A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

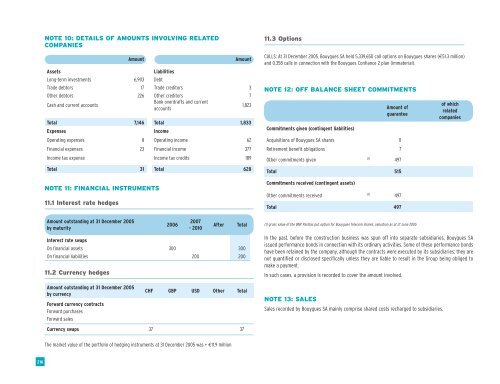

NOTE 10: DETAILS OF AMOUNTS INVOLVING RELATED<br />

COMPANIES<br />

Assets<br />

Long-term investments 6,903 Debt<br />

Amount Amount<br />

Liabilities<br />

Trade debtors 17 Trade creditors 3<br />

Other debtors 226 Other creditors 7<br />

Cash and current accounts<br />

Bank overdrafts and current<br />

accounts<br />

1,823<br />

Total 7,146 Total 1,833<br />

Expenses<br />

Income<br />

Operating expenses 8 Operating income 62<br />

Financial expenses 23 Financial income 377<br />

Income tax expense Income tax credits 189<br />

Total 31 Total 628<br />

NOTE 11: FINANCIAL INSTRUMENTS<br />

11.1 Interest rate hedges<br />

Amount outstanding at 31 December 2005<br />

by maturity<br />

Interest rate swaps<br />

2006<br />

2007<br />

- 2010<br />

After<br />

On financial assets 300 300<br />

On financial liabilities 200 200<br />

11.2 Currency hedges<br />

Amount outstanding at 31 December 2005<br />

by currency<br />

Forward currency contracts<br />

Forward purchases<br />

Forward sales<br />

Total<br />

CHF GBP USD Other Total<br />

Currency swaps 37 37<br />

11.3 Options<br />

CALLS: At 31 December 2005, <strong>Bouygues</strong> SA held 5,339,650 call options on <strong>Bouygues</strong> shares (€51.3 million)<br />

and 0.358 calls in connection with the <strong>Bouygues</strong> Confiance 2 plan (immaterial).<br />

NOTE 12: OFF BALANCE SHEET COMMITMENTS<br />

Commitments given (contingent liabilities)<br />

Amount of<br />

guarantee<br />

Acquisitions of <strong>Bouygues</strong> SA shares 11<br />

Retirement benefit obligations 7<br />

Other commitments given<br />

(1)<br />

497<br />

Total 515<br />

Commitments received (contingent assets)<br />

Other commitments received<br />

(1)<br />

497<br />

Total 497<br />

(1) gross value of the BNP Paribas put option for <strong>Bouygues</strong> Telecom shares, valuation as at 21 June 2005<br />

of which<br />

related<br />

companies<br />

In the past, before the construction business was spun off into separate subsidiaries, <strong>Bouygues</strong> SA<br />

issued performance bonds in connection with its ordinary activities. Some of these performance bonds<br />

have been retained by the company, although the contracts were executed by its subsidiaries; they are<br />

not quantified or disclosed specifically unless they are liable to result in the Group being obliged to<br />

make a payment.<br />

In such cases, a provision is recorded to cover the amount involved.<br />

NOTE 13: SALES<br />

Sales recorded by <strong>Bouygues</strong> SA mainly comprise shared costs recharged to subsidiaries.<br />

The market value of the portfolio of hedging instruments at 31 December 2005 was + €11.9 million<br />

216