A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KEY FIGURES<br />

FINANCIAL HIGHLIGHTS<br />

(€ million) – IFRS 2004 2005 2005/2004<br />

Sales<br />

of which international<br />

20,894<br />

5,989<br />

24,073<br />

7,127<br />

+15%<br />

+19%<br />

EBITDA (1) 2,943 3,505 +19%<br />

Current operating profit 1,557 1,852 +19%<br />

Operating profit 1,557 1,748 +12%<br />

Net profit attributable to the Group 909 832 - 8%<br />

Recurring net profit (2) 700 832 +19%<br />

Return on capital employed (ROCE) 12.7% 16.5% +3.8 pts<br />

Cash flow 2,714 3,090 +14%<br />

Free cash flow (3) 1,007 1,104 +10%<br />

Shareholders’ equity (period-end) 4,978 5,561 +12%<br />

Net debt (period-end) 1,875 2,352 +25%<br />

Gearing (period-end) 50% 42% -8 pts<br />

Market capitalisation (period-end) 11,314 13,908 +23%<br />

Net dividend 0.75 0.90 (4) +20%<br />

Number of employees 113,334 115,441 +2%<br />

As TPS was held for sale at end December 2005, only its share of net profit was booked in 2004 and 2005.<br />

(1) current operating profit plus net depreciation and amortisation expense and net increases in provisions<br />

(2) recurring net income before exceptional transactions (e.g. gain on sale of Saur in 2004)<br />

(3) cash flow minus cost of net debt minus tax and minus net capital expenditure<br />

(4) to be proposed to the Annual General Meeting of 27 April 2006<br />

2005 was another excellent year for the<br />

<strong>Bouygues</strong> group both in terms of sales and profit.<br />

Its construction businesses performed strongly and<br />

recorded a sharp increase in orders booked.<br />

Steep rise in profitability<br />

Full-year 2005 sales amounted to €24.1 billion, up<br />

15% on 2004. Current operating profit climbed 19%.<br />

Recurring net profit stood at €832 million, 19%<br />

higher than 2004. Return on capital employed was<br />

16.5%, compared with 12.7% in 2004.<br />

A solid financial structure<br />

Net debt amounted to €2,352 million at 31 December<br />

2005, giving a debt-to-equity ratio of 42%.<br />

Standard & Poor’s maintained its credit rating for<br />

<strong>Bouygues</strong>: A- with stable outlook.<br />

Cash flow rose by 14% to €3,090 million and free<br />

cash flow by 10% to €1,104 million.<br />

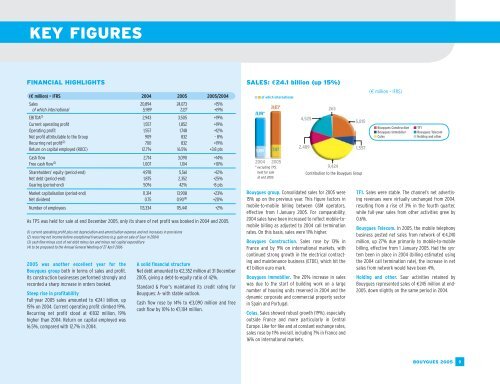

SALES: €24.1 billion (up 15%)<br />

20,894*<br />

of which international<br />

24,073*<br />

5,989 7,127<br />

2004 2005<br />

* excluding TPS,<br />

held for sale<br />

at end 2005<br />

4,525<br />

2,489<br />

263<br />

9,424<br />

5,815<br />

1,557<br />

Contribution to the <strong>Bouygues</strong> Group<br />

<strong>Bouygues</strong> group. Consolidated sales for 2005 were<br />

15% up on the previous year. This figure factors in<br />

mobile-to-mobile billing between GSM operators,<br />

effective from 1 January 2005. For comparability,<br />

2004 sales have been increased to reflect mobile-tomobile<br />

billing as adjusted to 2004 call termination<br />

rates. On this basis, sales were 11% higher.<br />

<strong>Bouygues</strong> Construction. Sales rose by 13% in<br />

France and by 9% on international markets, with<br />

continued strong growth in the electrical contracting<br />

and maintenance business (ETDE), which hit the<br />

€1 billion euro mark.<br />

<strong>Bouygues</strong> Immobilier. The 20% increase in sales<br />

was due to the start of building work on a large<br />

number of housing units reserved in 2004 and the<br />

dynamic corporate and commercial property sector<br />

in Spain and Portugal.<br />

Colas. Sales showed robust growth (19%), especially<br />

outside France and more particularly in Central<br />

Europe. Like-for-like and at constant exchange rates,<br />

sales rose by 11% overall, including 7% in France and<br />

16% on international markets.<br />

(€ million – IFRS)<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

TF1. Sales were stable. The channel’s net advertising<br />

revenues were virtually unchanged from 2004,<br />

resulting from a rise of 3% in the fourth quarter,<br />

while full-year sales from other activities grew by<br />

0.6%.<br />

<strong>Bouygues</strong> Telecom. In 2005, the mobile telephony<br />

business posted net sales from network of €4,240<br />

million, up 27% due primarily to mobile-to-mobile<br />

billing, effective from 1 January 2005. Had the system<br />

been in place in 2004 (billing estimated using<br />

the 2004 call termination rate), the increase in net<br />

sales from network would have been 4%.<br />

Holding and other. Saur activities retained by<br />

<strong>Bouygues</strong> represented sales of €245 million at end-<br />

2005, down slightly on the same period in 2004.<br />

BOUYGUES 2005<br />

9