A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

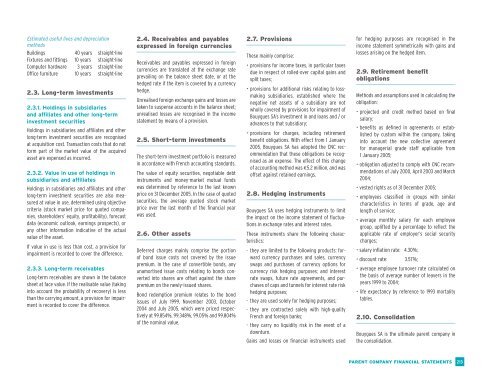

Estimated useful lives and depreciation<br />

methods<br />

Buildings 40 years straight-line<br />

Fixtures and fittings 10 years straight-line<br />

Computer hardware 3 years straight-line<br />

Office furniture 10 years straight-line<br />

2.3. Long-term investments<br />

2.3.1. Holdings in subsidiaries<br />

and affiliates and other long-term<br />

investment securities<br />

Holdings in subsidiaries and affiliates and other<br />

long-term investment securities are recognised<br />

at acquisition cost. Transaction costs that do not<br />

form part of the market value of the acquired<br />

asset are expensed as incurred.<br />

2.3.2. Value in use of holdings in<br />

subsidiaries and affiliates<br />

Holdings in subsidiaries and affiliates and other<br />

long-term investment securities are also measured<br />

at value in use, determined using objective<br />

criteria (stock market price for quoted companies,<br />

shareholders’ equity, profitability), forecast<br />

data (economic outlook, earnings prospects), or<br />

any other information indicative of the actual<br />

value of the asset.<br />

If value in use is less than cost, a provision for<br />

impairment is recorded to cover the difference.<br />

2.3.3. Long-term receivables<br />

Long-term receivables are shown in the balance<br />

sheet at face value. If the realisable value (taking<br />

into account the probability of recovery) is less<br />

than the carrying amount, a provision for impairment<br />

is recorded to cover the difference.<br />

2.4. Receivables and payables<br />

expressed in foreign currencies<br />

Receivables and payables expressed in foreign<br />

currencies are translated at the exchange rate<br />

prevailing on the balance sheet date, or at the<br />

hedged rate if the item is covered by a currency<br />

hedge.<br />

Unrealised foreign exchange gains and losses are<br />

taken to suspense accounts in the balance sheet;<br />

unrealised losses are recognised in the income<br />

statement by means of a provision.<br />

2.5. Short-term investments<br />

The short-term investment portfolio is measured<br />

in accordance with French accounting standards.<br />

The value of equity securities, negotiable debt<br />

instruments and money-market mutual funds<br />

was determined by reference to the last known<br />

price on 31 December 2005. In the case of quoted<br />

securities, the average quoted stock market<br />

price over the last month of the financial year<br />

was used.<br />

2.6. Other assets<br />

Deferred charges mainly comprise the portion<br />

of bond issue costs not covered by the issue<br />

premium. In the case of convertible bonds, any<br />

unamortised issue costs relating to bonds converted<br />

into shares are offset against the share<br />

premium on the newly-issued shares.<br />

Bond redemption premium relates to the bond<br />

issues of July 1999, November 2003, October<br />

2004 and July 2005, which were priced respectively<br />

at 99.854%, 99.348%, 99.05% and 99.804%<br />

of the nominal value.<br />

2.7. Provisions<br />

These mainly comprise:<br />

• provisions for income taxes, in particular taxes<br />

due in respect of rolled-over capital gains and<br />

split taxes;<br />

• provisions for additional risks relating to lossmaking<br />

subsidiaries, established where the<br />

negative net assets of a subsidiary are not<br />

wholly covered by provisions for impairment of<br />

<strong>Bouygues</strong> SA’s investment in and loans and / or<br />

advances to that subsidiary;<br />

• provisions for charges, including retirement<br />

benefit obligations. With effect from 1 January<br />

2005, <strong>Bouygues</strong> SA has adopted the CNC recommendation<br />

that these obligations be recognised<br />

as an expense. The effect of this change<br />

of accounting method was €5.2 million, and was<br />

offset against retained earnings.<br />

2.8. Hedging instruments<br />

<strong>Bouygues</strong> SA uses hedging instruments to limit<br />

the impact on the income statement of fluctuations<br />

in exchange rates and interest rates.<br />

These instruments share the following characteristics:<br />

- they are limited to the following products: forward<br />

currency purchases and sales, currency<br />

swaps and purchases of currency options for<br />

currency risk hedging purposes; and interest<br />

rate swaps, future rate agreements, and purchases<br />

of caps and tunnels for interest rate risk<br />

hedging purposes;<br />

- they are used solely for hedging purposes;<br />

- they are contracted solely with high-quality<br />

French and foreign banks;<br />

- they carry no liquidity risk in the event of a<br />

downturn.<br />

Gains and losses on financial instruments used<br />

for hedging purposes are recognised in the<br />

income statement symmetrically with gains and<br />

losses arising on the hedged item.<br />

2.9. Retirement benefit<br />

obligations<br />

Methods and assumptions used in calculating the<br />

obligation:<br />

• projected unit credit method based on final<br />

salary;<br />

• benefits as defined in agreements or established<br />

by custom within the company, taking<br />

into account the new collective agreement<br />

for managerial grade staff applicable from<br />

1 January 2005;<br />

• obligation adjusted to comply with CNC recommendations<br />

of July 2000, April 2003 and March<br />

2004;<br />

• vested rights as of 31 December 2005;<br />

• employees classified in groups with similar<br />

characteristics in terms of grade, age and<br />

length of service;<br />

• average monthly salary for each employee<br />

group, uplifted by a percentage to reflect the<br />

applicable rate of employer’s social security<br />

charges;<br />

• salary inflation rate: 4.30%;<br />

• discount rate: 3.57%;<br />

• average employee turnover rate calculated on<br />

the basis of average number of leavers in the<br />

years 1999 to 2004;<br />

• life expectancy by reference to 1993 mortality<br />

tables.<br />

2.10. Consolidation<br />

<strong>Bouygues</strong> SA is the ultimate parent company in<br />

the consolidation.<br />

PARENT COMPANY FINANCIAL STATEMENTS<br />

213