A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

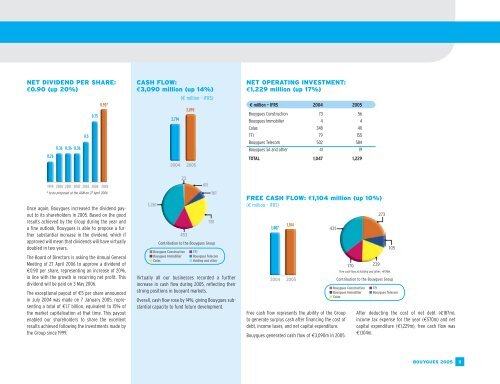

NET DIVIDEND PER SHARE:<br />

€0.90 (up 20%)<br />

0.26<br />

0.36 0.36 0.36<br />

Once again, <strong>Bouygues</strong> increased the dividend payout<br />

to its shareholders in 2005. Based on the good<br />

results achieved by the Group during the year and<br />

a fine outlook, <strong>Bouygues</strong> is able to propose a further<br />

substantial increase in the dividend, which if<br />

approved will mean that dividends will have virtually<br />

doubled in two years.<br />

The Board of Directors is asking the Annual General<br />

Meeting of 27 April 2006 to approve a dividend of<br />

€0.90 per share, representing an increase of 20%,<br />

in line with the growth in recurring net profit. This<br />

dividend will be paid on 3 May 2006.<br />

The exceptional payout of €5 per share announced<br />

in July 2004 was made on 7 January 2005, representing<br />

a total of €1.7 billion, equivalent to 15% of<br />

the market capitalisation at that time. This payout<br />

enabled our shareholders to share the excellent<br />

results achieved following the investments made by<br />

the Group since 1999.<br />

0.5<br />

0.75<br />

0.90*<br />

1999 2000 2001 2002 2003 2004 2005<br />

* to be proposed at the AGM on 27 April 2006<br />

CASH FLOW:<br />

€3,090 million (up 14%)<br />

1,261<br />

2,714<br />

(€ million – IFRS)<br />

23<br />

453<br />

3,090<br />

2004 2005<br />

411<br />

161<br />

781<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

Virtually all our businesses recorded a further<br />

increase in cash flow during 2005, reflecting their<br />

strong positions in buoyant markets.<br />

Overall, cash flow rose by 14%, giving <strong>Bouygues</strong> substantial<br />

capacity to fund future development.<br />

NET OPERATING INVESTMENT:<br />

€1,229 million (up 17%)<br />

€ million – IFRS 2004 2005<br />

<strong>Bouygues</strong> Construction 73 56<br />

<strong>Bouygues</strong> Immobilier 4 4<br />

Colas 348 411<br />

TF1 79 155<br />

<strong>Bouygues</strong> Telecom 502 584<br />

<strong>Bouygues</strong> SA and other 41 19<br />

TOTAL 1,047 1,229<br />

FREE CASH FLOW: €1,104 million (up 10%)<br />

(€ million – IFRS)<br />

1,007<br />

1,104<br />

2004 2005<br />

431<br />

Free cash flow represents the ability of the Group<br />

to generate surplus cash after financing the cost of<br />

debt, income taxes, and net capital expenditure.<br />

<strong>Bouygues</strong> generated cash flow of €3,090m in 2005.<br />

170<br />

239<br />

273<br />

Free cash flow at holding and other: -€114m.<br />

105<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

After deducting the cost of net debt (€187m),<br />

income tax expense for the year (€570m) and net<br />

capital expenditure (€1,229m), free cash flow was<br />

€1,104m.<br />

BOUYGUES 2005<br />

11