A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BOUYGUES AND ITS SHAREHOLDERS<br />

ROCE<br />

(Return on Capital<br />

Employed)<br />

One way to measure the value created<br />

by a business is to compare the return<br />

generated by the capital employed<br />

in the business (equity contributed<br />

by the shareholders and debt provided<br />

by banks) with the cost of that<br />

capital.<br />

In 2005, the <strong>Bouygues</strong> Group achieved<br />

ROCE of 16.5%, significantly higher<br />

than 2004. The Group’s ROCE is clearly<br />

superior to the weighted average cost<br />

of capital.<br />

8.6%<br />

2003<br />

French GAAP<br />

12.7%<br />

2004<br />

IFRS<br />

16.5%<br />

2005<br />

ROCE = (current operating profit after tax + share of profits<br />

and losses of associates) ÷ average capital employed<br />

(shareholders’ equity + debt).<br />

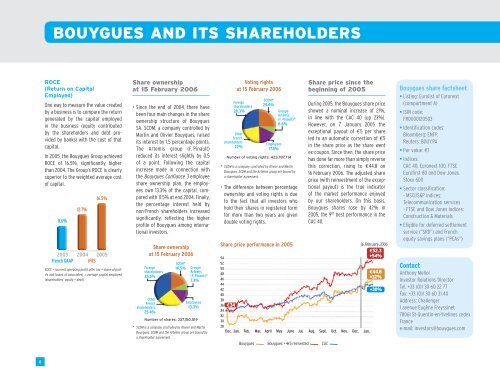

Share ownership<br />

at 15 February 2006<br />

• Since the end of 2004, there have<br />

been four main changes in the share<br />

ownership structure of <strong>Bouygues</strong><br />

SA. SCDM, a company controlled by<br />

Martin and Olivier <strong>Bouygues</strong>, raised<br />

its interest by 1.5 percentage points.<br />

The Artemis group (F. Pinault)<br />

reduced its interest slightly by 0.5<br />

of a point. Following the capital<br />

increase made in connection with<br />

the <strong>Bouygues</strong> Confiance 3 employee<br />

share ownership plan, the employees<br />

own 13.3% of the capital, compared<br />

with 11.5% at end 2004. Finally,<br />

the percentage interest held by<br />

non-French shareholders increased<br />

significantly, reflecting the higher<br />

profile of <strong>Bouygues</strong> among international<br />

investors.<br />

Foreign<br />

shareholders<br />

35.5%<br />

Other<br />

French<br />

shareholders<br />

25.4%<br />

Share ownership<br />

at 15 February 2006<br />

SCDM*<br />

18.5% Groupe<br />

Artémis<br />

(F. Pinault)*<br />

7.3%<br />

Employees<br />

13.3%<br />

Number of shares: 337,150,519<br />

* SCDM is a company controlled by Olivier and Martin<br />

<strong>Bouygues</strong>. SCDM and the Artémis group are bound by<br />

a shareholder agreement.<br />

Foreign<br />

shareholders<br />

28.3%<br />

Other<br />

French<br />

shareholders<br />

22%<br />

Voting rights<br />

at 15 February 2006<br />

SCDM*<br />

25.6%<br />

Employees<br />

17.5%<br />

Groupe<br />

Artémis<br />

(F. Pinault)*<br />

6.6%<br />

Number of voting rights: 423,787,714<br />

* SCDM is a company controlled by Olivier and Martin<br />

<strong>Bouygues</strong>. SCDM and the Artémis group are bound by<br />

a shareholder agreement.<br />

• The difference between percentage<br />

ownership and voting rights is due<br />

to the fact that all investors who<br />

hold their shares in registered form<br />

for more than two years are given<br />

double voting rights.<br />

Share price performance in 2005<br />

<strong>Bouygues</strong> <strong>Bouygues</strong> + €5 reinvested CAC<br />

Share price since the<br />

beginning of 2005<br />

During 2005, the <strong>Bouygues</strong> share price<br />

showed a nominal increase of 21%,<br />

in line with the CAC 40 (up 23%).<br />

However, on 7 January 2005 the<br />

exceptional payout of €5 per share<br />

led to an automatic correction of €5<br />

in the share price as the share went<br />

ex-coupon. Since then, the share price<br />

has done far more than simply reverse<br />

this correction, rising to €44.8 on<br />

16 February 2006. The adjusted share<br />

price (with reinvestment of the exceptional<br />

payout) is the true indicator<br />

of the market performance enjoyed<br />

by our shareholders. On this basis,<br />

<strong>Bouygues</strong> shares rose by 42% in<br />

2005, the 9 th best performance in the<br />

CAC 40.<br />

54<br />

52<br />

50<br />

48<br />

46<br />

44<br />

42<br />

40<br />

38<br />

36 €34<br />

34<br />

32<br />

30<br />

28<br />

Dec. Jan. Feb. Mar. April May June Jul. Aug. Sept. Oct. Nov. Dec. Jan.<br />

16 February 2006<br />

€52.3<br />

+54%<br />

€44.8<br />

+32%<br />

+30%<br />

<strong>Bouygues</strong> share factsheet<br />

• Listing: Eurolist of Euronext<br />

(compartment A)<br />

• ISIN code:<br />

FR0000120503<br />

• Identification codes:<br />

Bloomberg: ENFP,<br />

Reuters: BOUY.PA<br />

• Par value: €1<br />

• Indices:<br />

CAC 40, Euronext 100, FTSE<br />

Eurofirst 80 and Dow Jones<br />

Stoxx 600<br />

• Sector classification:<br />

- MSCI/S&P indices:<br />

Telecommunication services<br />

- FTSE and Dow Jones indices:<br />

Construction & Materials<br />

• Eligible for deferred settlement<br />

service (“SRD”) and French<br />

equity savings plans (“PEAs”)<br />

Contact<br />

Anthony Mellor<br />

Investor Relations Director<br />

Tel. +33 (0)1 30 60 22 77<br />

Fax: +33 (0)1 30 60 31 40<br />

Address: Challenger<br />

1 avenue Eugène Freyssinet<br />

78061 St-Quentin-en-Yvelines cedex<br />

France<br />

e-mail: investors@bouygues.com<br />

8