A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

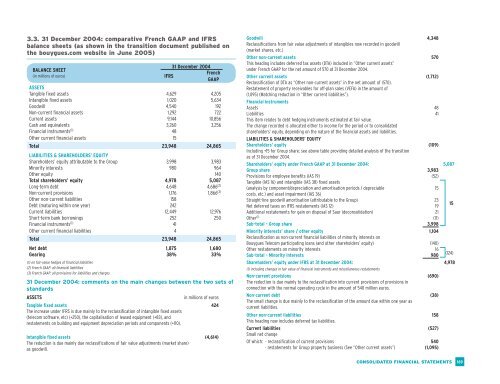

3.3. 31 December 2004: comparative French GAAP and IFRS<br />

balance sheets (as shown in the transition document published on<br />

the bouygues.com website in June 2005)<br />

BALANCE SHEET<br />

(in millions of euros)<br />

31 December 2004<br />

French<br />

IFRS<br />

GAAP<br />

ASSETS<br />

Tangible fixed assets 4,629 4,205<br />

Intangible fixed assets 1,020 5,634<br />

Goodwill 4,540 192<br />

Non-current financial assets 1,292 722<br />

Current assets 9,144 10,856<br />

Cash and equivalents 3,260 3,256<br />

Financial instruments (1) 48<br />

Other current financial assets 15<br />

Total 23,948 24,865<br />

LIABILITIES & SHAREHOLDERS’ EQUITY<br />

Shareholders’ equity attributable to the Group 3,998 3,983<br />

Minority interests 980 964<br />

Other equity 140<br />

Total shareholders’ equity 4,978 5,087<br />

Long-term debt 4,648 4,686 (2)<br />

Non-current provisions 1,176 1,866 (3)<br />

Other non-current liabilities 158<br />

Debt (maturing within one year) 242<br />

Current liabilities 12,449 12,976<br />

Short-term bank borrowings 252 250<br />

Financial instruments (1) 41<br />

Other current financial liabilities 4<br />

Total 23,948 24,865<br />

Net debt 1,875 1,680<br />

Gearing 38% 33%<br />

(1) on fair-value hedges of financial liabilities<br />

(2) French GAAP: all financial liabilities<br />

(3) French GAAP: all provisions for liabilities and charges<br />

31 December 2004: comments on the main changes between the two sets of<br />

standards<br />

ASSETS<br />

in millions of euros<br />

Tangible fixed assets 424<br />

The increase under IFRS is due mainly to the reclassification of intangible fixed assets<br />

(telecom software, etc) (+250), the capitalisation of leased equipment (+83), and<br />

restatements on building and equipment depreciation periods and components (+110).<br />

Intangible fixed assets (4,614)<br />

The reduction is due mainly due reclassifications of fair value adjustments (market share)<br />

as goodwill.<br />

Goodwill 4,348<br />

Reclassifications from fair value adjustments of intangibles now recorded in goodwill<br />

(market shares, etc.)<br />

Other non-current assets 570<br />

This heading includes deferred tax assets (DTA) included in “Other current assets”<br />

under French GAAP for the net amount of 570 at 31 December 2004.<br />

Other current assets (1,712)<br />

Reclassification of DTA as “Other non-current assets” in the net amount of (570).<br />

Restatement of property receivables for off-plan sales (VEFA) in the amount of<br />

(1,095) (Matching reduction in “Other current liabilities”).<br />

Financial instruments<br />

Assets 48<br />

Liabilities 41<br />

This item relates to debt hedging instruments estimated at fair value.<br />

The change recorded is allocated either to income for the period or to consolidated<br />

shareholders’ equity, depending on the nature of the financial assets and liabilities.<br />

LIABILITIES & SHAREHOLDERS’ EQUITY<br />

Shareholders’ equity (109)<br />

Including +15 for Group share; see above table providing detailed analysis of the transition<br />

as of 31 December 2004.<br />

Shareholders’ equity under French GAAP at 31 December 2004: 5,087<br />

Group share 3,983<br />

Provisions for employee benefits (IAS 19) (52)<br />

Tangible (IAS 16) and intangible (IAS 38) fixed assets<br />

(analysis by component/depreciation and amortisation periods / depreciable 15<br />

costs, etc.) and asset impairment (IAS 36)<br />

Straight-line goodwill amortisation (attributable to the Group) 23<br />

15<br />

Net deferred taxes on IFRS restatements (IAS 12) 19<br />

Additional restatements for gain on disposal of Saur (deconsolidation) 21<br />

Other (1) (11)<br />

Sub-total - Group share 3,998<br />

Minority interests’ share / other equity 1,104<br />

Reclassification as non-current financial liabilities of minority interests on<br />

<strong>Bouygues</strong> Telecom participating loans (and other shareholders’ equity) (140)<br />

Other restatements on minority interests 16<br />

Sub-total - Minority interests 980<br />

(124)<br />

Shareholders’ equity under IFRS at 31 December 2004: 4,978<br />

(1) including changes in fair value of financial instruments and miscellaneous restatements<br />

Non-current provisions (690)<br />

The reduction is due mainly to the reclassification into current provisions of provisions in<br />

connection with the normal operating cycle in the amount of 540 million euros.<br />

Non-current debt (38)<br />

The small change is due mainly to the reclassification of the amount due within one year as<br />

current liabilities.<br />

Other non-current liabilities 158<br />

This heading now includes deferred tax liabilities.<br />

Current liabilities (527)<br />

Small net change<br />

Of which: - reclassification of current provisions 540<br />

- restatements for Group property business (See “Other current assets”) (1,095)<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

169