A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

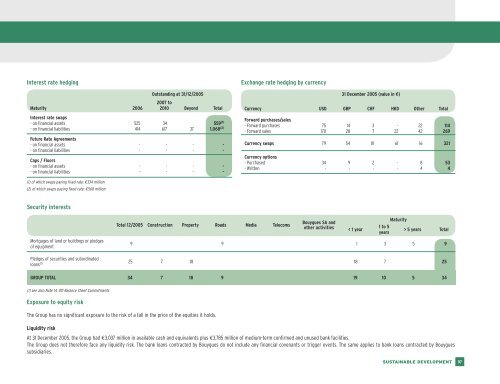

Interest rate hedging<br />

Maturity 2006<br />

Interest rate swaps<br />

- on financial assets<br />

- on financial liabilities<br />

Future Rate Agreements<br />

- on financial assets<br />

- on financial liabilities<br />

Caps / Floors<br />

- on financial assets<br />

- on financial liabilities<br />

(1) of which swaps paying fixed rate: €334 million<br />

(2) of which swaps paying fixed rate: €568 million<br />

525<br />

414<br />

-<br />

-<br />

-<br />

-<br />

Outstanding at 31/12/2005<br />

2007 to<br />

2010 Beyond Total<br />

34<br />

617 37<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

559 (1)<br />

1,068 (2)<br />

-<br />

-<br />

-<br />

-<br />

Exchange rate hedging by currency<br />

31 December 2005 (value in €)<br />

Currency USD GBP CHF HKD Other Total<br />

Forward purchases/sales<br />

- Forward purchases<br />

- Forward sales<br />

75<br />

170<br />

14<br />

28<br />

Currency swaps 79 54 111 61 16 321<br />

Currency options<br />

- Purchased<br />

- Written<br />

34<br />

-<br />

9<br />

-<br />

3<br />

7<br />

2<br />

-<br />

-<br />

22<br />

-<br />

-<br />

22<br />

42<br />

8<br />

4<br />

114<br />

269<br />

53<br />

4<br />

Security interests<br />

Mortgages of land or buildings or pledges<br />

of equipment<br />

Total 12/2005 Construction Property Roads Media Telecoms<br />

<strong>Bouygues</strong> SA and<br />

other activities<br />

< 1 year<br />

Maturity<br />

1 to 5<br />

> 5 years Total<br />

years<br />

9 9 1 3 5 9<br />

Pledges of securities and subordinated<br />

loans (1) 25 7 18 18 7 25<br />

GROUP TOTAL 34 7 18 9 19 10 5 34<br />

(1) see also Note 14: Off-Balance Sheet Commitments<br />

Exposure to equity risk<br />

The Group has no significant exposure to the risk of a fall in the price of the equities it holds.<br />

Liquidity risk<br />

At 31 December 2005, the Group had €3,037 million in available cash and equivalents plus €3,785 million of medium-term confirmed and unused bank facilities.<br />

The Group does not therefore face any liquidity risk. The bank loans contracted by <strong>Bouygues</strong> do not include any financial covenants or trigger events. The same applies to bank loans contracted by <strong>Bouygues</strong><br />

subsidiaries.<br />

SUSTAINABLE DEVELOPMENT<br />

97