RESULTS OF BOUYGUES SA 1. DIVIDEND 1.1. Appropriation and distribution of the earnings of <strong>Bouygues</strong> SA (parent company) The Annual Meeting, having acquainted itself with the Board of Directors’ report on operations and having noted that distributable earnings, before appropriation to the legal reserve, amounted to €537,180,016.80, is asked to approve the following appropriation and distribution: - distribution of a first net dividend (5% of par) of €0.05 per share or per investment certificate, representing a total amount of €16,838,144.80, drawn from distributable earnings; - distribution of an additional net dividend of €0.85 per share or per investment certificate, representing a total amount of €286,248,461.60; - appropriation of the balance, amounting to €234,093,410.40, to retained earnings. Subject to approval by the Annual General Meeting, the dividend of €0.90 net per share and per investment certificate will be paid in cash from 3 May 2006. Should the company hold some of its own stock when the dividend is distributed, the sum corresponding to the amount of dividend not paid because of the nature of such stock will be allocated to retained earnings. The company is required by law to state the dividends distributed in respect of each of the last three years and the related tax credits. They were as follows: 2002 2003 2004 Exceptional payout (2) Number of shares 344,361,919 333,199,969 332,758,624 332,758,624 Dividend €0.36 €0.50 €0.75 €2.52 Tax credit (1) €0.18 €0.25 - - Total dividend per share €0.54 €0.75 €0.75 €2.52 Total dividend payout €121,089,514.32 €166,423,811.00 €248,928,093.00 €838,551,732.48 Distributed income eligible for the rebate specified in item 2 of article 158.3 of the French General Tax Code - - €248,928,093.00 €838,551,732.48 (1) calculated at the rate of 50% (2) The amounts shown relate to the portion of the exceptional payout of €5.00 per share or per investment certificate (as approved by the Ordinary General Meeting of 7 October 2004 and paid on 7 January 2005) classified as dividend for tax purposes. Of the total €5.00 payout, €2.52 was classified as dividend and €2.48 as repayment of capital contributions for tax purposes. Dividends not claimed within five years are paid to the French State. 140

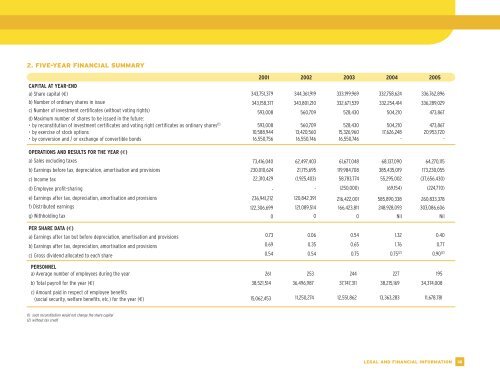

2. FIVE-YEAR FINANCIAL SUMMARY CAPITAL AT YEAR-END a) Share capital (€) b) Number of ordinary shares in issue c) Number of investment certificates (without voting rights) d) Maximum number of shares to be issued in the future: • by reconstitution of investment certificates and voting right certificates as ordinary shares (1) • by exercise of stock options • by conversion and / or exchange of convertible bonds 2001 2002 2003 2004 2005 343,751,379 343,158,371 593,008 593,008 10,588,944 16,550,756 344,361,919 343,801,210 560,709 560,709 13,420,560 16,550,746 333,199,969 332,671,539 528,430 528,430 15,326,960 16,550,746 332,758,624 332,254,414 504,210 504,210 17,626,248 - 336,762,896 336,289,029 473,867 473,867 20,953,720 - OPERATIONS AND RESULTS FOR THE YEAR (€) a) Sales excluding taxes 73,416,040 62,497,403 61,677,048 68,137,090 64,270,115 b) Earnings before tax, depreciation, amortisation and provisions 230,010,624 21,715,695 119,984,708 385,435,019 173,230,055 c) Income tax 22,310,429 (1,925,403) 58,783,774 55,295,002 (37,656,430) d) Employee profit-sharing e) Earnings after tax, depreciation, amortisation and provisions f) Distributed earnings g) Withholding tax - 236,941,212 122,306,699 0 - 120,842,391 121,089,514 0 (250,000) 216,422,001 166,423,811 0 (69,154) 585,890,338 248,928,093 Nil (224,770) 260,833,378 303,086,606 Nil PER SHARE DATA (€) a) Earnings after tax but before depreciation, amortisation and provisions b) Earnings after tax, depreciation, amortisation and provisions c) Gross dividend allocated to each share 0.73 0.69 0.54 0.06 0.35 0.54 0.54 0.65 0.75 0.40 1.32 0.75 (2) 0.90 (2) 1.76 0.77 PERSONNEL a) Average number of employees during the year 261 253 244 227 195 b) Total payroll for the year (€) 38,521,514 36,496,987 37,747,311 38,215,169 34,374,008 c) Amount paid in respect of employee benefits (social security, welfare benefits, etc.) for the year (€) 15,062,453 11,250,274 12,551,862 13,363,283 11,678,781 (1) such reconstitution would not change the share capital (2) without tax credit LEGAL AND FINANCIAL INFORMATION 141

