

3000,0 2000,0 1000,0 Comparative an

- Page 142 and 143:

It is of key importance for the cit

- Page 144 and 145:

One of the elements of the process

- Page 146 and 147:

Companies opinion about their indus

- Page 148 and 149:

Last year almost half of the survey

- Page 150 and 151:

Most companies operating in the tou

- Page 152 and 153:

Next year 82% of the surveyed compa

- Page 154 and 155:

Score Sightseeing paths 27 Access t

- Page 156 and 157:

Such immanent feature of Tbilisi sp

- Page 158 and 159:

Law project on “privatization of

- Page 160 and 161:

example, construction of “Tsavkis

- Page 162 and 163:

number of micro bus taxis (“marsh

- Page 164 and 165:

As a result of social and economic

- Page 166 and 167:

Alternative Strategy implementation

- Page 168 and 169:

Marketing Tbilisi livable city and

- Page 170 and 171:

Survey how economy is developing, w

- Page 172 and 173:

When creating long-lasting mechanis

- Page 174 and 175:

.

- Page 176 and 177:

• • • -

- Page 178 and 179:

-

- Page 180 and 181:

Tourism development projects Touri

- Page 182 and 183:

Tourism development projects Touri

- Page 184 and 185:

− − • • • •

- Page 186 and 187:

- -

- Page 188 and 189:

- - - -

- Page 190 and 191:

LOCAL ECONOMIC DEVELOPMENT PLAN FOR

- Page 192 and 193:

CHARTS Chart 2-1 City strategy stru

- Page 194 and 195:

1. Strategic management framework a

- Page 196 and 197:

2. Integration of strategic managem

- Page 198 and 199:

On that common basis the city manag

- Page 200 and 201:

managerial, to take action based on

- Page 202 and 203:

3. Strategy implementation methodol

- Page 204 and 205:

3.2. Process of writing the Corpora

- Page 206 and 207:

3.3. Methodology of updating the Co

- Page 208 and 209:

Phase IV The announcement of the li

- Page 210 and 211:

4. Strategy implementation tools 21

- Page 212 and 213:

4.1. Corporate City Development Pla

- Page 214 and 215:

4.3. Programs card Program : Goal :

- Page 216 and 217:

4.4. Projects card Project Title: L

- Page 218 and 219:

III. Project identification 3.1. De

- Page 220 and 221:

5.3. Detailed budget tasks task des

- Page 222 and 223:

5. Appendix - Directive of the Mayo

- Page 224 and 225:

1. STRUCTURING TEAMS DEALING WITH T

- Page 226 and 227:

3. METHODOLOGY OF UPDATING THE LOCA

- Page 228 and 229:

COMPETENCE DISTRIBUTION IN THE PROC

- Page 230 and 231:

5. CRITERIA OF SELECTING PROJECTS F

- Page 232 and 233:

TABLE OF CONTENTS Introduction ....

- Page 234 and 235:

CHARTS Chart 1-1 Tbilisi in the reg

- Page 236 and 237:

1. Cities matter 1.1. Cities are ke

- Page 238 and 239:

Due to the overlapping effects of r

- Page 240 and 241:

Cities combine diversity - of popul

- Page 242 and 243:

While assessing the present conditi

- Page 244 and 245:

These and other important issues sh

- Page 246 and 247:

Financing business - such initiativ

- Page 248 and 249:

City of Kutaisi Chart 2-1 City of K

- Page 250 and 251:

3. New dimension of city policies (

- Page 252 and 253:

The clusters have been assessed in

- Page 254 and 255:

Creative cluster The support for th

- Page 256 and 257:

From the city’s economic policy p

- Page 258 and 259:

3.5.2. Spatial structure Such imman

- Page 260 and 261:

The results of the 25 April earthqu

- Page 262 and 263:

As for the mass and wholesale large

- Page 264 and 265:

4. Tbilisi economy Tbilisi is on th

- Page 266 and 267:

Employment in business sector in Tb

- Page 268 and 269: 4.4. Turnover in business sector Tu

- Page 270 and 271: 4.5. Earnings Earnings in business

- Page 272 and 273: 4.6. General data of external trade

- Page 274 and 275: 4.7. Key industries of Tbilisi econ

- Page 276 and 277: Trade Chart 4-7 Turnover and employ

- Page 278 and 279: A thorough analysis of the tourist,

- Page 280 and 281: 5. Vision TBILISI offers wide range

- Page 282 and 283: 6. Strategic directions • Booming

- Page 284 and 285: • Time for business. Time for bus

- Page 286 and 287: • A place to live. The main objec

- Page 288 and 289: • The hospitable city. Culture an

- Page 290 and 291: • People empower Tbilisi. This di

- Page 292 and 293: 7. Strategy implementation An impor

- Page 294 and 295: Phase four - preparing the Plan doc

- Page 296 and 297: LOCAL ECONOMIC DEVELOPMENT PLAN FOR

- Page 298 and 299: TABLES Table 5-1 Tbilisi booming re

- Page 300 and 301: On its way to becoming a regional c

- Page 302 and 303: investments in such areas as teleco

- Page 304 and 305: Tiflis in 1872. In 1883 this railwa

- Page 306 and 307: Nowadays this second direction of t

- Page 308 and 309: 3. Vision for Tbilisi Economic futu

- Page 310 and 311: 5. Strategy implementation 5.1. Tbi

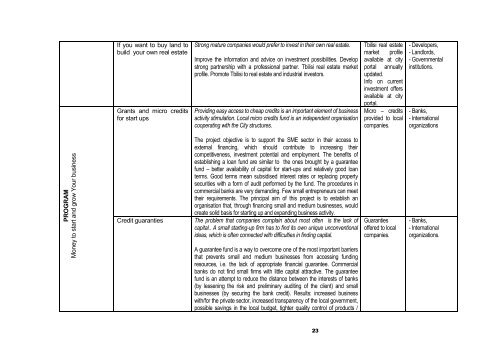

- Page 312 and 313: PROGRAM You can serves the region f

- Page 314 and 315: 5.2. Time for business in Tbilisi a

- Page 316 and 317: We build digital platform for our b

- Page 320 and 321: 5.3. Tbilisi place to live action p

- Page 322 and 323: PROGRAM Our neighborhoo d (ezo) Gre

- Page 324 and 325: Table 5-4 Tbilisi hospitable city -

- Page 326 and 327: 5.5. People empower Tbilisi action

- Page 328 and 329: PROGRAM Jobs for all How to upgrade

- Page 330: 6. Strategy implementation principl