A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

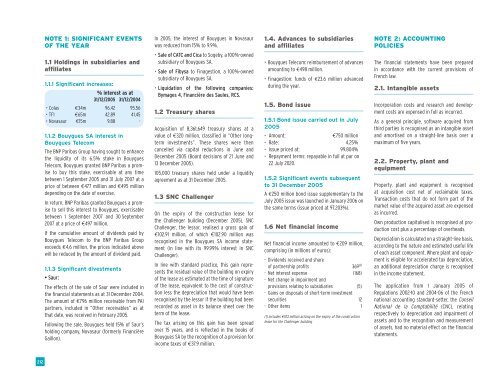

NOTE 1: SIGNIFICANT EVENTS<br />

OF THE YEAR<br />

1.1 Holdings in subsidiaries and<br />

affiliates<br />

1.1.1 Significant increases:<br />

% interest as at<br />

31/12/2005 31/12/2004<br />

• Colas €34m 96.42 95.56<br />

• TF1 €65m 42.89 41.45<br />

• Novasaur €15m 9.88 -<br />

1.1.2 <strong>Bouygues</strong> SA interest in<br />

<strong>Bouygues</strong> Telecom<br />

The BNP Paribas Group having sought to enhance<br />

the liquidity of its 6.5% stake in <strong>Bouygues</strong><br />

Telecom, <strong>Bouygues</strong> granted BNP Paribas a promise<br />

to buy this stake, exercisable at any time<br />

between 1 September 2005 and 31 July 2007 at a<br />

price of between €477 million and €495 million<br />

depending on the date of exercise.<br />

In return, BNP Paribas granted <strong>Bouygues</strong> a promise<br />

to sell this interest to <strong>Bouygues</strong>, exercisable<br />

between 1 September 2007 and 30 September<br />

2007 at a price of €497 million.<br />

If the cumulative amount of dividends paid by<br />

<strong>Bouygues</strong> Telecom to the BNP Paribas Group<br />

exceeds €4.6 million, the prices indicated above<br />

will be reduced by the amount of dividend paid.<br />

1.1.3 Significant divestments<br />

• Saur:<br />

The effects of the sale of Saur were included in<br />

the financial statements as at 31 December 2004.<br />

The amount of €796 million receivable from PAI<br />

partners, included in “Other receivables” as at<br />

that date, was received in February 2005.<br />

Following the sale, <strong>Bouygues</strong> held 15% of Saur’s<br />

holding company, Novasaur (formerly Financière<br />

Gaillon).<br />

In 2005, the interest of <strong>Bouygues</strong> in Novasaur<br />

was reduced from 15% to 9.9%.<br />

• Sale of CATC and Cica to Sogeby, a 100%-owned<br />

subsidiary of <strong>Bouygues</strong> SA.<br />

• Sale of Fibysa to Finagestion, a 100%-owned<br />

subsidiary of <strong>Bouygues</strong> SA.<br />

• Liquidation of the following companies:<br />

Bymages 4, Financière des Saules, RCS.<br />

1.2 Treasury shares<br />

Acquisition of 8,361,649 treasury shares at a<br />

value of €320 million, classified in “Other longterm<br />

investments”. These shares were then<br />

cancelled via capital reductions in June and<br />

December 2005 (Board decisions of 21 June and<br />

13 December 2005).<br />

105,000 treasury shares held under a liquidity<br />

agreement as at 31 December 2005.<br />

1.3 SNC Challenger<br />

On the expiry of the construction lease for<br />

the Challenger building (December 2005), SNC<br />

Challenger, the lessor, realised a gross gain of<br />

€102.91 million, of which €102.90 million was<br />

recognised in the <strong>Bouygues</strong> SA income statement<br />

(in line with its 99.99% interest in SNC<br />

Challenger).<br />

In line with standard practice, this gain represents<br />

the residual value of the building on expiry<br />

of the lease as estimated at the time of signature<br />

of the lease, equivalent to the cost of construction<br />

less the depreciation that would have been<br />

recognised by the lessor if the building had been<br />

recorded as asset in its balance sheet over the<br />

term of the lease.<br />

The tax arising on this gain has been spread<br />

over 15 years, and is reflected in the books of<br />

<strong>Bouygues</strong> SA by the recognition of a provision for<br />

income taxes of €37.9 million.<br />

1.4. Advances to subsidiaries<br />

and affiliates<br />

• <strong>Bouygues</strong> Telecom: reimbursement of advances<br />

amounting to €498 million.<br />

• Finagestion: funds of €23.6 million advanced<br />

during the year.<br />

1.5. Bond issue<br />

1.5.1 Bond issue carried out in July<br />

2005<br />

• Amount:<br />

€750 million<br />

• Rate: 4.25%<br />

• Issue priced at: 99.804%<br />

• Repayment terms: repayable in full at par on<br />

22 July 2020.<br />

1.5.2 Significant events subsequent<br />

to 31 December 2005<br />

A €250 million bond issue supplementary to the<br />

July 2005 issue was launched in January 2006 on<br />

the same terms (issue priced at 97.203%).<br />

1.6 Net financial income<br />

Net financial income amounted to €209 million,<br />

comprising (in millions of euros):<br />

- Dividends received and share<br />

of partnership profits 369 (1)<br />

- Net interest expense (168)<br />

- Net change in impairment and<br />

provisions relating to subsidiaries (5)<br />

- Gains on disposals of short-term investment<br />

securities 12<br />

- Other items 1<br />

(1) includes €103 million arising on the expiry of the construction<br />

lease for the Challenger building<br />

NOTE 2: ACCOUNTING<br />

POLICIES<br />

The financial statements have been prepared<br />

in accordance with the current provisions of<br />

French law.<br />

2.1. Intangible assets<br />

Incorporation costs and research and development<br />

costs are expensed in full as incurred.<br />

As a general principle, software acquired from<br />

third parties is recognised as an intangible asset<br />

and amortised on a straight-line basis over a<br />

maximum of five years.<br />

2.2. Property, plant and<br />

equipment<br />

Property, plant and equipment is recognised<br />

at acquisition cost net of reclaimable taxes.<br />

Transaction costs that do not form part of the<br />

market value of the acquired asset are expensed<br />

as incurred.<br />

Own production capitalised is recognised at production<br />

cost plus a percentage of overheads.<br />

Depreciation is calculated on a straight-line basis,<br />

according to the nature and estimated useful life<br />

of each asset component. Where plant and equipment<br />

is eligible for accelerated tax depreciation,<br />

an additional depreciation charge is recognised<br />

in the income statement.<br />

The application from 1 January 2005 of<br />

Regulations 2002-10 and 2004-06 of the French<br />

national accounting standard-setter, the Conseil<br />

National de la Comptabilité (CNC), relating<br />

respectively to depreciation and impairment of<br />

assets and to the recognition and measurement<br />

of assets, had no material effect on the financial<br />

statements.<br />

212