- Page 1 and 2:

BOUYGUES 2005 A N N U A L R E P O R

- Page 3 and 4:

CONTENTS Chairman’s statement 2 M

- Page 5 and 6:

CHAIRMAN'S STATEMENT cellent year f

- Page 7 and 8:

Bouygues Telecom Tons directs Logot

- Page 9 and 10:

with the announcement of our annual

- Page 11 and 12:

KEY FIGURES FINANCIAL HIGHLIGHTS (

- Page 13 and 14:

NET DIVIDEND PER SHARE: €0.90 (up

- Page 15 and 16:

Business activities Bouygues Constr

- Page 17 and 18:

ACTOR > Excellent commercial and fi

- Page 19 and 20:

uildings and offices was stable, wi

- Page 21 and 22:

Gautrain link project, South Africa

- Page 23 and 24:

PROPERTY DEVELOPER > Further growth

- Page 25 and 26:

• the Allée des Oliviers in Mont

- Page 27 and 28:

Poland, which generated sales of

- Page 29 and 30:

IN ROADWORKS > Sharp rise in sales

- Page 31 and 32:

the performance of contracts under

- Page 33 and 34:

Two major projects were completed i

- Page 35 and 36:

SION GROUP IN FRANCE > Biggest incr

- Page 37 and 38:

eginning to tire. The subsidiary’

- Page 39 and 40:

ments and very good viewing figures

- Page 41 and 42:

Bouygues Telecom Tons directs Logot

- Page 43 and 44:

Bouygues Telecom Logotype BT Quadri

- Page 45 and 46:

Bouygues Telecom Logotype BT Quadri

- Page 47 and 48:

Bond issue On 22 July 2005, Bouygue

- Page 49 and 50:

Sustainable development Sustainable

- Page 51 and 52:

PMENT IN THE GROUP Our culture is r

- Page 53 and 54:

THE GROUP diseases at the Treichvil

- Page 55 and 56:

culty to enter the labour market, e

- Page 57 and 58:

ing position in this area. While th

- Page 59 and 60:

Bouygues Bâtiment Ile-de-France, f

- Page 61 and 62:

Private Construction QSE ® plans T

- Page 63 and 64:

erly constructed, supervised, teste

- Page 65 and 66:

teams. The workforce increased by 2

- Page 67 and 68:

The sustainable development committ

- Page 69 and 70:

Internships and apprenticeships App

- Page 71 and 72:

■ Internal communication: promoti

- Page 73 and 74:

ing and construction waste. In 2005

- Page 75 and 76:

Nanotechnologies to support technol

- Page 77 and 78:

Messages for children on TF1 After

- Page 79 and 80:

tional risks in order to raise awar

- Page 81 and 82:

Example of the local impact of the

- Page 83 and 84:

Bouygues Telecom Tons directs Logot

- Page 85 and 86:

Bouygues Telecom Tons directs Logot

- Page 87 and 88:

Bouygues Telecom Logotype BT Quadri

- Page 89 and 90:

Bouygues Telecom Logotype BT Quadri

- Page 91 and 92: Bouygues Telecom Tons directs Logot

- Page 93 and 94: Bouygues Telecom Logotype BT Quadri

- Page 95 and 96: its transmitters. Thus, if a radio

- Page 97 and 98: dual exchange rate risk arising fro

- Page 99 and 100: Interest rate hedging Maturity 2006

- Page 101 and 102: competition undertakings relating t

- Page 103 and 104: assessments. The Group uses all leg

- Page 105 and 106: Innovation, research and developmen

- Page 107 and 108: H AND DEVELOPMENT • modelling (ha

- Page 109 and 110: Legal and financial information Cor

- Page 111 and 112: DEPUTY CHIEF EXECUTIVE OFFICERS Exp

- Page 113 and 114: Expertise / Experience Principal po

- Page 115 and 116: Expertise / Experience Principal po

- Page 117 and 118: Expertise / Experience Principal po

- Page 119 and 120: Expertise / Experience Principal po

- Page 121 and 122: devoted an item on its agenda to a

- Page 123 and 124: 1.3.3. Selection Committee The Sele

- Page 125 and 126: is a centralised and formalised sys

- Page 127 and 128: Challenger Express, intended for se

- Page 129 and 130: A. Dupont P. Le Lay Y. Gabriel A. P

- Page 131 and 132: 2. REPORT ON THE ALLOCATION AND EXE

- Page 133 and 134: SHARE OWNERSHIP 1. CHANGES IN SHARE

- Page 135 and 136: STOCK MARKET 1. BOUYGUES ON THE STO

- Page 137 and 138: CAPITAL 1. GENERAL INFORMATION 1.2.

