- Page 1 and 2: AGENDA CITY OF WATSONVILLE CITY COU

- Page 3 and 4: asked, or may ask questions for cla

- Page 5: 5.0 ITEMS REMOVED FROM CONSENT AGEN

- Page 8 and 9: M I N U T E S PERSONNEL COMMISSION

- Page 10 and 11: "Gather, Learn and Celebrate!” Mi

- Page 12 and 13: ASSOCIATION OF MONTEREY BAY AREA GO

- Page 14 and 15: Group Drafts of Mission Statement C

- Page 16 and 17: PURPOSE AND VISION AMBAG 2009/11 St

- Page 18 and 19: Regional Blueprint Third year of Bl

- Page 20 and 21: PROGRAMS THAT SHOULD BECOME CORE CO

- Page 22 and 23: Monterey Bay National Marine Sanctu

- Page 24 and 25: POTENTIAL AREAS OF INVOLVEMENT Stor

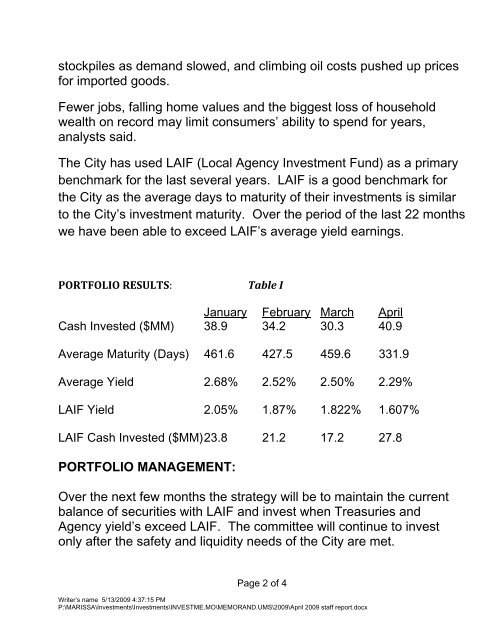

- Page 28 and 29: The Local Agency Investment Fund (L

- Page 30 and 31: City of Watsonville Investment Repo

- Page 32 and 33: City Council _________ RESOLUTION N

- Page 37 and 38: City Council______________ City of

- Page 39 and 40: ALTERNATIVES: The Council can choos

- Page 41 and 42: Improvements in the amount of $109,

- Page 43 and 44: The Agreement provides the Parks an

- Page 45 and 46: City Council _________ RESOLUTION N

- Page 47 and 48: AGREEMENT BETWEEN THE CITY OF WATSO

- Page 49 and 50: e. Comply with such rules and regul

- Page 51 and 52: IN WITNESS WHEREOF, the parties her

- Page 53 and 54: NOW, THEREFORE, BE IT RESOLVED BY T

- Page 55 and 56: APPENDIX A

- Page 57 and 58: APPENDIX A

- Page 59 and 60: NOW, THEREFORE, BE IT RESOLVED BY T

- Page 61 and 62: APPENDIX A

- Page 63 and 64: APPENDIX A

- Page 65 and 66: NOW, THEREFORE, BE IT RESOLVED BY T

- Page 67 and 68: TABLE OF CONTENTS 1.0 COMPENSATION

- Page 69 and 70: 1.1.5 Effective the first full payr

- Page 71 and 72: The City shall maintain the IRS Sec

- Page 73 and 74: 2.1.6 For any member of the Unit wh

- Page 75 and 76: Confidential 2009-2010 MOU CC Draft

- Page 77 and 78:

-- determine the procedures and sta

- Page 79 and 80:

of alternate schedules include flex

- Page 81 and 82:

APPENDIX A

- Page 83 and 84:

City Council _________ RESOLUTION N

- Page 85 and 86:

MEMORANDUM OF UNDERSTANDING BETWEEN

- Page 87 and 88:

MEMORANDUM OF UNDERSTANDING BETWEEN

- Page 89 and 90:

1.4 Administrative Leave 1.4.1 Curr

- Page 91 and 92:

Council at a duly noticed meeting n

- Page 93 and 94:

October 1, 2006 $776.15 July 1, 200

- Page 95 and 96:

3.2 Holidays There shall be thirtee

- Page 97 and 98:

APPENDIX A

- Page 99 and 100:

APPENDIX A

- Page 101 and 102:

NOW, THEREFORE, BE IT RESOLVED BY T

- Page 103 and 104:

TABLE OF CONTENT 1.0 COMPENSATION .

