A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

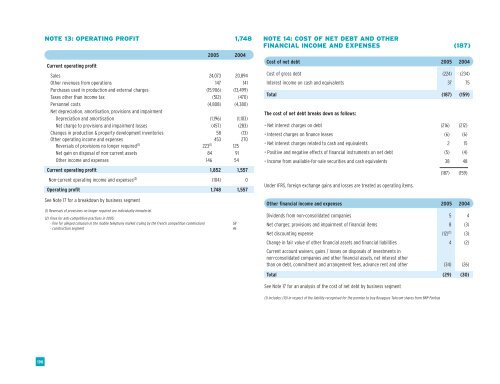

NOTE 13: OPERATING PROFIT 1,748<br />

Current operating profit<br />

2005 2004<br />

Sales 24,073 20,894<br />

Other revenues from operations 147 141<br />

Purchases used in production and external charges (15,906) (13,499)<br />

Taxes other than income tax (512) (470)<br />

Personnel costs (4,808) (4,380)<br />

Net depreciation, amortisation, provisions and impairment<br />

Depreciation and amortisation (1,196) (1,103)<br />

Net charge to provisions and impairment losses (457) (283)<br />

Changes in production & property development inventories 58 (13)<br />

Other operating income and expenses 453 270<br />

Reversals of provisions no longer required (1) 223 (1) 125<br />

Net gain on disposal of non-current assets 84 91<br />

Other income and expenses 146 54<br />

Current operating profit 1,852 1,557<br />

Non-current operating income and expenses (2) (104) 0<br />

Operating profit 1,748 1,557<br />

See Note 17 for a breakdown by business segment<br />

(1) Reversals of provisions no longer required are individually immaterial.<br />

(2) fines for anti-competitive practices in 2005:<br />

- fine for alleged collusion in the mobile telephony market (ruling by the French competition commission) 58<br />

- construction segment 46<br />

NOTE 14: COST OF NET DEBT AND OTHER<br />

FINANCIAL INCOME AND EXPENSES (187)<br />

Cost of net debt 2005 2004<br />

Cost of gross debt (224) (234)<br />

Interest income on cash and equivalents 37 75<br />

Total (187) (159)<br />

The cost of net debt breaks down as follows:<br />

• Net interest charges on debt (216) (212)<br />

• Interest charges on finance leases (6) (6)<br />

• Net interest charges related to cash and equivalents 2 15<br />

• Positive and negative effects of financial instruments on net debt (5) (4)<br />

• Income from available-for-sale securities and cash equivalents 38 48<br />

Under IFRS, foreign exchange gains and losses are treated as operating items.<br />

(187) (159)<br />

Other financial income and expenses 2005 2004<br />

Dividends from non-consolidated companies 5 4<br />

Net charges: provisions and impairment of financial items 8 (3)<br />

Net discounting expense (12) (1) (3)<br />

Change in fair value of other financial assets and financial liabilities 4 (2)<br />

Current account waivers, gains / losses on disposals of investments in<br />

non-consolidated companies and other financial assets, net interest other<br />

than on debt, commitment and arrangement fees, advance rent and other (34) (26)<br />

Total (29) (30)<br />

See Note 17 for an analysis of the cost of net debt by business segment<br />

(1) includes: (10) in respect of the liability recognised for the promise to buy <strong>Bouygues</strong> Telecom shares from BNP Paribas<br />

190