A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

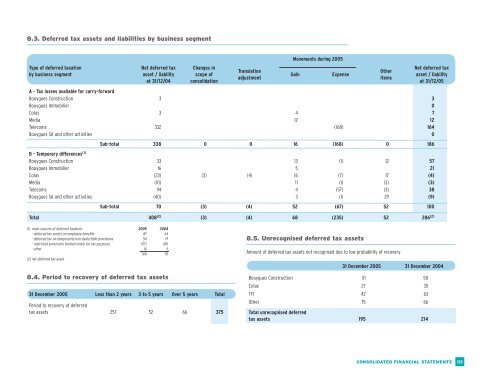

8.3. Deferred tax assets and liabilities by business segment<br />

Movements during 2005<br />

Type of deferred taxation<br />

by business segment<br />

Net deferred tax<br />

asset / liability<br />

at 31/12/04<br />

Changes in<br />

scope of<br />

consolidation<br />

Translation<br />

adjustment<br />

Gain<br />

Expense<br />

Other<br />

items<br />

Net deferred tax<br />

asset / liability<br />

at 31/12/05<br />

A - Tax losses available for carry-forward<br />

<strong>Bouygues</strong> Construction 3 3<br />

<strong>Bouygues</strong> Immobilier 0<br />

Colas 3 4 7<br />

Media 12 12<br />

Telecoms 332 (168) 164<br />

<strong>Bouygues</strong> SA and other activities 0<br />

Sub-total 338 0 0 16 (168) 0 186<br />

B - Temporary differences (1)<br />

<strong>Bouygues</strong> Construction 33 13 (1) 12 57<br />

<strong>Bouygues</strong> Immobilier 16 5 21<br />

Colas (23) (3) (4) 16 (7) 17 (4)<br />

Media (10) 11 (1) (3) (3)<br />

Telecoms 94 4 (57) (3) 38<br />

<strong>Bouygues</strong> SA and other activities (40) 3 (1) 29 (9)<br />

Sub-total 70 (3) (4) 52 (67) 52 100<br />

Total 408 (2) (3) (4) 68 (235) 52 286 (2)<br />

(1) main sources of deferred taxation: 2005 2004<br />

- deferred tax assets on employee benefits 87 64<br />

- deferred tax on temporarily non-deductible provisions 54 19<br />

- restricted provisions booked solely for tax purposes (57) (18)<br />

- other 16 5<br />

100 70<br />

(2) net deferred tax asset<br />

8.4. Period to recovery of deferred tax assets<br />

31 December 2005 Less than 2 years 3 to 5 years Over 5 years Total<br />

Period to recovery of deferred<br />

tax assets 257 52 66 375<br />

8.5. Unrecognised deferred tax assets<br />

Amount of deferred tax assets not recognised due to low probability of recovery<br />

31 December 2005 31 December 2004<br />

<strong>Bouygues</strong> Construction 51 50<br />

Colas 27 35<br />

TF1 42 63<br />

Other 75 66<br />

Total unrecognised deferred<br />

tax assets 195 214<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

185