A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

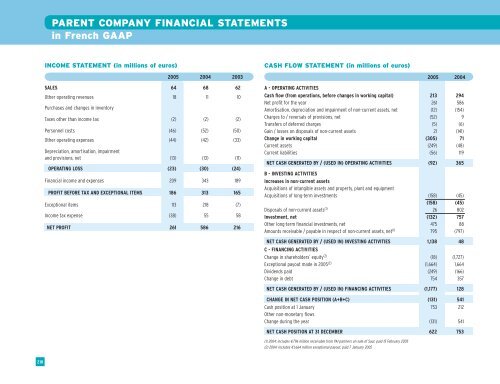

PARENT COMPANY FINANCIAL STATEMENTS<br />

in French GAAP<br />

INCOME STATEMENT (in millions of euros)<br />

CASH FLOW STATEMENT (in millions of euros)<br />

2005 2004 2003<br />

SALES 64 68 62<br />

Other operating revenues 18 11 10<br />

Purchases and changes in inventory<br />

Taxes other than income tax (2) (2) (2)<br />

Personnel costs (46) (52) (50)<br />

Other operating expenses (44) (42) (33)<br />

Depreciation, amortisation, impairment<br />

and provisions, net (13) (13) (11)<br />

OPERATING LOSS (23) (30) (24)<br />

Financial income and expenses 209 343 189<br />

PROFIT BEFORE TAX AND EXCEPTIONAL ITEMS 186 313 165<br />

Exceptional items 113 218 (7)<br />

Income tax expense (38) 55 58<br />

NET PROFIT 261 586 216<br />

2005 2004<br />

A - OPERATING ACTIVITIES<br />

Cash flow (from operations, before changes in working capital) 213 294<br />

Net profit for the year 261 586<br />

Amortisation, depreciation and impairment of non-current assets, net (12) (154)<br />

Charges to / reversals of provisions, net (52) 9<br />

Transfers of deferred charges (5) (6)<br />

Gain / losses on disposals of non-current assets 21 (141)<br />

Change in working capital (305) 71<br />

Current assets (249) (48)<br />

Current liabilities (56) 119<br />

NET CASH GENERATED BY / (USED IN) OPERATING ACTIVITIES (92) 365<br />

B - INVESTING ACTIVITIES<br />

Increases in non-current assets<br />

Acquisitions of intangible assets and property, plant and equipment<br />

Acquisitions of long-term investments (158) (45)<br />

(158) (45)<br />

Disposals of non-current assets (1) 26 802<br />

Investment, net (132) 757<br />

Other long-term financial investments, net 475 88<br />

Amounts receivable / payable in respect of non-current assets, net (1) 795 (797)<br />

NET CASH GENERATED BY / (USED IN) INVESTING ACTIVITIES 1,138 48<br />

C - FINANCING ACTIVITIES<br />

Change in shareholders’ equity (2) (18) (1,727)<br />

Exceptional payout made in 2005 (2) (1,664) 1,664<br />

Dividends paid (249) (166)<br />

Change in debt 754 357<br />

NET CASH GENERATED BY / (USED IN) FINANCING ACTIVITIES (1,177) 128<br />

CHANGE IN NET CASH POSITION (A+B+C) (131) 541<br />

Cash position at 1 January 753 212<br />

Other non-monetary flows<br />

Change during the year (131) 541<br />

NET CASH POSITION AT 31 DECEMBER 622 753<br />

(1) 2004: includes €796 million receivable from PAI partners on sale of Saur, paid 15 February 2005<br />

(2) 2004: includes €1,664 million exceptional payout, paid 7 January 2005<br />

210