WHEREAS - Watsonville California

WHEREAS - Watsonville California

WHEREAS - Watsonville California

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

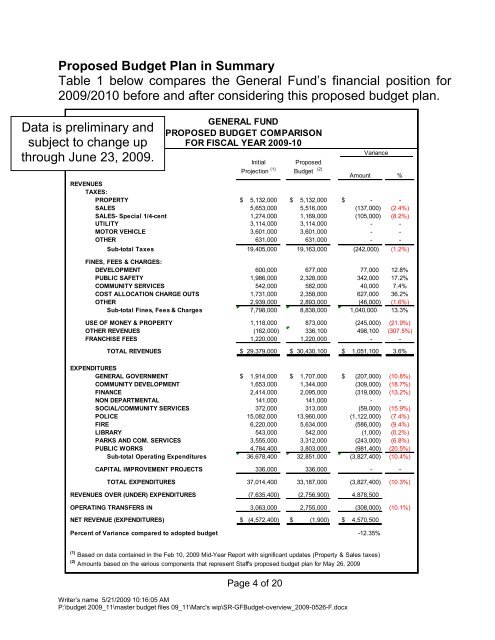

Proposed Budget Plan in Summary<br />

Table 1 below compares the General Fund’s financial position for<br />

2009/2010 before and after considering this proposed budget plan.<br />

Data is preliminary and<br />

subject to change up<br />

through June 23, 2009.<br />

GENERAL FUND<br />

PROPOSED BUDGET COMPARISON<br />

FOR FISCAL YEAR 2009-10<br />

Initial<br />

Projection (1)<br />

Proposed<br />

Variance<br />

Budget (2) Amount %<br />

REVENUES<br />

TAXES:<br />

PROPERTY $ 5,132,000 $ 5,132,000 $ - -<br />

SALES 5,653,000 5,516,000 (137,000) (2.4%)<br />

SALES- Special 1/4-cent 1,274,000 1,169,000 (105,000) (8.2%)<br />

UTILITY 3,114,000 3,114,000 - -<br />

MOTOR VEHICLE 3,601,000 3,601,000 - -<br />

OTHER 631,000 631,000 - -<br />

Sub-total Taxes 19,405,000 19,163,000 (242,000) (1.2%)<br />

FINES, FEES & CHARGES:<br />

DEVELOPMENT 600,000 677,000 77,000 12.8%<br />

PUBLIC SAFETY 1,986,000 2,328,000 342,000 17.2%<br />

COMMUNITY SERVICES 542,000 582,000 40,000 7.4%<br />

COST ALLOCATION CHARGE OUTS 1,731,000 2,358,000 627,000 36.2%<br />

OTHER 2,939,000 2,893,000 (46,000) (1.6%)<br />

Sub-total Fines, Fees & Charges 7,798,000 8,838,000 1,040,000 13.3%<br />

USE OF MONEY & PROPERTY 1,118,000 873,000 (245,000) (21.9%)<br />

OTHER REVENUES (162,000) 336,100 498,100 (307.5%)<br />

FRANCHISE FEES 1,220,000 1,220,000 - -<br />

TOTAL REVENUES $ 29,379,000 $ 30,430,100 $ 1,051,100 3.6%<br />

EXPENDITURES<br />

GENERAL GOVERNMENT $ 1,914,000 $ 1,707,000 $ (207,000) (10.8%)<br />

COMMUNITY DEVELOPMENT 1,653,000 1,344,000 (309,000) (18.7%)<br />

FINANCE 2,414,000 2,095,000 (319,000) (13.2%)<br />

NON DEPARTMENTAL 141,000 141,000 - -<br />

SOCIAL/COMMUNITY SERVICES 372,000 313,000 (59,000) (15.9%)<br />

POLICE 15,082,000 13,960,000 (1,122,000) (7.4%)<br />

FIRE 6,220,000 5,634,000 (586,000) (9.4%)<br />

LIBRARY 543,000 542,000 (1,000) (0.2%)<br />

PARKS AND COM. SERVICES 3,555,000 3,312,000 (243,000) (6.8%)<br />

PUBLIC WORKS 4,784,400 3,803,000 (981,400) (20.5%)<br />

Sub-total Operating Expenditures 36,678,400 32,851,000 (3,827,400) (10.4%)<br />

CAPITAL IMPROVEMENT PROJECTS 336,000 336,000 - -<br />

TOTAL EXPENDITURES 37,014,400 33,187,000 (3,827,400) (10.3%)<br />

REVENUES OVER (UNDER) EXPENDITURES (7,635,400) (2,756,900) 4,878,500<br />

OPERATING TRANSFERS IN 3,063,000 2,755,000 (308,000) (10.1%)<br />

NET REVENUE (EXPENDITURES) $ (4,572,400) $ (1,900) $ 4,570,500<br />

Percent of Variance compared to adopted budget -12.35%<br />

(1) Based on data contained in the Feb 10, 2009 Mid-Year Report with significant updates (Property & Sales taxes)<br />

(2) Amounts based on the various components that represent Staff's proposed budget plan for May 26, 2009<br />

Page 4 of 20<br />

Writer’s name 5/21/2009 10:16:05 AM<br />

P:\budget 2009_11\master budget files 09_11\Marc's wip\SR-GFBudget-overview_2009-0526-F.docx