- Page 139 and 140: 2. ADDITIONAL REPORT ON THE USE OF

- Page 141: Transactions carried out other than

- Page 145 and 146: 3.4. Double voting rights (Article

- Page 147 and 148: MISCELLANEOUS INFORMATION Date of p

- Page 149 and 150: MISCELLANEOUS INFORMATION Date of p

- Page 151 and 152: 7 November 2005 from 31 October to

- Page 153 and 154: Financial statements CONSOLIDATED F

- Page 155 and 156: CONSOLIDATED INCOME STATEMENT (in m

- Page 157 and 158: CHANGES IN CONSOLIDATED SHAREHOLDER

- Page 159 and 160: NOTE 1: SIGNIFICANT EVENTS OF THE Y

- Page 161 and 162: ■ Business combinations Business

- Page 163 and 164: ■ Leases: Items of property, plan

- Page 165 and 166: 2.8. Financial instruments Some gro

- Page 167 and 168: Services carried out on behalf of c

- Page 169 and 170: 3.2. December 2004: financial state

- Page 171 and 172: 3.3. 31 December 2004: comparative

- Page 173 and 174: 3.5. 31 December 2004: transition o

- Page 175 and 176: 4.2. Movements during the period 4,

- Page 177 and 178: 4.2.3. Goodwill 4,618 ■ Movement

- Page 179 and 180: 4.2.5. Other non-current financial

- Page 181 and 182: 5.2. Advances and down-payments on

- Page 183 and 184: 6.2.1. Attributable to the Group (I

- Page 185 and 186: 2 - Fair value remeasurement reserv

- Page 187 and 188: 8.3. Deferred tax assets and liabil

- Page 189 and 190: 9.3. Liquidity at 31 December 2005

- Page 191 and 192: Information about construction cont

- Page 193 and 194:

NOTE 15: INCOME TAX EXPENSE (570) 1

- Page 195 and 196:

17.2. Analysis by business segment:

- Page 197 and 198:

17.4. Income statement by function

- Page 199 and 200:

18.1.2. Currency hedges ■ Analysi

- Page 201 and 202:

19.3. Other commitments 19.5. Conti

- Page 203 and 204:

20.2.2. Defined-benefit plans ■ N

- Page 205 and 206:

20.3. Employee share ownership NOTE

- Page 207 and 208:

NOTE 23: AUDITORS’ FEES The table

- Page 209 and 210:

NOTE 25: PRINCIPAL EXCHANGE RATES N

- Page 211 and 212:

PARENT COMPANY FINANCIAL STATEMENTS

- Page 213 and 214:

NOTES TO THE PARENT COMPANY FINANCI

- Page 215 and 216:

Estimated useful lives and deprecia

- Page 217 and 218:

NOTE 7: COMPOSITION OF SHARE CAPITA

- Page 219 and 220:

NOTE 14: GROUP TAX ELECTION AND INC

- Page 221 and 222:

Annual general meeting of 27 April

- Page 223 and 224:

BOARD OF DIRECTORS' REPORTS BOARD O

- Page 225 and 226:

This delegation is granted to the B

- Page 227 and 228:

AUDITORS' REPORTS AUDITORS’ GENER

- Page 229 and 230:

AUDITORS’ REPORT IN ACCORDANCE WI

- Page 231 and 232:

Agreements to buy and sell Bouygues

- Page 233 and 234:

AUDITORS’ REPORT ON THE REDUCTION

- Page 235 and 236:

RECONSTITUTION OF INVESTMENT CERTIF

- Page 237 and 238:

Consequently, we ask you, subject t

- Page 239 and 240:

I. Analysis of the relative value o

- Page 241 and 242:

DRAFT RESOLUTIONS 1. ORDINARY PART

- Page 243 and 244:

plies with a code of conduct recogn

- Page 245 and 246:

• thirteenth resolution (Authoris

- Page 247 and 248:

CERTIFICATE OF RESPONSIBILITY Havin