A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

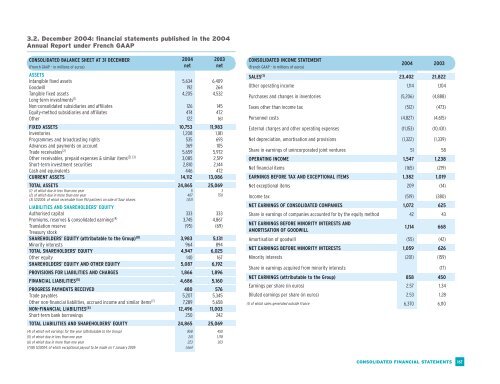

3.2. December 2004: financial statements published in the 2004<br />

Annual Report under French GAAP<br />

CONSOLIDATED BALANCE SHEET AT 31 DECEMBER<br />

(French GAAP - in millions of euros)<br />

2004<br />

net<br />

ASSETS<br />

Intangible fixed assets 5,634 6,409<br />

Goodwill 192 264<br />

Tangible fixed assets 4,205 4,532<br />

Long-term investments (1)<br />

Non-consolidated subsidiaries and affiliates 126 145<br />

Equity-method subsidiaries and affiliates 474 472<br />

Other 122 161<br />

FIXED ASSETS 10,753 11,983<br />

Inventories 1,208 1,181<br />

Programmes and broadcasting rights 535 693<br />

Advances and payments on account 369 105<br />

Trade receivables (2) 5,659 5,972<br />

Other receivables, prepaid expenses & similar items (2) (3) 3,085 2,519<br />

Short-term investment securities 2,810 2,144<br />

Cash and equivalents 446 472<br />

CURRENT ASSETS 14,112 13,086<br />

2003<br />

net<br />

TOTAL ASSETS 24,865 25,069<br />

(1) of which due in less than one year 5 3<br />

(2) of which due in more than one year 407 750<br />

(3) 12/2004: of which receivable from PAI partners on sale of Saur shares 1,031<br />

LIABILITIES AND SHAREHOLDERS’ EQUITY<br />

Authorised capital 333 333<br />

Premiums, reserves & consolidated earnings (4) 3,745 4,867<br />

Translation reserve (95) (69)<br />

Treasury stock<br />

SHAREHOLDERS’ EQUITY (attributable to the Group) (8) 3,983 5,131<br />

Minority interests 964 894<br />

TOTAL SHAREHOLDERS’ EQUITY 4,947 6,025<br />

Other equity 140 167<br />

SHAREHOLDERS’ EQUITY AND OTHER EQUITY 5,087 6,192<br />

PROVISIONS FOR LIABILITIES AND CHARGES 1,866 1,896<br />

FINANCIAL LIABILITIES (5) 4,686 5,160<br />

PROGRESS PAYMENTS RECEIVED 480 576<br />

Trade payables 5,207 5,345<br />

Other non-financial liabilities, accrued income and similar items (7) 7,289 5,658<br />

NON-FINANCIAL LIABILITIES (6) 12,496 11,003<br />

Short-term bank borrowings 250 242<br />

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 24,865 25,069<br />

(4) of which net earnings for the year (attributable to the Group) 858 450<br />

(5) of which due in less than one year 241 1,178<br />

(6) of which due in more than one year 223 303<br />

(7)(8) 12/2004: of which exceptional payout to be made on 7 January 2005 1,664<br />

CONSOLIDATED INCOME STATEMENT<br />

(French GAAP - in millions of euros)<br />

2004 2003<br />

SALES (1) 23,402 21,822<br />

Other operating income 1,114 1,104<br />

Purchases and changes in inventories (5,206) (4,888)<br />

Taxes other than income tax (512) (473)<br />

Personnel costs (4,827) (4,615)<br />

External charges and other operating expenses (11,153) (10,431)<br />

Net depreciation, amortisation and provisions (1,322) (1,339)<br />

Share in earnings of unincorporated joint ventures 51 58<br />

OPERATING INCOME 1,547 1,238<br />

Net financial items (165) (219)<br />

EARNINGS BEFORE TAX AND EXCEPTIONAL ITEMS 1,382 1,019<br />

Net exceptional items 209 (14)<br />

Income tax (519) (380)<br />

NET EARNINGS OF CONSOLIDATED COMPANIES 1,072 625<br />

Share in earnings of companies accounted for by the equity method 42 43<br />

NET EARNINGS BEFORE MINORITY INTERESTS AND<br />

AMORTISATION OF GOODWILL<br />

1,114 668<br />

Amortisation of goodwill (55) (42)<br />

NET EARNINGS BEFORE MINORITY INTERESTS 1,059 626<br />

Minority interests (201) (159)<br />

Share in earnings acquired from minority interests (17)<br />

NET EARNINGS (attributable to the Group) 858 450<br />

Earnings per share (in euros) 2.57 1.34<br />

Diluted earnings per share (in euros) 2.53 1.28<br />

(1) of which sales generated outside France 6,370 6,110<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

167