A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RISKS<br />

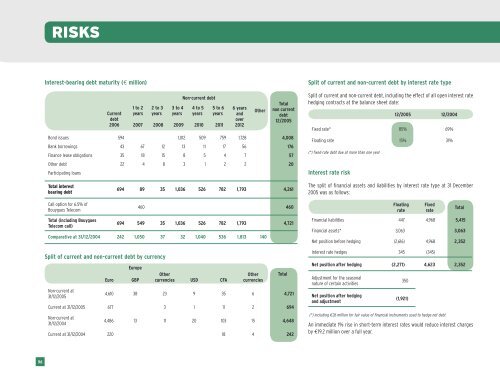

Interest-bearing debt maturity (€ million)<br />

Split of current and non-current debt by interest rate type<br />

Current<br />

debt<br />

2006<br />

1 to 2<br />

years<br />

2 to 3<br />

years<br />

3 to 4<br />

years<br />

Non-current debt<br />

4 to 5<br />

years<br />

5 to 6<br />

years<br />

2007 2008 2009 2010 2011<br />

6 years<br />

and<br />

over<br />

2012<br />

Other<br />

Total<br />

non current<br />

debt<br />

12/2005<br />

Split of current and non-current debt, including the effect of all open interest rate<br />

hedging contracts at the balance sheet date:<br />

Fixed rate*<br />

12/2005 12/2004<br />

85%<br />

69%<br />

Bond issues<br />

Bank borrowings<br />

Finance lease obligations<br />

594<br />

43<br />

35<br />

67<br />

18<br />

12<br />

15<br />

1,012<br />

13<br />

8<br />

509<br />

11<br />

5<br />

759<br />

17<br />

4<br />

1,728<br />

56<br />

7<br />

4,008<br />

176<br />

57<br />

Floating rate<br />

(*) fixed-rate debt due at more than one year<br />

15%<br />

31%<br />

Other debt<br />

Participating loans<br />

22<br />

4<br />

8<br />

3<br />

1<br />

2<br />

2<br />

20<br />

Interest rate risk<br />

Total interest<br />

bearing debt<br />

694 89 35 1,036 526 782 1,793 4,261<br />

The split of financial assets and liabilities by interest rate type at 31 December<br />

2005 was as follows:<br />

Call option for 6.5% of<br />

<strong>Bouygues</strong> Telecom<br />

Total (including <strong>Bouygues</strong><br />

Telecom call)<br />

460 460<br />

694 549 35 1,036 526 782 1,793 4,721<br />

Comparative at 31/12/2004 242 1,050 37 32 1,040 536 1,813 140<br />

Split of current and non-current debt by currency<br />

Non-current at<br />

31/12/2005<br />

Euro<br />

Europe<br />

GBP<br />

Other<br />

currencies<br />

USD<br />

CFA<br />

Other<br />

currencies<br />

4,610 38 23 9 35 6 4,721<br />

Current at 31/12/2005 677 3 1 11 2 694<br />

Non-current at<br />

31/12/2004<br />

4,486 13 11 20 103 15 4,648<br />

Current at 31/12/2004 220 18 4 242<br />

Total<br />

Floating<br />

rate<br />

Fixed<br />

rate<br />

Total<br />

Financial liabilities 447 4,968 5,415<br />

Financial assets* 3,063 3,063<br />

Net position before hedging (2,616) 4,968 2,352<br />

Interest rate hedges 345 (345)<br />

Net position after hedging (2,271) 4,623 2,352<br />

Adjustment for the seasonal<br />

nature of certain activities<br />

Net position after hedging<br />

and adjustment<br />

350<br />

(1,921)<br />

(*) including €26 million for fair value of financial instruments used to hedge net debt<br />

An immediate 1% rise in short-term interest rates would reduce interest charges<br />

by €19.2 million over a full year.<br />

96