A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

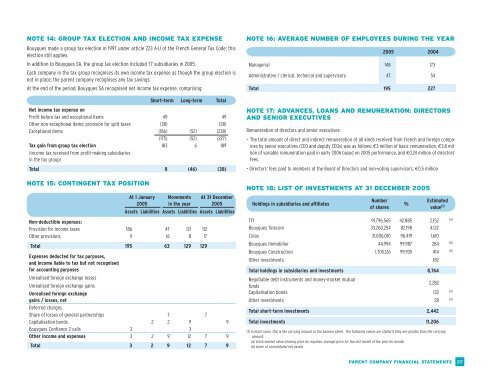

NOTE 14: GROUP TAX ELECTION AND INCOME TAX EXPENSE<br />

<strong>Bouygues</strong> made a group tax election in 1997 under article 223 A-U of the French General Tax Code; this<br />

election still applies.<br />

In addition to <strong>Bouygues</strong> SA, the group tax election included 77 subsidiaries in 2005.<br />

Each company in the tax group recognises its own income tax expense as though the group election is<br />

not in place; the parent company recognises any tax savings.<br />

At the end of the period, <strong>Bouygues</strong> SA recognised net income tax expense, comprising:<br />

NOTE 15: CONTINGENT TAX POSITION<br />

At 1 January<br />

2005<br />

Movements<br />

in the year<br />

At 31 December<br />

2005<br />

Assets Liabilities Assets Liabilities Assets Liabilities<br />

Non-deductible expenses:<br />

Provision for income taxes 186 47 121 112<br />

Other provisions 9 16 8 17<br />

Total 195 63 129 129<br />

Expenses deducted for tax purposes,<br />

and income liable to tax but not recognised<br />

for accounting purposes<br />

Unrealised foreign exchange losses<br />

Unrealised foreign exchange gains<br />

Short-term Long-term Total<br />

Net income tax expense on<br />

Profit before tax and exceptional items 49 49<br />

Other non-exceptional items: provision for split taxes (38) (38)<br />

Exceptional items (186) (52) (238)<br />

(175) (52) (227)<br />

Tax gain from group tax election 183 6 189<br />

(income tax received from profit-making subsidiaries<br />

in the tax group)<br />

Total 8 (46) (38)<br />

Unrealised foreign exchange<br />

gains / losses, net<br />

Deferred charges<br />

Share of losses of general partnerships 7 7<br />

Capitalisation bonds 2 2 9 9<br />

<strong>Bouygues</strong> Confiance 2 calls 3 3<br />

Other income and expenses 3 2 9 12 7 9<br />

Total 3 2 9 12 7 9<br />

NOTE 16: AVERAGE NUMBER OF EMPLOYEES DURING THE YEAR<br />

2005 2004<br />

Managerial 148 173<br />

Administrative / clerical, technical and supervisory 47 54<br />

Total 195 227<br />

NOTE 17: ADVANCES, LOANS AND REMUNERATION: DIRECTORS<br />

AND SENIOR EXECUTIVES<br />

Remuneration of directors and senior executives:<br />

• The total amount of direct and indirect remuneration of all kinds received from French and foreign companies<br />

by senior executives (CEO and deputy CEOs) was as follows: €3 million of basic remuneration, €3.8 million<br />

of variable remuneration paid in early 2006 based on 2005 performance, and €0.24 million of directors’<br />

fees.<br />

• Directors’ fees paid to members of the Board of Directors and non-voting supervisors: €0.5 million<br />

NOTE 18: LIST OF INVESTMENTS AT 31 DECEMBER 2005<br />

Holdings in subsidiaries and affiliates<br />

Number<br />

of shares<br />

%<br />

Estimated<br />

value (1)<br />

TF1 91,796,565 42.885 2,152<br />

(a)<br />

<strong>Bouygues</strong> Telecom 33,260,254 82.198 4,122<br />

Colas 31,006,010 96.419 1,610<br />

<strong>Bouygues</strong> Immobilier 44,994 99.987 284<br />

(b)<br />

<strong>Bouygues</strong> Construction 1,705,126 99.935 414<br />

(b)<br />

Other investments 182<br />

Total holdings in subsidiaries and investments 8,764<br />

Negotiable debt instruments and money-market mutual<br />

funds<br />

2,282<br />

Capitalisation bonds 132<br />

(a)<br />

Other investments 28<br />

(a)<br />

Total short-term investments 2,442<br />

Total investments 11,206<br />

(1) In most cases, this is the carrying amount in the balance sheet. The following values are stated if they are greater than the carrying<br />

amount:<br />

(a) stock market value (closing price for equities, average price for the last month of the year for bonds)<br />

(b) share of consolidated net assets<br />

PARENT COMPANY FINANCIAL STATEMENTS<br />

217