- Page 105 and 106:

1.1.4 Effective the first full payr

- Page 107 and 108:

Employees who are assigned to be on

- Page 109 and 110:

The City shall continue in effect t

- Page 111 and 112:

2.2.6 Absent notification to the co

- Page 113 and 114:

. In connection with the adoption o

- Page 115 and 116:

• The exercise by the City throug

- Page 117 and 118:

7.1 An employee having authority to

- Page 119 and 120:

APPENDIX A

- Page 121 and 122:

City Council _________ RESOLUTION N

- Page 123 and 124:

MEMORANDUM OF UNDERSTANDING BETWEEN

- Page 125 and 126:

MEMORANDUM OF UNDERSTANDING BETWEEN

- Page 127 and 128:

Daily On-Call: Employees shall rece

- Page 129 and 130:

esignation of another employee. Thi

- Page 131 and 132:

employee only rate and the employee

- Page 133 and 134:

maximum shall have a sixty (60) day

- Page 135 and 136:

4.0 RETIREMENT 3.5.2 An employee is

- Page 137 and 138:

-- exercise complete control and di

- Page 139 and 140:

9.6 Boot Allowance 9.6.1 Field empl

- Page 141 and 142:

the single highest year benefit. Th

- Page 143 and 144:

APPENDIX A

- Page 145 and 146:

City Council _________ RESOLUTION N

- Page 147 and 148:

hereby determines to ratify said Am

- Page 149 and 150:

22.0 SALARY All sworn officers assi

- Page 151 and 152:

All other terms and conditions of t

- Page 153 and 154:

Association Unit, in accordance wit

- Page 155 and 156:

Side Letter between City of Watsonv

- Page 157 and 158:

City Council _________ RESOLUTION N

- Page 159 and 160:

hereby determines to ratify said Am

- Page 161 and 162:

coordinated so that they are taken

- Page 163 and 164:

IN WITNESS WHEREOF, the parties her

- Page 165 and 166:

Management Unit, in accordance with

- Page 167 and 168:

Side Letter between City of Watsonv

- Page 169 and 170:

City Council _________ RESOLUTION N

- Page 171 and 172:

MEMORANDUM OF UNDERSTANDING BETWEEN

- Page 173 and 174:

9.13 Video Display Terminals Use (V

- Page 175 and 176:

3.0 PAST PRACTICES bargaining unit

- Page 177 and 178:

During the term of this agreement,

- Page 179 and 180:

SEIU 521 2009-2010 MOU CC Draft 5/2

- Page 181 and 182:

5.3.9 Employees physically called b

- Page 183 and 184:

5.7 Early Retirement SEIU 521 2009-

- Page 185 and 186:

6.2.2 In addition to this amount, t

- Page 187 and 188:

Sick leave is payable only in the c

- Page 189 and 190:

7.8 Leave of Absence Without Pay Up

- Page 191 and 192:

9.0 MISCELLANEOUS 9.1 Certificates:

- Page 193 and 194:

SEIU 521 2009-2010 MOU CC Draft 5/2

- Page 195 and 196:

SEIU 521 2009-2010 MOU CC Draft 5/2

- Page 197 and 198:

SEIU 521 2009-2010 MOU CC Draft 5/2

- Page 199 and 200:

appointing authority when a vacancy

- Page 201 and 202:

APPENDIX A

- Page 203:

APPENDIX A

- Page 207 and 208:

3. That the City Clerk is hereby di

- Page 209:

Rodriguez Street public and vehicul

- Page 217 and 218:

Community Resources Educational At

- Page 220 and 221:

EXECUTIVE SUMMARY 2009 - 2011 Backg

- Page 222 and 223:

Action Plan Implementation 2009-201

- Page 224 and 225:

Objective 2: Streets & Traffic 42.

- Page 226 and 227:

Proposed New Projects and Initiativ

- Page 228 and 229:

Environmental Analysis Strengths 1.

- Page 230 and 231:

Opportunities 1. Economic stimulus

- Page 232 and 233:

City Council _______ DATE: May 21,

- Page 234 and 235:

Review of Social Service Guidelines

- Page 236 and 237:

SOCIAL AND COMMUNITY SERVICE GRANTS

- Page 238 and 239:

staff, a sound but painful plan to

- Page 240 and 241:

Proposed Budget Plan in Summary Tab

- Page 242 and 243:

The biggest component of these agre

- Page 244 and 245:

Table 2 details those essential ser

- Page 246 and 247:

This preliminary table does not ref

- Page 248 and 249:

creating one-time and on-going savi

- Page 250 and 251:

Past proposals by the State to redu

- Page 252 and 253:

Watsonville, the County Assessor is

- Page 254 and 255:

wide library funding instead of the

- Page 256 and 257:

interested and eligible positions t

- Page 258 and 259:

2. That the Retirement Incentive (R

- Page 260 and 261:

purpose of VTO would not be achieve

- Page 262 and 263:

CITY OF WATSONVILLE VOLUNTARY TIME

- Page 264:

City of Watsonville Retirement Ince