A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

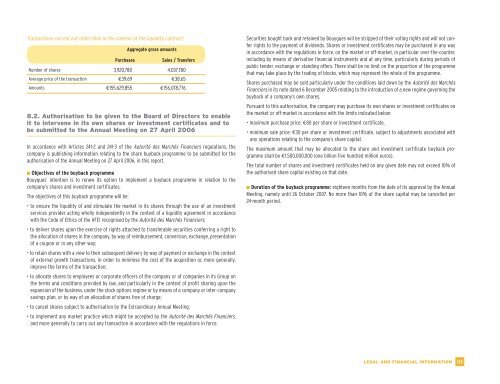

Transactions carried out other than in the context of the liquidity contract:<br />

Purchases<br />

Aggregate gross amounts<br />

Sales / Transfers<br />

Number of shares 3,920,780 4,037,780<br />

Average price of the transaction €39.69 €38.65<br />

Amounts €155,629,855 €156,078,776<br />

8.2. Authorisation to be given to the Board of Directors to enable<br />

it to intervene in its own shares or investment certificates and to<br />

be submitted to the Annual Meeting on 27 April 2006<br />

In accordance with Articles 241-2 and 241-3 of the Autorité des Marchés Financiers regulations, the<br />

company is publishing information relating to the share buyback programme to be submitted for the<br />

authorisation of the Annual Meeting on 27 April 2006, in this report.<br />

■ Objectives of the buyback programme<br />

<strong>Bouygues</strong>’ intention is to renew its option to implement a buyback programme in relation to the<br />

company’s shares and investment certificates.<br />

The objectives of this buyback programme will be:<br />

• to ensure the liquidity of and stimulate the market in its shares through the use of an investment<br />

services provider acting wholly independently in the context of a liquidity agreement in accordance<br />

with the Code of Ethics of the AFEI recognised by the Autorité des Marchés Financiers;<br />

• to deliver shares upon the exercise of rights attached to transferable securities conferring a right to<br />

the allocation of shares in the company, by way of reimbursement, conversion, exchange, presentation<br />

of a coupon or in any other way;<br />

• to retain shares with a view to their subsequent delivery by way of payment or exchange in the context<br />

of external growth transactions, in order to minimise the cost of the acquisition or, more generally,<br />

improve the terms of the transaction;<br />

• to allocate shares to employees or corporate officers of the company or of companies in its Group on<br />

the terms and conditions provided by law, and particularly in the context of profit sharing upon the<br />

expansion of the business, under the stock options regime or by means of a company or inter-company<br />

savings plan, or by way of an allocation of shares free of charge;<br />

• to cancel shares subject to authorisation by the Extraordinary Annual Meeting;<br />

• to implement any market practice which might be accepted by the Autorité des Marchés Financiers,<br />

and more generally to carry out any transaction in accordance with the regulations in force.<br />

Securities bought back and retained by <strong>Bouygues</strong> will be stripped of their voting rights and will not confer<br />

rights to the payment of dividends. Shares or investment certificates may be purchased in any way<br />

in accordance with the regulations in force, on the market or off-market, in particular over-the-counter,<br />

including by means of derivative financial instruments and at any time, particularly during periods of<br />

public tender, exchange or standing offers. There shall be no limit on the proportion of the programme<br />

that may take place by the trading of blocks, which may represent the whole of the programme.<br />

Shares purchased may be sold particularly under the conditions laid down by the Autorité des Marchés<br />

Financiers in its note dated 6 December 2005 relating to the introduction of a new regime governing the<br />

buyback of a company’s own shares.<br />

Pursuant to this authorisation, the company may purchase its own shares or investment certificates on<br />

the market or off-market in accordance with the limits indicated below:<br />

• maximum purchase price: €80 per share or investment certificate,<br />

• minimum sale price: €30 per share or investment certificate, subject to adjustments associated with<br />

any operations relating to the company’s share capital.<br />

The maximum amount that may be allocated to the share and investment certificate buyback programme<br />

shall be €1,500,000,000 (one billion five hundred million euros).<br />

The total number of shares and investment certificates held on any given date may not exceed 10% of<br />

the authorised share capital existing on that date.<br />

■ Duration of the buyback programme: eighteen months from the date of its approval by the Annual<br />

Meeting, namely until 26 October 2007. No more than 10% of the share capital may be cancelled per<br />

24-month period.<br />

LEGAL AND FINANCIAL INFORMATION<br />

139