A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

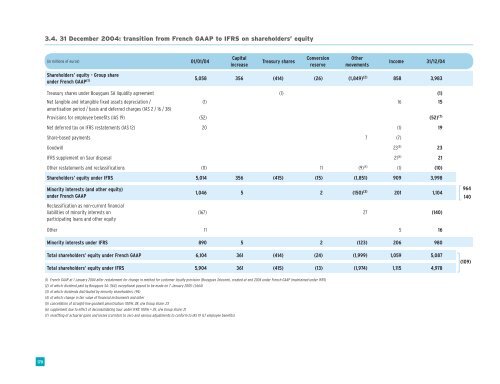

3.4. 31 December 2004: transition from French GAAP to IFRS on shareholders’ equity<br />

(in millions of euros) 01/01/04<br />

Capital<br />

increase<br />

Treasury shares<br />

Conversion<br />

reserve<br />

Other<br />

movements<br />

Income 31/12/04<br />

Shareholders’ equity - Group share<br />

under French GAAP (1) 5,058 356 (414) (26) (1,849) (2) 858 3,983<br />

Treasury shares under <strong>Bouygues</strong> SA liquidity agreement (1) (1)<br />

Net tangible and intangible fixed assets depreciation / (1) 16 15<br />

amortisation period / basis and deferred charges (IAS 2 / 16 / 38)<br />

Provisions for employee benefits (IAS 19) (52) (52) (7)<br />

Net deferred tax on IFRS restatements (IAS 12) 20 (1) 19<br />

Share-based payments 7 (7)<br />

Goodwill 23 (5) 23<br />

IFRS supplement on Saur disposal 21 (6) 21<br />

Other restatements and reclassifications (11) 11 (9) (4) (1) (10)<br />

Shareholders’ equity under IFRS 5,014 356 (415) (15) (1,851) 909 3,998<br />

Minority interests (and other equity)<br />

under French GAAP<br />

Reclassification as non-current financial<br />

liabilities of minority interests on<br />

participating loans and other equity<br />

1,046 5 2 (150) (3) 201 1,104<br />

(167) 27 (140)<br />

964<br />

140<br />

Other 11 5 16<br />

Minority interests under IFRS 890 5 2 (123) 206 980<br />

Total shareholders’ equity under French GAAP 6,104 361 (414) (24) (1,999) 1,059 5,087<br />

Total shareholders’ equity under IFRS 5,904 361 (415) (13) (1,974) 1,115 4,978<br />

(109)<br />

(1) French GAAP at 1 January 2004 after restatement for change in method for customer loyalty provision (<strong>Bouygues</strong> Telecom), created at end 2004 under French GAAP (maintained under IFRS)<br />

(2) of which: dividend paid by <strong>Bouygues</strong> SA: (164), exceptional payout to be made on 7 January 2005: (1,664)<br />

(3) of which: dividends distributed by minority shareholders: (94)<br />

(4) of which: change in fair value of financial instruments and other<br />

(5) cancellation of straight-line goodwill amortisation: 100%: 28; o/w Group share: 23<br />

(6) supplement due to effect of deconsolidating Saur under IFRS: 100% = 25, o/w Group share: 21<br />

(7) resettting of actuarial gains and losses (corridor) to zero and various adjustments to conform to IAS 19 (LT employee benefits)<br />

170