A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KEY FIGURES<br />

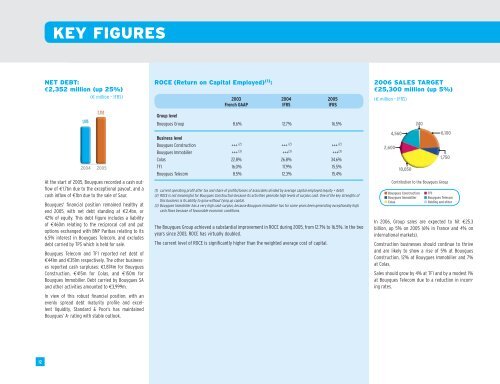

NET DEBT:<br />

€2,352 million (up 25%)<br />

ROCE (Return on Capital Employed) (1) :<br />

2006 SALES TARGET<br />

€25,300 million (up 5%)<br />

(€ million – IFRS) 2003<br />

French GAAP<br />

2004<br />

IFRS<br />

2005<br />

IFRS<br />

(€ million – IFRS)<br />

1,875<br />

2,352<br />

2004 2005<br />

At the start of 2005, <strong>Bouygues</strong> recorded a cash outflow<br />

of €1.7bn due to the exceptional payout, and a<br />

cash inflow of €1bn due to the sale of Saur.<br />

<strong>Bouygues</strong>' financial position remained healthy at<br />

end 2005, with net debt standing at €2.4bn, or<br />

42% of equity. This debt figure includes a liability<br />

of €460m relating to the reciprocal call and put<br />

options exchanged with BNP Paribas relating to its<br />

6.5% interest in <strong>Bouygues</strong> Telecom, and excludes<br />

debt carried by TPS which is held for sale.<br />

<strong>Bouygues</strong> Telecom and TF1 reported net debt of<br />

€441m and €351m respectively. The other businesses<br />

reported cash surpluses: €1,874m for <strong>Bouygues</strong><br />

Construction, €415m for Colas, and €150m for<br />

<strong>Bouygues</strong> Immobilier. Debt carried by <strong>Bouygues</strong> SA<br />

and other activities amounted to €3,999m.<br />

In view of this robust financial position, with an<br />

evenly spread debt maturity profile and excellent<br />

liquidity, Standard & Poor’s has maintained<br />

<strong>Bouygues</strong>’ A- rating with stable outlook.<br />

Group level<br />

<strong>Bouygues</strong> Group 8.6% 12.7% 16.5%<br />

Business level<br />

<strong>Bouygues</strong> Construction +++ (2) +++ (2) +++ (2)<br />

<strong>Bouygues</strong> Immobilier +++ (3) +++ (3) +++ (3)<br />

Colas 22.8% 26.8% 34.6%<br />

TF1 16.0% 17.9% 15.5%<br />

<strong>Bouygues</strong> Telecom 8.5% 12.3% 15.4%<br />

(1) current operating profit after tax and share of profits/losses of associates divided by average capital employed (equity + debt)<br />

(2) ROCE is not meaningful for <strong>Bouygues</strong> Construction because its activities generate high levels of surplus cash. One of the key strengths of<br />

this business is its ability to grow without tying up capital.<br />

(3) <strong>Bouygues</strong> Immobilier has a very high cash surplus, because <strong>Bouygues</strong> Immobilier has for some years been generating exceptionally high<br />

cash flows because of favourable economic conditions.<br />

The <strong>Bouygues</strong> Group achieved a substantial improvement in ROCE during 2005, from 12.7% to 16.5%. In the two<br />

years since 2003, ROCE has virtually doubled.<br />

The current level of ROCE is significantly higher than the weighted average cost of capital.<br />

2,600<br />

4,560<br />

10,050<br />

240<br />

6,100<br />

1,750<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

In 2006, Group sales are expected to hit €25.3<br />

billion, up 5% on 2005 (6% in France and 4% on<br />

international markets).<br />

Construction businesses should continue to thrive<br />

and are likely to show a rise of 5% at <strong>Bouygues</strong><br />

Construction, 12% at <strong>Bouygues</strong> Immobilier and 7%<br />

at Colas.<br />

Sales should grow by 4% at TF1 and by a modest 1%<br />

at <strong>Bouygues</strong> Telecom due to a reduction in incoming<br />

rates.<br />

12