A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

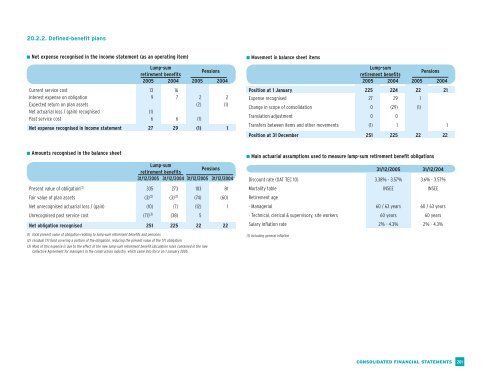

20.2.2. Defined-benefit plans<br />

■ Net expense recognised in the income statement (as an operating item)<br />

Lump-sum<br />

Pensions<br />

retirement benefits<br />

2005 2004 2005 2004<br />

Current service cost 13 16<br />

Interest expense on obligation 9 7 2 2<br />

Expected return on plan assets (2) (1)<br />

Net actuarial loss / (gain) recognised (1)<br />

Past service cost 6 6 (1)<br />

Net expense recognised in income statement 27 29 (1) 1<br />

■ Movement in balance sheet items<br />

Lump-sum<br />

retirement benefits<br />

Pensions<br />

2005 2004 2005 2004<br />

Position at 1 January 225 224 22 21<br />

Expense recognised 27 29 1<br />

Change in scope of consolidation 0 (29) (1)<br />

Translation adjustment 0 0<br />

Transfers between items and other movements (1) 1 1<br />

Position at 31 December 251 225 22 22<br />

■ Amounts recognised in the balance sheet<br />

Lump-sum<br />

Pensions<br />

retirement benefits<br />

31/12/2005 31/12/2004 31/12/2005 31/12/2004<br />

Present value of obligation (1) 335 273 103 81<br />

Fair value of plan assets (3) (2) (3) (2) (74) (60)<br />

Net unrecognised actuarial loss / (gain) (10) (7) (12) 1<br />

Unrecognised past service cost (71) (3) (38) 5<br />

Net obligation recognised 251 225 22 22<br />

(1) total present value of obligation relating to lump-sum retirement benefits and pensions<br />

(2) residual TF1 fund covering a portion of the obligation, reducing the present value of the TF1 obligation<br />

(3) Most of this expense is due to the effect of the new lump-sum retirement benefit calculation rules contained in the new<br />

Collective Agreement for managers in the construction industry, which came into force on 1 January 2005.<br />

■ Main actuarial assumptions used to measure lump-sum retirement benefit obligations<br />

31/12/2005 31/12/204<br />

Discount rate (OAT TEC 10) 3.38% - 3.57% 3.6% - 3.57%<br />

Mortality table INSEE INSEE<br />

Retirement age<br />

- Managerial 60 / 63 years 60 / 63 years<br />

- Technical, clerical & supervisory, site workers 60 years 60 years<br />

Salary inflation rate 2% - 4.3% 2% - 4.3%<br />

(1) including general inflation<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

201