A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

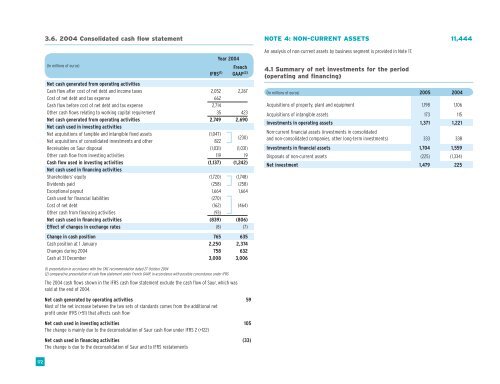

3.6. 2004 Consolidated cash flow statement<br />

(In millions of euros)<br />

IFRS (1)<br />

Year 2004<br />

French<br />

GAAP (2)<br />

Net cash generated from operating activities<br />

Cash flow after cost of net debt and income taxes 2,052 2,267<br />

Cost of net debt and tax expense 662<br />

Cash flow before cost of net debt and tax expense 2,714<br />

Other cash flows relating to working capital requirement 35 423<br />

Net cash generated from operating activities 2,749 2,690<br />

Net cash used in investing activities<br />

Net acquisitions of tangible and intangible fixed assets (1,047)<br />

Net acquisitions of consolidated investments and other 822<br />

(230)<br />

Receivables on Saur disposal (1,031) (1,031)<br />

Other cash flow from investing activities 119 19<br />

Cash flow used in investing activities (1,137) (1,242)<br />

Net cash used in financing activities<br />

Shareholders’ equity (1,720) (1,748)<br />

Dividends paid (258) (258)<br />

Exceptional payout 1,664 1,664<br />

Cash used for financial liabilities (270)<br />

Cost of net debt (162) (464)<br />

Other cash from financing activities (93)<br />

Net cash used in financing activities (839) (806)<br />

Effect of changes in exchange rates (8) (7)<br />

Change in cash position 765 635<br />

Cash position at 1 January 2,250 2,374<br />

Changes during 2004 758 632<br />

Cash at 31 December 3,008 3,006<br />

NOTE 4: NON-CURRENT ASSETS 11,444<br />

An analysis of non-current assets by business segment is provided in Note 17.<br />

4.1 Summary of net investments for the period<br />

(operating and financing)<br />

(In millions of euros) 2005 2004<br />

Acquisitions of property, plant and equipment 1,198 1,106<br />

Acquisitions of intangible assets 173 115<br />

Investments in operating assets 1,371 1,221<br />

Non-current financial assets (investments in consolidated<br />

and non-consolidated companies, other long-term investments) 333 338<br />

Investments in financial assets 1,704 1,559<br />

Disposals of non-current assets (225) (1,334)<br />

Net investment 1,479 225<br />

(1) presentation in accordance with the CNC recommendation dated 27 October 2004<br />

(2) comparative presentation of cash flow statement under French GAAP, in accordance with possible concordance under IFRS<br />

The 2004 cash flows shown in the IFRS cash flow statement exclude the cash flow of Saur, which was<br />

sold at the end of 2004.<br />

Net cash generated by operating activities 59<br />

Most of the net increase between the two sets of standards comes from the additional net<br />

profit under IFRS (+51) that affects cash flow<br />

Net cash used in investing activities 105<br />

The change is mainly due to the deconsolidation of Saur cash flow under IFRS 2 (+122)<br />

Net cash used in financing activities (33)<br />

The change is due to the deconsolidation of Saur and to IFRS restatements<br />

172